Gulf countries 'should abandon dollar peg and float currencies'

Fixed exchange rate makes nations vulnerable to outside forces, says expert

Dubai: Gulf countries should drop their peg to the US dollar to avoid unnecessary risk, John Taylor, chairman of FX Concepts, the world's largest currency hedge fund based in New York, said in Dubai on Monday.

"Any fixed exchange rate makes countries vulnerable to activity that has nothing to do with their economy," he said at Hedge Funds World Middle East 2011 conference, referring to fiscal policies in the US.

The dollar until recently was declining due to the country's severe fiscal deficit. The deficit rose by $40.2 billion (Dh147.85 billion) in December, the biggest in 12 months, the Commerce Department said.

Meanwhile, the US budget deficit is expected to reach $1.35 trillion in 2010, according to US Congress estimates.

Taylor said that for Gulf countries, a floating currency is better. The local currencies would then be affected only by economic positions of each country and its fiscal policy.

Talks

Since 2001, the six GCC countries have been in talks to de-peg from the dollar and create a single currency.

A deadline was earlier set for 2010, but talks fell through after Riyadh was selected as the base for the future central bank of the single currency.

Currently, four countries are still included in the union, with the UAE and Oman having opted out. Kuwait has already de-pegged its currency, but is part of the single currency talks.

The new date for the European-style shared currency is set for 2015. That will allow economies to integrate and create a monetary policy independent from that of the US.

The board of the new monetary council will include central bank governors from Kuwait, Saudi Arabia, Bahrain and Qatar.

A currency union would be a "wise" decision as the economies are similar in their resources and trade, according to Taylor.

‘Appropriate currency'

"They are what's called an appropriate currency unit… they would do very well," he said.

Taylor said that while the big sovereign wealth funds may lose some money, it would not be as important as the flow of business between the countries.

Trade and tourism would "make sure that the [single] currency is correctly priced for the customer and the United States has nothing to do with that. So you really shouldn't be pegged to the dollar," he added.

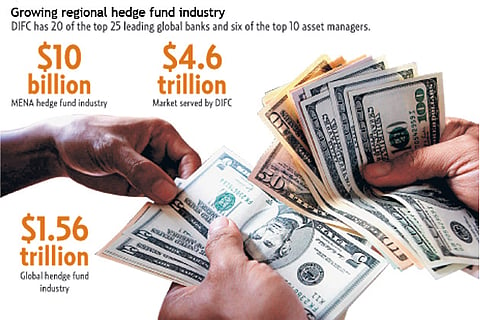

Speaking at the event, Ahmad Humaid Al Tayer, Governor of Dubai International Financial Centre (DIFC), said the Middle East and North Africa region (Mena) is seeing increasingly significant levels of capital and investor interest in alternative investments.

"There continues to be a slow but noticeable increase in hedge funds with a Mena focus. There is increased consumption in these [emerging] markets, and they will continue to accumulate capital.

The Mena hedge fund industry is estimated at $12 billion, while the global figure is close to $1.56 trillion.

In the fallout from the global crisis, some 75 hedge funds liquidated last year, after losing billions in assets, according to data from Hedge Fund Research Inc.