Union Properties deal with bank is not winning over investors

Other bellweather stocks are getting a lot of attention, while Taqa is making gains again

Also In This Package

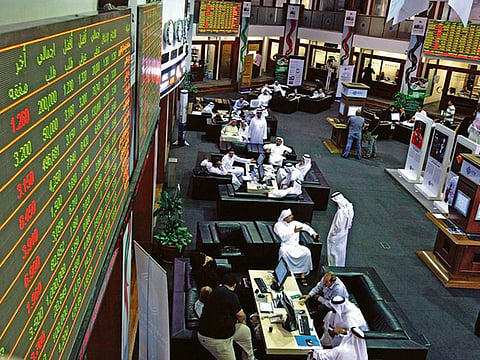

The DFM was unchanged on Monday while ADX gained 0.57 per cent in Monday’s trade, with Taqa resuming its spate of gains, this time by 9.92 per cent, while Waha Capital closed higher by 4.26 per cent.

At the macro level, the UAE economy will benefit from Central Bank initiatives to improve liquidity and increase fundi flow to corporates. The additional measures are launched as a part of the Targeted Economic Support Scheme, which was first unveiled in March as a Dh100 billion stimulus package.

Right now, the Net Stable Funding Ratio (NSFR) for large banks have been reduced to 90 per cent, and the Advances to Stable Resources Ratio (ASRR) allowed to go over 100 per cent. These measures will help in increasing the availability of sizeable funds to the financial sector and help improve monetary transmission, thus averting any liquidity crunch.

The measures of the Central Bank will enable banks to give leeway to deserving corporates.

Not finding traction with investors

In corporate news, Union Properties reached an agreement with Emirates NBD for a full restructuring of its Dh946 million debt. Investors remain unenthused as shares declined 0.30 per cent today.

The company also announced a three-year turnaround plan and the launch of ‘Motor City Hills’ with a gross floor area of 2.9 million square feet. Constructing more projects and contributing to the oversupply is something that investors don’t appreciate.

It is certainly not a sign of financial prudence.

Abu Dhabi Ship Building (ADSB) has transferred 105.91 million of its shares from Emirates Defence Industries Company to Edge Platforms and Defense Systems. Edge is an advanced technology group in the defence space, and the move is good for for the company. Recently it had signed a conditional agreement to acquire full ownership of Advanced Military Maintenance Repair and Overhaul Centre (AMMROC).

DFM and ADX continue to trade above the 50- and 100-day moving averages.

- Vijay Valecha is Chief Investment Officer at Century Financial.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox