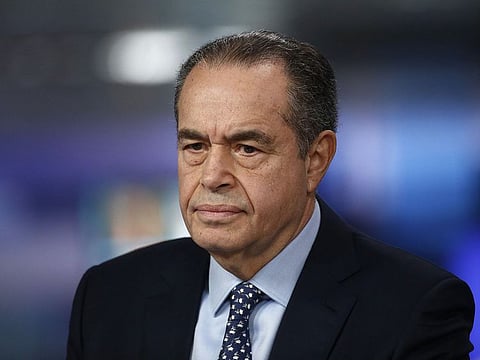

After Twitter exit, Egyptian billionaire investor plans EV push

Mansour said he reduced his stake in Meta and sold all his shares in Twitter last year

Cairo: Egyptian billionaire Mohamed Mansour said he’s cut his investments in social media including stakes in Twitter and Meta Platforms Inc. while boosting his involvement in green projects, like building electric cars for the Middle East’s most populous country.

Mansour, whose family’s wealth is valued at $6.8 billion, according to the Bloomberg Billionaires Index, plans to produce 15,000 electric vehicles in Egypt over the next three to five years through his company Al-Mansour Automotive, which has a long-running partnership with General Motors Co. It also plans to import and market five models of Cadillac EVs by 2025.

“I feel it’s going to be a big success,” Mansour, 74, said in an interview in Sharm El-Sheikh, site of this year’s United Nations climate change conference. He said his almost 50 years of experience in the automotive sector helps him “understand what’s marketable and what’s not.”

By the end of the decade, more than 77 million passenger EVs will be on the road globally, according to BloombergNEF research. That’s almost triple the current number.

“We want to be a leader in that aspect,” said Mansour.

The use of electric cars in Egypt, which is home to about 104 million people, is still extremely limited. A government official last year estimated that only a few hundred of the vehicles are plying the busy streets. But there are signs that’s changing, with state-backed plans to build affordable vehicles and open a network of charging stations.

The Egyptian billionaire

Mansour has been running the family’s conglomerate - which originated as a cotton exporter in 1952 - since his father’s death 46 years ago. It has since diversified into real estate, food services and manufacturing, including owning one of the world biggest Caterpillar construction equipment dealerships and the franchise for all McDonald’s Corp. restaurants in Egypt.

The Mansours do much of their investing through a London-based family office, Man Capital.

In recent years, one of the biggest drivers of the family’s growing fortune has been tech. Mansour was an early investor in juggernauts like Airbnb Inc., Snowflake Inc. and Spotify Technology SA. He also invests in tech via San Francisco-based venture capital firm 1984 Ventures, which he helped found in 2017.

Mansour said he reduced his stake in Meta and sold all his shares in Twitter last year for a “good price.” He declined to specify the size of the stakes or the price at which he sold.

Those sales were part of a wider effort over the past two years to trim the family’s exposure to equities by half, mainly in tech, and build liquidity, he said. Mansour said he hasn’t ruled out returning to the stock markets in the second or third quarter of 2023 should conditions improve.

“We are waiting now with cash,” he said.

By 2024, Mansour is aiming for 10 per cent of all his investments to be green-focused, up from 2 per cent currently. He already owns a stake in one of Africa’s largest renewables producers and has interests in wind turbines in the UK.

Back in Egypt, one of his family firms, Palm Hills, is developing a green housing project on a 3,000-acre (1,214 hectare) plot west of Cairo that will accommodate 250,000 inhabitants when finished. It’s slated to be the first city in the Middle East and North Africa to be built in full accordance with the UN’s Sustainable Development Goals.

“If we didn’t do our share, I think the generations that follow will pay,” he said.