Inheritance laws in UAE remain unclear

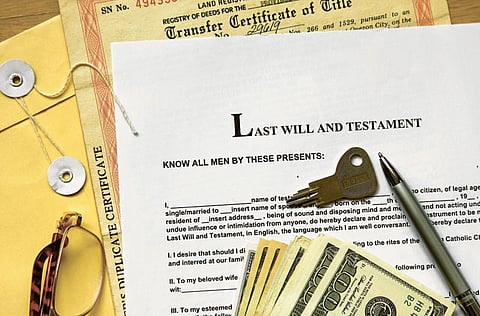

Can property ownership rights pass smoothly on to the rightful heirs named in the deceased's will?

Dubai: While the UAE waits for stability in its real estate marketplace, there are a few ambiguities that property investors are still living with. One concern that is yet to be resolved relates to the status of such assets upon an investor's demise.

Can the property ownership rights pass smoothly on to the rightful heirs named in the deceased's will?

"Non-Muslim residents in the UAE are never sure whether they would be subject to Sharia or not on what was likely their biggest asset," said Jesse Hester, chairman of Atlas Corporate Services, which specialises in consultancy related to the setting up and management of offshore companies and trusts.

Time-consuming process

"The Sharia courts may propose that they will follow the laws of the deceased's home country, though this is not guaranteed, and procedures are still complicated, time-consuming and expensive.

"Offshore companies — or potentially a corporate trustee — can, therefore, be used to own shares of a Jebel Ali offshore company owning the property, thus taking it outside the scope of the UAE inheritance legislation."

As it is, few homeowners and property investors here are fully aware of the implications of the laws governing property inheritance.

Consult a lawyer

"Although we are not licensed to give people legal advice, we always suggest our clients to seek legal opinion when purchasing a property," said Cecilia Reinaldo, managing director at Fine & Country, a property services firm.

"The more savvy owners owning more than three properties tend to register the titles with offshore companies [in Jebel Ali Free Zone Authority (Jafza) as an example] to ensure that in case of death, the assets are not subject to Sharia."

The specific mention of Jafza as the offshore jurisdiction should be noted. Last January Dubai decreed that purchases of property cannot be done through offshore companies other than those registered in Jebel Ali. In one stroke, Dubai thus assured itself of all fees related to property transactions.

But the concern in property circles at the time was whether this would impact heavily on the overseas investor interest in Dubai. Such investors have traditionally relied on investment vehicles such as trusts and offshore companies to fund their purchases.

Builder repute to blame

Hester does not see it that way. "It is true that interest has dropped in purchasing properties via offshore companies," Hester said.

"However, we feel that this is more to do with the effects of the downturn and the international repute of some developers and buildings than queries over holding structures."

Now, that is one pressing issue that is more within the ambit of the local developers to address.

As regards those related to inheritance, only time and the setting of legal precedents in the courts will determine how these are to be resolved.

Dubai The decision as to how property assets here will pass on to the heirs after the non-Muslim owner's demise stems from two contradictory regulations.

Article 17 (1) of the UAE Civil Transactions code states: "Inheritance shall be governed by the law of the deceased at the time of his death". This by itself makes for a smooth ownership transition of the deceased's assets to the heirs, or as mentioned in the will.

But the contradiction comes from Article 17 (5), which says: "The law of the United Arab Emirates shall apply to wills made by aliens disposing of their real property located in the State."

According to Jerry Parks, partner at the law firm Taylor Wessing (Middle East), "The position is that the UAE courts should respect the terms of a foreign will of a non-Muslim, provided the will is valid under the laws of citizenship of the deceased.

"Uncertainty, however, continues, largely because the courts have discretion to apply Sharia if they consider it appropriate to do so. Hence, one cannot always rely on the courts to rule in the way that you might expect or in the way that the deceased intended."

Replace wills with trusts

Trusts and foundations set up for the ownership and management of assets have not been given their due by regional jurisdictions. But, such investment vehicles can serve their purposes, according to Jesse Hester of Atlas Corporate Services.

"A trust can negate the need for a will, thus avoiding probate, can protect assets and mitigate forced heirship," Hester said.

"While trusts have never been able to directly own property here, in the other direction, local investors should absolutely be using structures to own property overseas, especially in jurisdictions that have inheritance tax such as the UK.

"For example, many investors own property in London in their own names, as culturally, for them, this is the norm. They assume that just because they are not residents or UK passport holders, the property is outside the scope of UK taxes.

"In actuality, the death of an individual owning UK-situated property will potentially create an inheritance tax liability, irrespective of the owner being resident in the UK or indeed their nationality. The current rate of inheritance tax is 40 per cent, though the first £325,000 [Dh1.87 million] of value is exempt.

"Thus, if a person owning a UK property worth £1 million dies, his estate will be liable to a tax bill of £270,000… easy money for the taxman. This can generally be avoided by owning the property through a company — the company doesn't die even if its owner does."