Dubai: Dubai Police are advising residents to register for SMS notifications from their bank in order to detect fraud at the earliest opportunity.

“Subscription to the SMS service associated with your bank account is an early warning if your account is compromised or stolen #YourSecurityOurHappiness #SmartSecureTogether,” read a tweet from the Dubai Police twitter account on Wednesday.

SMS notifications from your bank enable you to see as and when your card has been used for transactions, alerting you to any misuse.

In June, Dubai Police announced that there had been 811 cases of bank fraud reported in the emirate over the last three years.

These figures were shared at the launch of a UAE-wide #SecureYourAccount campaign, a joint initiative with Emirates NBD to educate the public on fraud.

The average cost of cybercrime for the banking sector globally rose 10 per cent last year to US$18 million (Dh66 million), according to the 2019 Cost of Cyber Crime Study, by Accenture and Ponemon Institute.

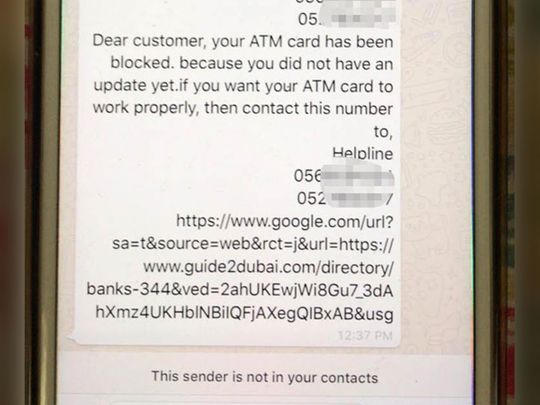

At the campaign launch Abdullah Qassem, Group chief Operating Officer of Emirates NBD, said: “We will never call customers or send emails asking for account numbers, CVVs or user ID. So please don’t share these pieces of information with any source or with any individuals.”

Human error remains the biggest vulnerability when it comes to fighting cybercrime, officials said at the launch.

The procedure for recovering stolen money is done on a case-to-case basis to rule out fake claims, said Qassem.

“We have to ensure it is a genuine human error and that there is no collusion [between any party and the fraudster]. So we study it case by case and if it’s a genuine human error, the bank will refund them.”

Qassem added that Emirates NBD had invested a major portion of its Dh1 billion digital transformation investment towards strengthening their infrastructure and digital processes that provide customers with increased protection, including the SmartPass that enables customers to authorize transfer and payments by using a token generated through their mobiles.