Highlights

- With more borders being reopened, IATA sees travel industry en route to recovery.

- All markets — Africa, Europe, Latin America, Middle East and North America — showed “very strong performance” in February 2022 versus February of 2021.

- 200+% rise in ME passenger traffic noted.

As more countries open their borders, the travel industry is soaring towards recovery, according to an industry report.

It cited a massive 381 per cent jump in passenger traffic in Europe in February 2022 vs February 2021.

“The good news…is that demand for passenger flying continues to be resilient,” Willie Walsh, director general of the International Air Transport Association (IATA), said in a recent press briefing, the transcript of which was released on April 7, 2022.

“And we can see the international sales continuing to pick up despite all of the issues, particularly associated with the war in Ukraine,” added Walsh, who took over the IATA leadership in April 2021.

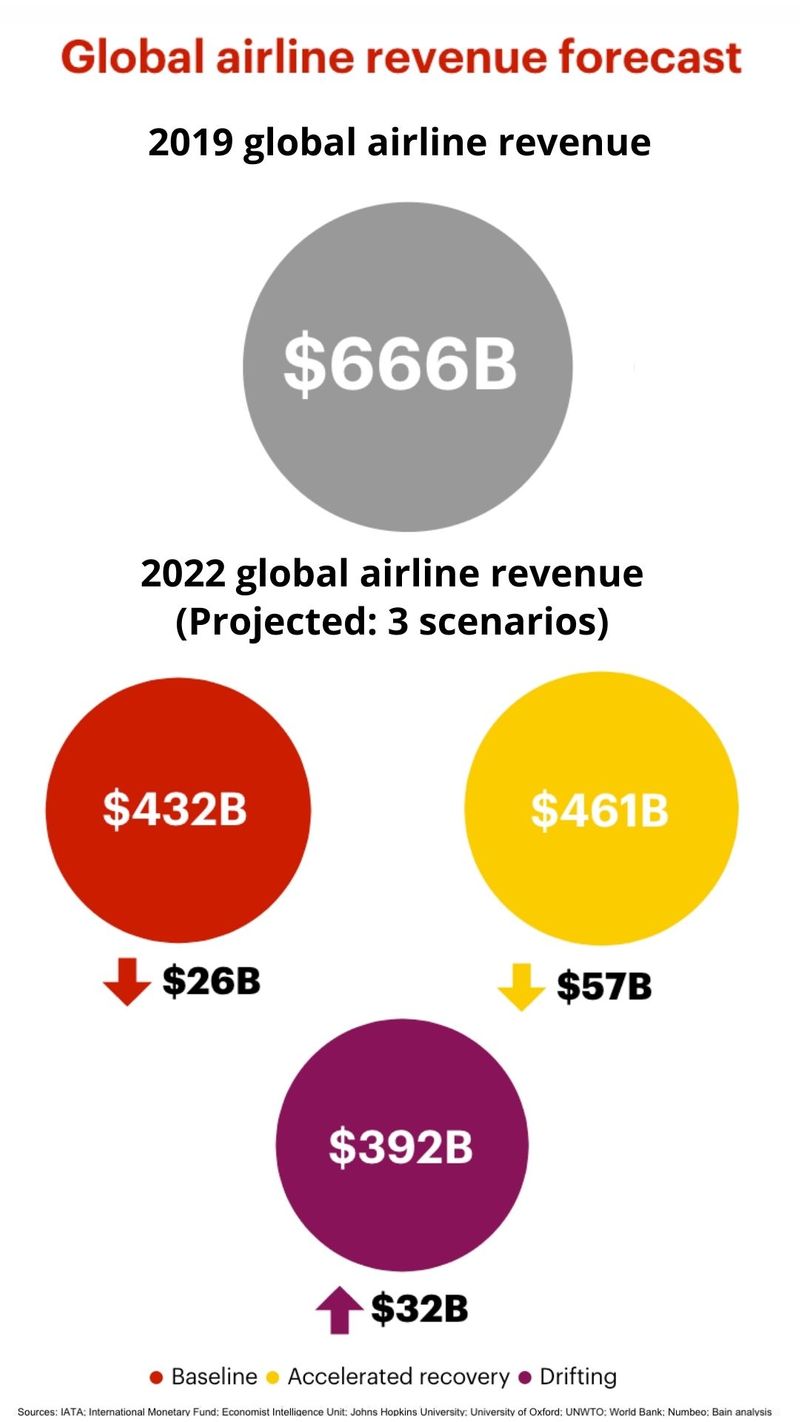

This represents 65% of 2019’s revenue.

In the same “baseline” scenario, by end-2022, global air travel demand could recover to 84% of 2019 levels.

The surge in Omicron sub-variants surge in some countries continues to stall recovery.

Following are the highlights of IATA director general Willie Walsh's briefing:

- All markets — Africa, Europe, Latin America, Middle East and North America — showed “very strong performance” in February 2022 versus February of 2021.

- After a short pause in January, the recovery has picked up again.

- IATA noted a strong performance by cargo of 11.9% in February vs. the same month in 2019.

- Passenger traffic in February 2022 overall was still down 45.5% down from February 2019.

- The US domestic aviation market is recovering fast: In February 2022, it was just about back to where it was, just under 7% compared to February 2019.

- February 2022 international passenger traffic has recovered, but was still down nearly 60%, and domestic, 22% down vs February 2019 levels.

- Russia continues to grow, relative to 2019, though the IATA chief expects that to be significantly impacted in March because of the war in Ukraine.

- The Asia Pacific region continues to lag significantly behind other segments, given the ongoing border restrictions.

- While Europe is up 381% in February 2022 vs February 2021, it is clearly still lagging behind 2019 numbers.

- Europe was still 45% down in February 2022 vs February 2019, Middle East is still at minus 46%, North America minus 44%, and the Latin America minus 44% in the two comparative periods.

IATA’s Welsh said: “We would expect to see a number of countries starting to relax their restrictions as we go through the rest of this month.”

Cargo: at 32-year high

Globally, air cargo has posted a record February, the best February performance on record since 1990, according to IATA.

Walsh said: "December (2021) was the record month." However, he cited that the softening in global demand, given the purchasing managers' index (PMI) below 50 globally, may affect affect the air cargo industry's performance in the coming months.

“Based on this and based on the ongoing disruption to supply chains that we're witnessing, we would expect to see the growth and very strong performance of cargo just begin to ease as we go through the next couple of months,” Walsh said.

The price of fuel, too, has been a major challenge for airlines. “And given that fuel represents the single biggest cost base of the industry, it averaged 27% over the 10 years up to 2019," he said.

"It's inevitable that these high oil prices will be reflected in higher fares, and I've heard a number of CEOs indicate that in recent weeks.”