Customer satisfaction top priority

Leading organisations focus on transparency, cooperation and speed of redressal to ensure clients' issues are resolved

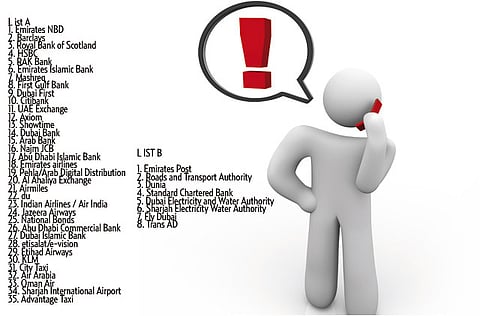

Gulf News lists companies on how they deal with consumer complaints

The pen is mightier than the sword. It is clichéd, but readers repeatedly use this tool as a shield. They write to Gulf News to be heard.

The newspaper has been processing consumer complaints for well over a decade. It acts as a conduit because good customer service be it in the private or public sector offers a direct benefit to the country's economy and contributes to the positive image of the nation.

Readers appreciate the media house for providing this community service. A reader Piyush Maloo said: "Let me congratulate Gulf News team for the bold initiative taken and a public forum like this one really keeps corporations on a frequent check. It is only because of the newspaper's efforts that our concerns are being addressed."

Thanikal Poulose, another reader, said: "When Gulf News takes up an issue there is immediate response from the bank, whereas I had spent months spending time and money with no response."

Udayan Gaidhani added: "I am indeed grateful to Gulf News for taking up [my] issue with the bank and safeguarding my interests. This is a wonderful community service that Gulf News is doing as the fourth pillar of society and I urge everyone who has been unable to redress their grievances to use the services and get justice."

It is of paramount importance to mention that it is not at all possible without the cooperation of the concerned companies. It is time to recognise them for their efforts.

Gulf News has ranked the companies that processed our readers' complaints from January to June 2010. The criteria for ranking the companies are based on their speed of redressal, transparency of process, satisfaction with the solutions, cooperation on the complaint process and attitude towards consumers.

The Consumer Complaint List is a measure to promote better business practices and recognise those who understand the need to treat their customers with respect. The A listers met all the criteria with scores ranging from 80 to 100 per cent. The B listers got a score lower than that.

Gulf News interviewed the top three organisations on how they dealt with consumer issues.

Why do you make customer service a priority?

Abdullah Al Kindi, General Manager, Retail Banking, Emirates NBD: We consider customer service a priority to achieve high customer satisfaction levels and enhance customer loyalty. Our aim is to promote a strong service culture across the bank and ensure that customer service is the key differentiator in each interaction with our customers. At our 24/7 Call Centre, we have upgraded our systems with advanced technology and provided continuous training to our call centre agents to offer superior service.

Tabassum Vally, Head of Customer Service, Barclays: Customer service is central to Barclays business strategy, as we believe it is a key differentiator. We believe banking should be easy and convenient. The banking needs of our customers continuously evolve in line with their lifestyle and future plans.

We value the opinions and experiences of our customers and we genuinely want to hear from them about ways in which we can improve our service. It's important for us to know when we're meeting or exceeding our customer expectations as it is for us to know when we're not.

It is an important part of our business to ensure that any suggestion, feedback or query is addressed appropriately.

Omer Shahid Naqi, Brand Manager, The Royal Bank of Scotland: With increased competition and rapidly changing customer needs, financial institutions face enormous pressure to stand out from the crowd and deliver top customer service and build customer loyalty. Our service promise is a longterm plan to create unique customer experiences and meaningful relationships. We do this by acting in our customers' best interest, meeting their expectations, treating unsatisfied customers with careful attention, and overall, helping our customers make managing their finances simple and [free of] hassle. This requires commitment and involvement from everyone within the bank.

Do you provide better customer care through transparency?

Al Kindi: We believe in being transparent with our customers while dealing with any service related matters. This is part of our culture. In this context, we have recently launched the ‘Customer Care Online' platform on our website in order to enable our customers to interact directly at their convenience and respond to them appropriately. We have also rolled out a Customer Day Programme at many of our branches giving our customers an opportunity to interact with the bank's senior management team and provide their feedback directly to them.

Vally: Barclays policy ‘Treat Customers Fairly' (TCF) provides employees with guidelines for dealing with customers. TCF provides a framework for employees to demonstrate diligence in their efforts to service customers in a fair and transparent manner. We understand that lack of information and communication can often lead to frustration and dissatisfaction among customers. At Barclays, it is a priority for us to keep our customers up to date on all new developments and processes. It is important to gain and sustain trust in our relationship and we believe the best way to do so is by being transparent.

Naqi: We believe that being transparent gives us deeper insight into our organisation. More than ever, organisations need to listen to customers rather than dictate to them. This dialogue encourages transparency, which leads to better decisions and processes.

How does the Gulf News consumer complaint process help your organisation?

Al Kindi: This process will enable our continued focus to deliver superior customer service and establish longterm relationships with them. Our endeavour is to be recognised as a service oriented organisation and enhance our customers' trust and loyalty through high satisfaction levels. Towards this, we have made significant investments in expanding our branch and ATM/CDM network.

Vally: There is no substitute for quality customer service. Our customers can be confident that they are dealing with a company where the fair treatment of customers is central to both our corporate culture and our business strategy.

Naqi: Transparent organisations inspire more trust with their customers and are less inclined to create and allow irregularities. Our customer service professionals are there to meet customer needs and resolve their problems. Being transparent helps us to open up and involve our customers in crafting solutions. In turn, Gulf News makes this information available to other customers. The economics of this type of customer care are superior to anything that can be done with internal resources alone.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox