Dubai: Qatar is forecast to make a strong post-pandemic economic recovery, thanks to limited health impact of COVID-19, fast pace of immunization programme and the improving economic conditions in the region, according to Institute of International Finance (IIF).

The IIF expects recovery this year, though modest, will be supported by the strengthening of oil and gas prices, the revival in domestic demand on the back of the progress made in vaccination, and the end of the three-year blockade by its Gulf of Qatar by Saudi Arabia, the UAE, Egypt, and Bahrain. The recent de-is expected also contribute to stronger economic activity for all countries in the Gulf region

“We expect modest economic recovery in 2021 with real GDP growing by 3.2 per cent, following a contraction of 3.7 per cent in 2020. The private sector support programs implemented by the Central Bank of Qatar (QCB) and commercial banks have provided breathing space to small and medium enterprises (SMEs).

In 2022, growth is projected to accelerate to 4 per cent supported by further significant increase in gas production and the projected substantial increase in tourist receipts for the FIFA World Cup (scheduled for November 21-December 18, 2022).

LNG factor

Qatar is reinforcing its position as the world’s second-largest gas exporter and the largest exporter of LNG given its massive reserves and surging global demand. In early February of this year, Qatar Petroleum (QP) announced its investment decision on the $29 billion expansion of its North Field. This will allow QP to expand its production capacity from 77 to 110 million tons of LNG per annum by 2025. Qatar’s long-term LNG contracts are linked to crude oil prices, and such an expansion in gas production would lower the fiscal and external breakeven oil prices from around $50/bbl in 2020 to $30/bbl by 2025.

Resilient banking system

The banking system has remained relatively resilient, helped by sound initial capital and liquidity positions and a flexible pandemic response by QCB, including regulatory forbearance. Financial support programs have been critical to sustain corporate credit. While keeping lending rates low, the QCB has also provided liquidity to local banks through a special window at zero interest rate. Given the lingering impact of the pandemic, the QCB is appropriately avoiding a premature winding-down of these measures.

Banks remain adequately capitalised with a 17.6 per cent Tier 1 capital ratio, and low nonperforming loan ratio of 2 per cent in 2020. However, these measures are seen encouraging banks to postpone loan repayment conceal the true extent of bank asset quality deterioration.

“Once the forbearance is lifted by the QCB, we could see a modest deterioration in asset quality or a higher non-per-forming loan ratio,” said Iradian.

Funding and liquidity will improve this year supported by the end of the rift with Saudi Arabia and the UAE, which should diversify the funding base of Qatari banks and reduce funding costs. Qatari banks are highly dependent on non-resident deposits, which accounted for 28 per cent of total deposits in March 2021.

Strong fiscal and external positions

In 2020, Qatar had a modest fiscal deficit of 2.4 per cent of GDP, the lowest in the MENA region and is expected to swing to a surplus of 2.5 per cent of GDP in 2021.

Fiscal balance is expected to shift to sizeable sur-pluses beyond 2022, as the increase in nonhydrocarbon revenues will more than offset the projected modest increase in spending. Central government debt increased to 70 per cent of GDP in 2020, partly due to the decline nominal GDP. A gradual fiscal consolidation beyond 2021 would help preserve net public sector wealth.

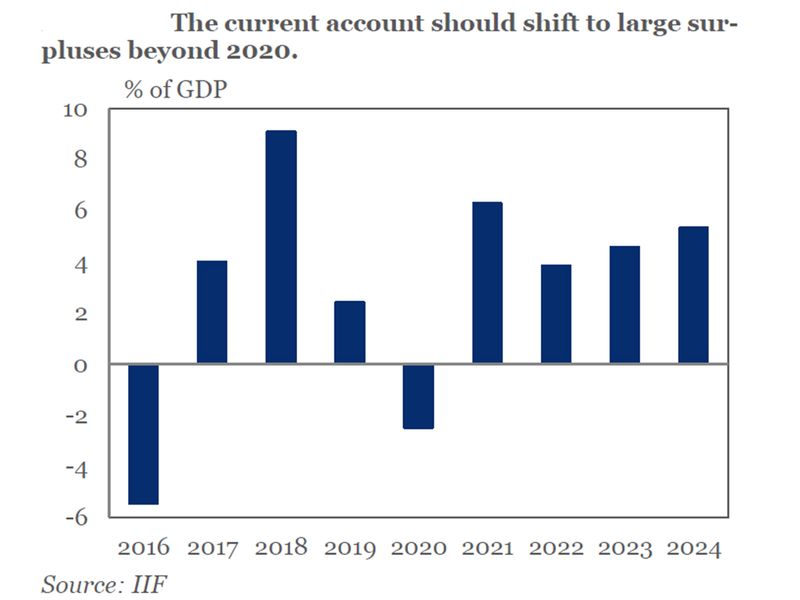

The current account is forecast to swing from a small deficit of 2.5 per cent of GDP in 2020 to a large surplus of 6.3 per cent of GDP in 2021 supported by the significant increase in natural gas production and recovery in energy prices.

Public foreign assets (official reserves + the foreign assets of Qatar Investment Authority) will increase to about $362 billion (214 per cent of GDP).