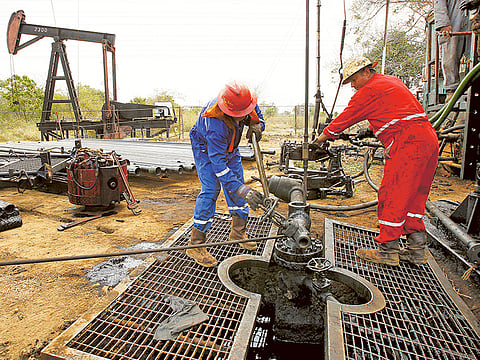

Oil gains as Saudi stands by Opec supply cuts, US rig activity drops

Saudi’s Falih says too early to change OPEC+ policy in April

London: Oil prices rose on Monday, lifted by comments from Saudi Energy Minister Khalid Al Falih that an end to Opec-led supply cuts was unlikely before June and a report showing a fall in US drilling activity.

US West Texas Intermediate (WTI) crude oil futures were at $56.50 (Dh207.48) per barrel at 0945 GMT GMT, up 43 cents, or 0.77 per cent from their last close.

Brent crude futures were at $66.29 per barrel, up 55 cents, or 0.84 per cent.

Al Falih said on Sunday it would be too early to change a production curb pact agreed by the Organization of the Petroleum Exporting Countries and allies including Russia before the group’s meeting in June.

“We will see what happens by April, if there is any unforeseen disruption somewhere else, but barring this I think we will just be kicking the can forward,” Al Falih said.

Oil markets have been supported this year by ongoing supply cuts by the group called Opec+, which has pledged to cut 1.2 million barrels per day (bpd) in crude supply since the start of the year to tighten markets and prop up prices.

The group will meet on April 17-18, with another gathering scheduled for June 25-26, to discuss supply policy.

Further underlining the desire of the world’s top exporter to drive down prices, a Saudi official said on Monday that the country plans to cut crude oil exports in April to below 7 million barrels per day.

Despite the gains, markets were held back after US

employment data raised concerns that an economic slowdown in Asia and Europe was spilling into the United States.

However, UBS said in a note that high crude imports by China would soak up excess supply, making for healthy demand which will help support prices.

“We expect the oil market to tighten further in 2Q19, allowing Brent to recover to the USD 7080/bbl range over the next few months,” said UBS analyst Giovanni Staunovo.

Prices were also buoyed by US energy services firm Baker Hughes’ latest weekly report showing the number of rigs drilling for new oil production in the United States fell by nine to 834.

But the Paris-based International Energy Agency predicted a surge in US production, which would see its exports exceed Russia’s and near Saudi Arabia’s by 2024.

“The second wave of the US shale revolution is coming,” the IEA’s Fatih Birol said.

“It will see the United States account for 70 per cent of the rise in global oil production... with profound implications for the geopolitics of energy.”