Dubai: Police on Sunday issued a fresh alert to residents to protect themselves from scammers and to refrain from sharing their debit or credit card numbers and Personal Identification Number (PIN).

Dubai Police, in a tweet, warned residents to not fall for scammers seeking money through ‘fake prizes’ saying, "Remember that scammers seek your money through "fake prizes”. Never share your debit/credit card number and PIN.”

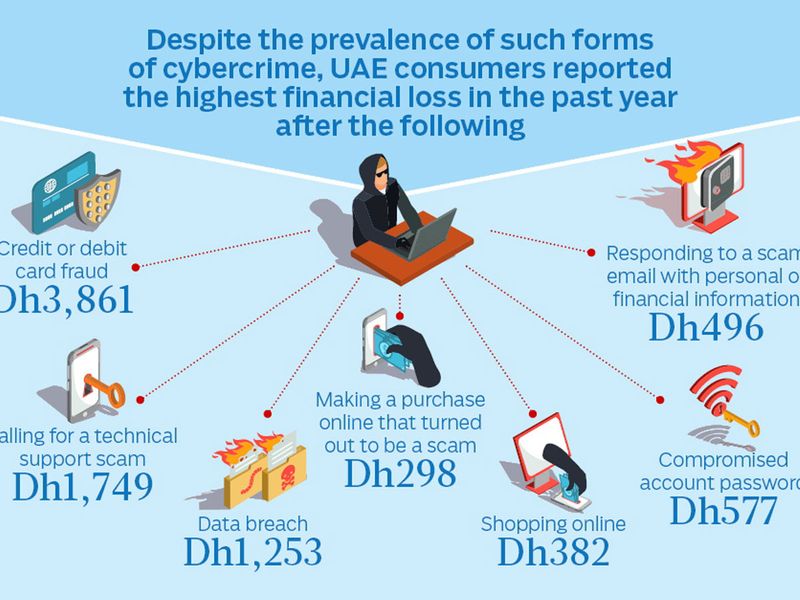

Digital platforms have made it easier for users worldwide to communicate and spread information. But the price of online convenience is that people are increasingly exposed to scammers.

In what is now popularly known as phishing, fraudsters gain control of a person’s bank account by tricking internet users into sending their personal information by offering them fake prizes. They may also convince them into forwarding money by pretending to be from a legitimate company, government office or retailer.

Tips from UAE banks on how to avoid online scams

Here are a few tips we collated from major UAE banks on this specific alert by the Dubai Police. While most of these are common, checking them off can help you transact online safely.

• Treat your card as cash, never leave it unattended. In the same way, carry only the cards you need, especially when travelling.

Pro-tip: You could get a Travel card; you can use this card as prepaid card for expenses while travelling. You can add money on the card as and when it runs out - it is not directly linked to the funds in your bank account.

• Sign the back of your credit card immediately after you receive it.

• Record card numbers, expiration dates and customer care numbers clearly and store these in a safe place. Use it if you need to report your lost or stolen cards.

• Never note your card number, or personal identification number (PIN) on the outside of an envelope or postcard. Never put any notes with your PIN on the card itself or in your wallet. Don't store essential passwords on your mobile either.

• Act quickly if you suspect fraud. If you believe someone is trying to commit fraud by pretending to be your bank, notify the bank immediately.

• Change your online banking password often and use strong alphanumeric passwords.

• Do not visit suspicious sites. Look for a secure connection. This is usually identified by a green area in the address bar, along with https in the URL.

• Make sure your home computer has the most current anti-virus software. Install a personal firewall to help prevent unauthorised access to your home computer. This is especially important if you connect to the internet via broadband.

• Monitor your transactions regularly. Review your order confirmations, credit card and bank statements as soon as you receive them to make sure you are being charged only for transactions that have taken place. Immediately report any irregularities to your bank.

Source: Emirates NBD, Mashreq Bank and RAK Bank websites