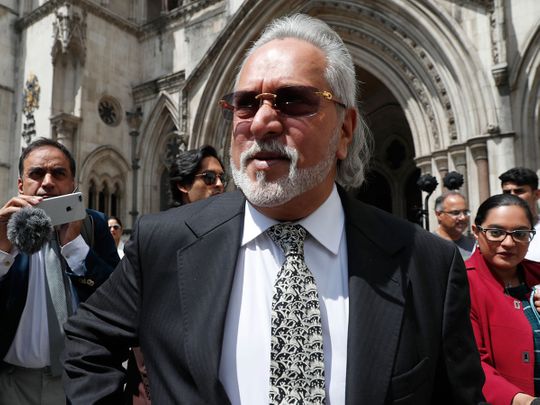

London: Fugitive Indian businessman Vijay Mallya on Monday was declared bankrupt by a British court allowing Indian banks to pursue his assets worldwide.

The Companies and Insolvency Court of UK passed the ruling, according to a statement of the UK High Court press office.

The Companies Court (now part of the Insolvency and Companies List) is a specialist court within the Chancery Division of the High Court of Justice of England and Wales, which deals with certain matters relating to companies.

Mallya has been denied any right to appeal against the bankruptcy decision.

The decision was announced at an oral hearing today.

Mallya, the owner of the now-defunct Kingfisher Airlines, owes more than Rs 9 billion to a consortium of banks in principal and interest.

The petitioners were State Bank of India (SBI)-led consortium of 13 Indian banks, including Bank of Baroda, Corporation Bank, Federal Bank Ltd, IDBI Bank, Indian Overseas Bank, Jammu & Kashmir Bank, Punjab & Sind Bank, Punjab National Bank, State Bank of Mysore, UCO Bank, United Bank of India and JM Financial Asset Reconstruction Co Pvt Ltd.

The ruling is being seen as a major victory for the consortium of Indian banks pursuing debts owed by the now-defunct Kingfisher Airlines.

Mallya fled to the UK and has been fighting on multiple fronts to avoid extradition to India.

He remains on bail after he was ordered to be extradited in December 2018 by Westminster Magistrate's Court in London - a ruling he has repeatedly tried and failed to overturn.

The 65-year-old fugitive businessman has exhausted legal procedures available to him to fight the government's effort to extradite him to India. The UK government is dealing with a "confidential matter" pertaining to Mallya. There is speculation that Mallya has sought political asylum in the UK.