In yet another sign of aviation industry recovery, demand for air cargo has soared globally above pre-COVID-19 levels despite a challenging operating environment, an industry report said.

The higher-than-pre-COVID demand was hit in February 2022, indicating recovery for the sector, according to the International Air Transport Association (IATA).

Air cargo has posted a 32-year record in February, the best February performance on record since 1990.

11.9% higher

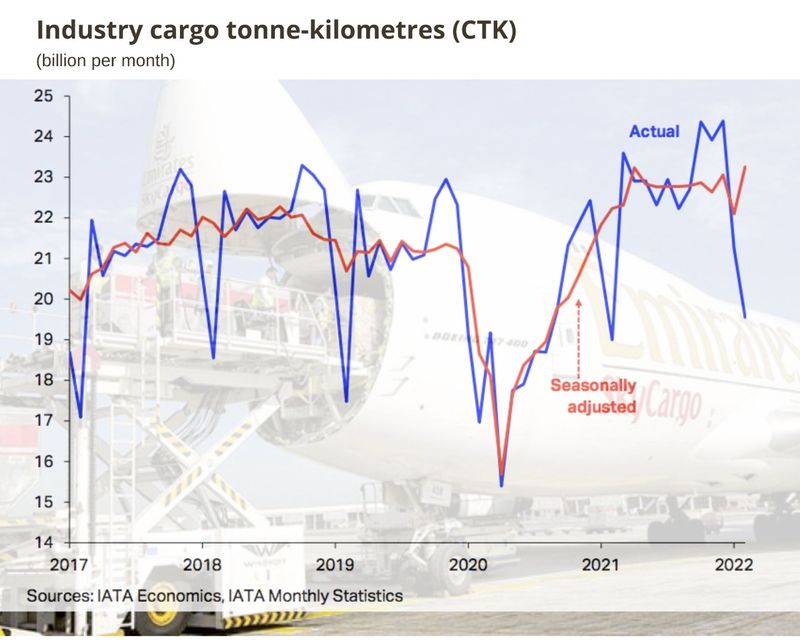

Global air cargo demand, measured in cargo tonne-kilometers (CTKs), was up 11.9% in February 2022 vs. the same month in 2019. It was up 2.9% in February 2022 compared to February 2021.

A key driver that boosted the industry include ramped up manufacturing activity after the early February Lunar New Year holiday.

Capacity was enhanced by other of factors: the general and progressive relaxation of COVID-19 travel curbs; increased flight operations after Omicron-related restrictions were relaxed (especially outside of Asia); and fewer winter weather operational disruptions.

“Demand for air cargo continued to expand despite growing challenges in the trading environment,” said Willie Walsh, IATA’s Director General, in a statement.

Uncertainty

However, a dip in global demand noted in March may affect the air cargo industry's performance in the coming months. The ongoing geopolitical uncertainty triggered by the war in Ukraine will negatively affect the global economy. Sanction-related shifts in manufacturing and economic activity, rising oil prices and geopolitical uncertainty will take their toll on air cargo’s performance, IATA noted.

Demand softening

The Purchasing Managers’ Index (PMI) — an indicator of global new export orders — fell to 48.2 in March, the lowest since July 2020. This shows a majority of surveyed businesses reported a fall in new export orders.

IATA expects downward pressure from related sanctions (particularly higher energy costs and reduced trade) will become more visible from March.

“Based on this, and based on the ongoing disruption to supply chains that we're witnessing, we would expect to see the growth and very strong performance of cargo just begin to ease as we go through the next couple of months,” Walsh said.

Airlines have had to grapple with the rising fuel prices, too. “And given that fuel represents the single biggest cost base of the industry, it averaged 27% over the 10 years up to 2019," he said.

Regional air cargo performance:

Following are the relevant air cargo numbers per region, based on IATA data:

Africa

African airlines saw cargo volumes increase by 4.6% in February 2022 compared to February 2021. Capacity was 8.2% above February 2021 levels.

Asia-Pacific

Asia-Pacific airlines saw their air cargo volumes increase 3.0% in February 2022 compared to the same month in 2021. Available capacity in the region was up 15.5% compared to February 2021, however it remains heavily constrained compared to pre-COVID-19 levels, down 14.6% compared to February 2019.

Europe

European carriers saw a 2.2% increase in cargo volumes in February 2022 compared to the same month in 2021. It was slower than the previous month (6.4%). Seasonally-adjusted demand on the Asia-Europe route, one of the most affected by the conflict decreased by 2% month on month. Capacity was up 10.0% in February 2022 compared to February 2021, and down 11.1% compared to pre-crisis levels (2019).

Latin America

Latin American carriers reported an increase of 21.2% in cargo volumes in February 2022 compared to the 2021 period. This was the strongest performance of all regions. Some of the largest airlines in the region are benefitting from the end of bankruptcy procedures. Capacity in February was up 18.9% compared to the same month in 2021.

Middle East

Middle Eastern carriers experienced a 5.3% year-on-year decrease in cargo volumes in February. This was the weakest performance of all regions, which was owing to a deterioration in traffic on several key routes such as Middle East-Asia, and Middle East-North America. There are signs of improvement: capacity was up 7.2% compared to February 2021.

North America

North American carriers posted a 6.1% increase in cargo volumes in February 2022 compared to February 2021. The ramp up of manufacturing activity in China following the end of the Lunar New Year resulted in growth in the Asia–North America market, with seasonally adjusted volumes rising by 4.3% in February. Capacity was up 13.4% compared to February 2021.