Dubai: The UAE telecom du is launching money transfer services via its platform to more than 200 countries, as the company gets cracking with its newly acquired fintech license. These money transfer services are also open to those who are not existing du subscribers.

du’s entry into fintech services – and particularly money transfers – is a pivotal moment as digital payment options become embedded among UAE consumers. The Dubai headquartered telecom service provider has 8.6 million mobile subscribers currently, having seen significant growth in recent quarters.

The du fintech services will also include peer-to-peer payments, another growth area with high take up rates among the young.

Our vision with du Pay is to challenge the status quo and redefine the future of digital financial services

“These new services will operate under the ‘du pay’ umbrella, and will also allow users to receive their salary deposits through an IBAN,” said CEO Fahad Al Hassawi. “Users will soon receive their physical cards to associate with their digital wallets or to use at the ATM.

“Even now, without the cards, they can take out cash from ATMs using card-less services.”

It's on the money transfer side of things that du will expect some heavy early action. To incentivize users, the company is offering zero fees and offering a Dh5 opening balance. And even 10GB data for du mobile subscribers.

On DFM, the du stock is trading at Dh5.58. The 52-week high is Dh6.05.

"Capitalizing on du's robust infrastructure and market reputation, du Pay leverages du’s assets and expertise to deliver a superior platform that is not only convenient and cost-effective but also tailored to meet the evolving needs of customers," said du in a statement.

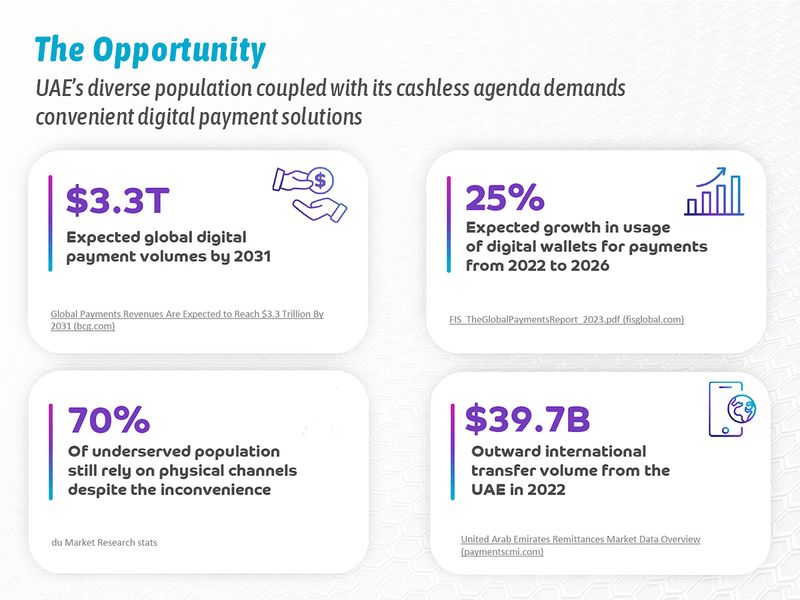

"This move is aligned with market projections, which anticipate substantive growth in the digital payment sector, expecting it to reach $3.3 trillion in payment services by 2031."

The CEO declined to go into specifics into what sort of boost the du pay services will have on the company's top-line numbers. In 2023, the company recorded significant gains across key numbers, while keeping its capex plans steady.

"If you see how telecom providers in advanced economies are doing with their non-core services, you can spot the growth potential these offer," said Hassawi. "We have had another non-core revenue stream via our commercial enterprise services - data centers, cloud operations, etc. - for years.

"But with fintech capabilities being added, there is a chance for us to shout out about it. And create more non-core revenues from it."

According to Nicolas Levi, CEO of du Pay, "Our app is designed to include everyone, supporting multiple languages. What sets us apart is we are leveraging on du’s strong customer centric focus, infrastructure and telco benefits that we can offer to customers to make our value proposition even stronger."

More to follow...