Dubai: Global sukuk issuances that slowed in 2020 compared to the previous year is expected to pick up momentum in 2021 led by GCC, and other key Islamic countries according to rating agency Standard & Poor’s.

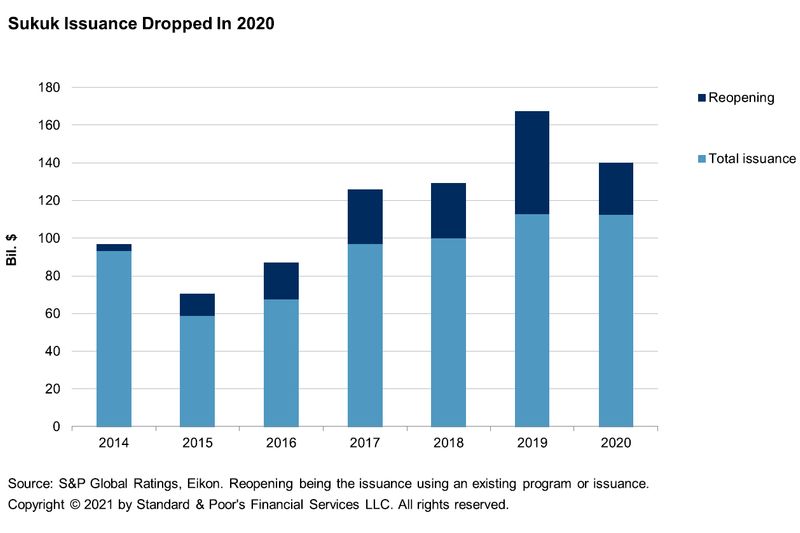

S&P expects market conditions to remain buoyant throughout 2021, with record-low interest rates and abundant liquidity. It forecasts total sukuk issuance of about $140 billion–$155 billion this year, thanks to a recovery in issuance in Malaysia, Indonesia, and the GCC countries. This compares with a drop in issuance to $139.8 billion in 2020 from $167.3 billion a year earlier.

“We expect GDP growth in the core Islamic finance countries -- the GCC countries, Malaysia, Indonesia, and Turkey -- to recover from a sharp recession in 2020. We also assume that the price of oil will stabilize at about $50 per barrel in 2021. Together, these factors underpin a stronger performance by the global sukuk market in 2021 than in 2020,” said Mohamed Damak, Global head of Islamic Finance at S&P.

Likely surge in 2021

S&P expects that some sovereigns in the core Islamic finance countries will tap the sukuk market more aggressively in 2021 along with increased issuance by corporates.

The corporate activity was muted in 2020 as they held on to cash and deferred capital expenditure (capex) because of the pandemic. They are likely to execute some of this capex in 2021, thereby necessitating access to capital markets.

We expect GDP growth in the core Islamic finance countries -- the GCC countries, Malaysia, Indonesia, and Turkey -- to recover from a sharp recession in 2020. We also assume that the price of oil will stabilize at about $50 per barrel in 2021. Together, these factors underpin a stronger performance by the global sukuk market in 2021 than in 2020.

Finally, $65 billion of sukuk mature in 2021, and part of this sum is likely to be refinanced on the sukuk market.

Rebound in demand

The rating agency expects pandemic to come under control gradually in developed countries from second-quarter 2021, through a combination of vaccines, medical treatments, and testing, and more widely in the second half of the year. This should allow for a lifting of many

social-distancing measures, a resumption of international travel, and a rebound in private demand.

While governments’ financing needs are likely to decline in 2021 compared with 2020 as the oil price stabilizes and their economies grow, S&P analysts think that part of these needs will be satisfied with sukuk issuance.

In 2020, some governments in the core Islamic finance countries issued conventional bonds rather than sukuk, since they are easier to structure, and reportedly allow them to tap a wider investor base.

Central banks also reduced their issuance volume in most of the core Islamic finance countries in 2020, as they injected liquidity into banks and encouraged banks to lend it to corporates at preferential rates in response to low oil prices and the pandemic. This meant that the banks had met most of their economies’ financing needs and corporates had less need to issue sukuk.

DIEDC embarked on this project with the Islamic Development Bank and the UAE Ministry of Finance and several other advisors in 2020.

“Depending on the outcome of the project, issuers may benefit from a speedier and more streamlined process to tap the Islamic finance market. Investors may also gain greater clarity on sukuk resolution in the case of default. Overall, the industry could profit from greater integration of all its components, including banking, takaful, and capital market activities,” said Damak.

Restructurings

The economic shocks in 2020 have increased credit risk for banks in the core Islamic finance countries. However, this risk has not yet fully materialized on banks’ balance sheets because of the regulatory forbearance and liquidity support measures implemented in many of the countries. According to S&P, the extension of these measures in most countries has further delayed the materialization of credit risk.

“We are likely to see an increase in default rates among corporates and potentially sukuk issuers in the next 12 months, especially those with low credit quality or business plans that depend on supportive economies and market conditions. We see pressure on real estate developers in particular, given the drop in real estate prices in the GCC and the building risks in the commercial real estate sector,” said Damak.