Dubai: What can auto dealerships in the UAE come up with next?

They already sell some of the most popular or coveted models, their after-sales operations are motoring on nicely, and, these days, they are tapping aggressively into demand for pre-owned vehicles. It needn’t stop with that…

The Dubai-headquartered Gargash Group, the Mercedes dealership, is thinking of doing so in digital ways. “Ride-hailing and subscription services are being assessed by our teams at the moment,” said Walid Hizaoui, Group Chief Strategy Officer at the company. “Once our feasibility study is complete and we have a clearer picture of our expansion plans, we will announce.”

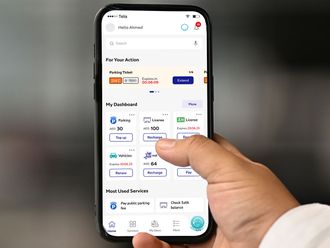

If Gargash does get into either/both of these emerging mobility businesses, they could well set the template in a sector dominated by pure-tech startups such as Uber, udrive, ekar and others who have muscled their way into reckoning. Pay-per-kilometer and monthly car subscription services have in the last two years made enough inroads with users here, and there is nothing to suggest it will be any different this year.

According to auto industry sources, other dealerships in the UAE and across the Gulf too have been watching this space closely. “The dealerships have the inventory – the vehicles – and enough of them to fuel a new business launch in pay-per-kilometer or subscription,” said a source. “If they can get the tech side of things right, it should be a relatively easy entry.”

Alt-investments - chauffeur services

Gargash Group had joined a recent funding round for Blacklane, a global chauffeur services provider. It’s no coincidence that Mercedes-Benz Mobility has been a long-standing backer of Blacklane. The Series F round ‘brings a significant million dollar investment in double digits at a valuation roughly 50 per cent higher than the one from 2020’. So far, Blacklane has raised $100 million across all series.

“We’re always looking for ways to expand our presence in the market,” said Hizaoui. “This investment by Gargash Group is an effort in the same direction, and with it, we are looking at upscaling our services in line with Mercedes-Benz’s offering.”

Blacklane with the new investment will focus on its fleet’s transition to electric vehicles (EVs) including a retained super-charging network. The company founded its first Chauffeur Academy in Dubai. “The important Middle East market serves Blacklane as a test bed to optimize its structure and subsequently scale the new approach globally,” a statement added.

In a statement, Shehab Gargash, Managing Director and Group CEO of Gargash Group, said: “Gargash Group has been witnessing the progress of Blacklane and believes that their strategic direction is much in line with the vision the Group has for its future. Our decision to make this investment at this juncture is very much aligned with how we see our industry evolving.”

“Dubai is an important gateway for international clients, a key leisure and commercial city, hungry for innovation, and committed to sustainability,” said Jens Wohltorf, CEO and founder of Blacklane. “Hence, Gargash Group’s expertise and partnership lay the foundation to globally ramp up our premium electric fleet, set up our local chauffeur academies, and support the technical and operational expansion of our platform.

“In the past three years, we successfully introduced innovative products, thereby winning an impressive amount of new business accounts, quadrupling revenues in 2022 year-on-year, and achieving EBIT profitability.”