2023 is probably going to be that type of year. As investors, we may need to keep our foothold weak and an optimum strategy could well be to keep shifting views and altering investing strategies as the year goes by and incoming data gives more clarity on the future trajectory.

Through most of 2020 and 2021, global central banks’ as well as the RBI’s pandemic-driven approach of doing “whatever it takes” gave a somewhat secular narrative to the interest rate backdrop, while 2022 for most part has been a one way street of central banks making up for past follies and frantically raising interest rates to gain control over the inflation genie. As we head into 2023, the year promises to be interesting with high level of confidence that the end of rate hikes across most countries is almost in sight, however with much lower confidence levels of the path that lies beyond.

That path, in our view, is still very hazy and likely to make various markets swing from one side to the other as 2023 goes by, requiring a nimble approach from investors.

Let’s take a look at a few dominant questions which are likely to impact our bond markets, as we lay down our thoughts on those, with a frank and clear disclaimer at the outset, that many of these views are indeed fickle and more likely than not, will undergo changes though the course of 2023.

The markets are currently pricing in another 25bps hike from 6.25 per cent to 6.5 per cent, a pause thereafter, and then expectations of rate cuts into the second half of FY2024. In our view as well, the Monetary Policy Committee (MPC) is likely to hike rates to 6.50 per cent and then pause to gauge impact of past tightening.

Outlook for the Fed and US interest rates

Market are currently expecting the US Fed to raise rates to just below 5 per cent from 4.25-4.5 per cent currently, and then from mid-2023 onwards, do an about turn and start cutting rates almost thrice (~75bps) by Jan 2024. The pendulum on this one has swung a few times already. From a 5.25-5.50 per cent projected peak rate just few months ago, markets are now pricing a peak at below 5 per cent. More interestingly, despite various Fed speakers including Chair Powell, repeatedly telling the markets that rates need to remain at the peak levels for a longer period to achieve their inflation objective, bond markets continue to price in a Fed buckling down under recession worries and reversing course to rate cuts after just a few months post the last rate hike.

We believe as the year goes by, bond markets may come closer to where the Fed currently is, rather than the other way around. Which does mean that US interest rates could have an upward bias as and when the markets get more convinced of the higher for longer Fed messaging.

Outlook for India’s growth and inflation

India’s growth outlook for FY24 is somewhat hazy, with forecasts for GDP growth ranging from as low as 5 per cent to an impressive 7 per cent as well. In an environment of global growth slowdown, the crucial determinant of growth would be the intrinsic strength of the domestic economy being able to weather the external headwinds. While various fast indicators of growth are all over the place and can be used to justify either side of the growth spectrum, in our view – the economy may turn out to be more resilient than market expectations and from a bond market perspective, less of an influencer in making RBI do a volte face in its rate trajectory.

RBI MPC

The markets are currently pricing in another 25bps hike from 6.25 per cent to 6.5 per cent, a pause thereafter, and then expectations of rate cuts into the second half of FY2024. In our view as well, the Monetary Policy Committee (MPC) is likely to hike rates to 6.50 per cent and then pause to gauge impact of past tightening.

However, we do think the MPC is unlikely to cut rates in latter half of 2023 or even early 2024. Whether rate cuts do materialise so soon or not, would be an important determinant of investment strategy, especially with regard to the need to worry about re-investment risks or on merits of duration extension.

The other risk scenario to not lose sight of, even if low probability, is that of the RBI being forced to continue hiking rates beyond 6.50 per cent due to the Fed forcing their way well beyond 5 per cent on the Fed funds rate. However delinked we may like to believe India is, maintaining a minimum interest rate differential between our rates and the US would be warranted to ensure macro and currency stability.

Banking balance sheets

This, we believe, is probably the most important variable not just for government security yields, but also crucially for credit spreads. With credit growth likely to remain in the mid-to-high teens in FY24, the pressure to grow their deposit base is likely to intensify on the banking sector, thereby keeping the overall level of interest rates high in our economy.

This bodes well for the gradual resurgence of deposit flows into the banking sector, but given the long lead time needed to achieve that, there is likely to be transition effects that the bond markets may need to deal with viz. government bond yields remaining elevated to ensure their relative attractiveness versus commercial credit, and secondly banks pricing credit risks more prudently, leading to higher costs for borrowing from the banking sector.

This would hopefully in our view, finally lead to increased corporate issuance and importantly, a widening of credit spreads in our bond markets as well, something that mutual fund investors have been waiting for some time now!

To sum up, the bands of uncertainty around the interest rate outlook are high and many of our assumptions and outlooks may indeed change as we navigate 2023, but we do believe a nimble approach open to change, and able to optimise portfolio strategies, is probably the best way to play 2023 and beyond.

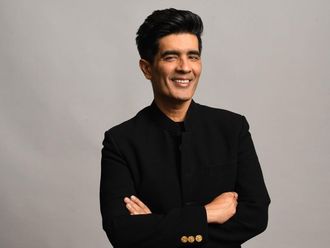

- The writer is the Chief Investment Officer, Fixed Income, HSBC Asset Management India