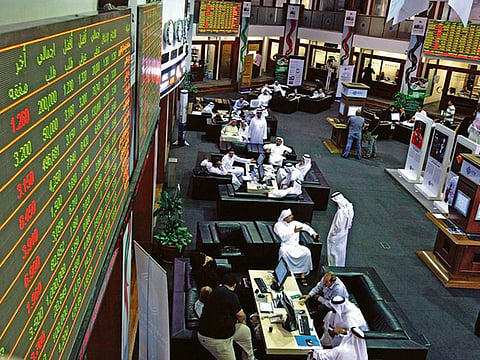

Dubai shares slide; UAE's biggest lender FAB lifts Abu Dhabi index

Most major Gulf markets fall, weighed down by banking shares

Most major Gulf markets fell on Thursday weighed down by banking shares, mirroring wider Asian slump amid the US-China trade conflict. But UAE’s top lender lifted Abu Dhabi.

Dubai’s index lost 0.9 per cent with all financial and real estate shares sliding.

Emirates NBD, its largest lender, dropped 1.8 per cent and blue-chip developer Emaar Properties was down 0.5 per cent.

Property prices have been falling since a mid-2014 peak, hurt by weaker oil prices and muted sales, which in part were behind the index’s poor performance the last year.

However, the index had shown signs of recovery starting this year and rose past 9 per cent by end of April before seeing a sell-off in May due to global trade war and regional geo-political tensions.

The index is down 7.4 per cent this month, though still up 1.3 per cent year-to-date.

Saudi’s index decreased 0.4 per cent with Al Rajhi Bank shedding 0.9 per cent and Sahara International Petrochemical falling 2.6 per cent.

The latter completed the merger of equals with Sahara Petrochemical, which delisted on May 20.

Saudi Arabian mall operator Arabian Centres, which debuted on Wednesday, dipped further by 1.8 per cent to 24.5 riyals ($6.53) from its initial public offer price of 26 riyals.

Arabian Centres’ share sale, which raised 2.47 billion riyals ($658.65 million), was the kingdom’s third biggest since Saudi lender National Commercial Bank raised $6 billion in 2014, according to Refinitiv data.

Qatar’s index declined 0.3 per cent with Qatar Fuel dropping 1.4 per cent and Qatar Islamic Bank was down 0.7 per cent.

The Abu Dhabi index rose 0.4 per cent with First Abu Dhabi Bank, the country’s largest lender, adding 1.2 per cent.

J.P. Morgan retained ‘overweight’ rating on the stock despite recent price volatility and said it preferred the bank over Abu Dhabi Commercial Bank, which was down 0.5 per cent.

Dana Gas gained 1.9 per cent. The stock has been increasing since Tuesday when the energy firm said it had started drilling operations at the Merak-1 offshore well in Egypt.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox