UAE companies raise production, hiring

Output by UAE private sector companies in September grew at the highest rate since April

Dubai: UAE-based private sector companies are buying and producing more goods and services even as they hire more staff to meet the requirements of an "increasing normalisation" of econ-omic activity, a new index showed Tuesday.

Output by UAE private sector companies in September grew at the highest rate since April.

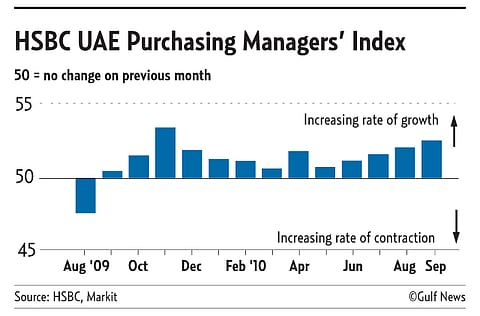

Firms also hired extra staff and raised buying activity last month to accommodate greater business requirements and expansions. Job creation picked up as a result, according to the HSBC Purchasing Managers' Index (PMI) 2010.

Purchasing also rose faster, but growth remained weak, according to the PMI, which is based on independent data is collated by financial information specialist Markit and which will be released each month by HSBC.

"The numbers show sustainable growth is starting to come through," said Simon Cooper, HSBC's chief executive for the Middle East and North Africa.

"The release of this data not only gives us a clear view of actual economic activity in the UAE, but also helps to support customers, stakeholders and analysts who are looking for further detail as they make business decisions involving the UAE," he said.

Analysts at other financial entities have supported the view that the UAE's economic activity is accelerating. Bank of America Merrill Lynch said in a note yesterday that it expects GDP growth in the UAE to double to two per cent next year from one per cent this year.

The International Monetary Fund too has modified its forecast for UAE GDP growth to 1.3 per cent in 2010 accelerating to 3.1 per cent in 2011.

More optimistic

HSBC, however, is more optimistic. "The data underlying the PMI support our forecast of two per cent GDP growth in the UAE this year, rising to 3.5 per cent in 2011," said Simon Williams, the bank's chief economist for the MENA region.

Registering 52.6 in September, the headline seasonally adjusted HSBC UAE PMI ended the third quarter of 2010 at a ten-month high. PMIs are independently sourced monthly surveys of purchasing managers which provide investors and economists with leading indicators of a region's economic performance.

The PMI is seasonally adjusted for changes in business cycles during summer and periods such as Ramadan.

The encouraging econ-omic news from the UAE comes even as the rest of the world, including emerging markets, experiences a renewed slowdown.

Copenhagen-based Saxo Bank says it is concerned about a looming slowdown in China and continued sovereign default concerns. It is "also concerned about the Eurozone", said Saxo's chief economist David Karsbol.

Work-in-hand in the UAE private sector continued to fall during September despite further gains in new orders, the HSBC UAE PMI shows.

"Respondents indicated that activity growth had outpaced the rise in new business and backlogs had been depleted as a result. That said, the rate of reduction was the mildest for seven months," HSBC said.