Dubai: Strong fiscal response by some of the GCC sovereigns are expected to preserve their financial and credit strength as oil price is likely to remain low for long, according to rating agency Moody’s.

The rating agency recently revised down their average oil price assumptions to $35/barrel in 2020 and $45/barrel in 2021, and as a result, expect a very large drop in fiscal revenues for all GCC sovereigns.

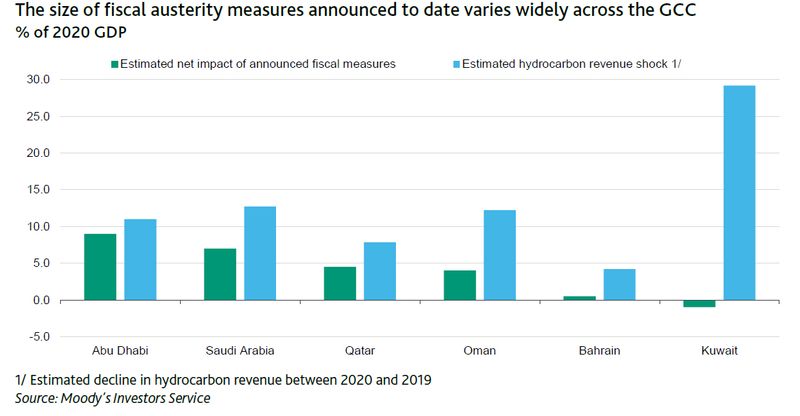

While GCC sovereigns have provided some targeted support to buffer their economies against the coronavirus shock, Moody’s said most have enacted consolidation measures that significantly exceed the cost of fiscal stimulus with the aim of offsetting expected revenue losses.

“Large fiscal adjustments planned by Abu Dhabi and Saudi Arabia will likely allow for a preservation of their fiscal strength despite the lower for even longer oil price environment. On the other hand, Oman, Bahrain and Kuwait will likely see a deterioration in their fiscal strength, although Kuwait’s very large sovereign wealth fund assets potentially provide a significant buffer,” said Alexander Perjessy, VP-Senior Analyst at Moody’s.

Spending cuts

Over the past three months, GCC governments have announced various measures to offset at least a part of the large revenue losses that Moody’s expect will result this year from the combination of sharply lower oil prices and, in most cases, lower oil production.

A vast majority of the measures announced so far have been on the expenditure side, reflecting the simultaneous shock to the nonoil economy from the coronavirus pandemic and governments’ desires not to place an additional burden on the productive sectors through new or higher taxes and fees.

Spending cuts announced so far include a large cut planned by Abu Dhabi, which is estimated at around 10 per cent of GDP and will likely center on current spending and reductions in overseas grants and aid payments, as well as a reduction in spending on behalf of the Federal government

“We expect the government to target these items because they are likely to have a more modest impact on domestic non-oil economic activity, which was contracting even prior to the coronavirus outbreak in 2019,” said Thaddeus Best, an analyst at Moody’s.

Saudi Arabia has also announced large spending cuts over the past three months. Moody’s estimate that the total cut relative to the 2019 budget outcome (which includes an expenditure reduction planned in the approved 2020 budget), will amount to around 7.5 per cent of GDP, although up to two percentage points of these savings will likely be offset by higher coronavirus-related healthcare and social spending, thus reducing the net spending cut to around 5.5 per cent of GDP.

Qatar and Oman have announced somewhat more modest spending cuts so far, amounting to around 4 to 5 per cent of GDP. In Oman, the government announced and began to implement a 10 per cent cut to its non-interest spending. In Qatar, cuts include a large reduction in non-priority capital expenditures, which the government had announced in early March.

By contrast, Bahrain and Kuwait have announced very little so far, reflecting a politically more complex governance structure, particularly in Kuwait where the relatively more powerful parliament, compared with the rest of the GCC, has been a long-standing obstacle to implementing fiscal consolidation measures.

In May, Bahrain announced that it would cut current spending excluding wages and transfers by around 30 per cent. Although, at least on the surface, this appears to be a large adjustment, Moody’s estimates that it will only produce around 1.5 per cent of GDP in savings.

Revenue augmentation

Only Saudi Arabia has so far this year announced new non-oil revenue measures to offset the impact of lower oil prices. The government announced that it would triple the VAT tax rate to 15 per cent from the beginning of July 2020, which, when fully implemented, we estimate could yield equivalent of around 4.5% of GDP in additional revenue annually. In 2020, it will likely generate only around 2% of GDP, due to being introduced mid-year and taking into account erosion in consumption spending due to the coronavirus pandemic.