Industry will attain greater heights

Despite slowdown, planemaker has order backlog of 2,200 aircraft worth $273b

Dubai: There's a seven-year waiting time to get the delivery of an aircraft after signing a firm order.

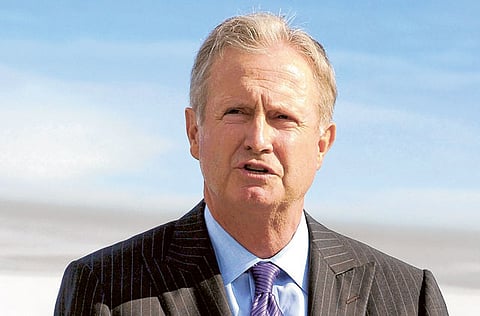

It's not just the best aircraft, it's about having the "best aircraft available", said James F. Albaugh, President and Chief Executive Officer of Boeing Commercial Airplanes.

This probably explains why Gulf carriers such as Emirates, Etihad and Qatar Airways have built up a huge order backlog — that collectively stands close to 500, including 239 to be delivered to Emirates.

Then there is the chronic delay in commercial deliveries of the new-age energy-efficient aircraft — be it Boeing's Dreamliner 787 or the Airbus A380 or A350.

All these technologically advanced aircraft launches have one thing in common — delays and angry customers.

However, once delivered, the results speak for their worth, and perhaps the delay.

"We are currently ramping up our 787 production and raising average monthly deliveries from 7 per month to 8.3," he said.

"That's why, I don't want to over-promise and under deliver. I'd rather under promise and over deliver," Albaugh, a civil engineer by training, said on the sidelines of the recently concluded Dubai Airshow.

Boeing clinched the biggest single order in US dollar terms in its 95-year history at the Dubai Airshow last week — a whopping $18 billion firm orders at list price for 50 Boeing 777-300ERs, with an option for 20 more worth a further $8 billion.

Albaugh shared some of his views of the global aviation industry. Excerpts:

Gulf News: How do you see the European debt crisis affecting the aircraft orders, since the capacity of European lenders has effectively been limited?

James Albaugh: Well, airlines will continue to carry passengers and banks will continue to lend — that's their business. Of course there will be short-term challenges like the current one.

However, I am a firm believer in the long-term future and I see lots of opportunities. Globally, more and more people will fly and the airlines will continue to place orders.

Even in the middle of a worldwide slowdown we have a huge order backlog involving 2,200 aircraft worth $273 billion — that's a lot and will be good enough to keep the production facilities busy for a number of years.

If you place an order now, we won't be able to deliver them in the next few years as the production and delivery slots have all been booked, unless someone gives up their slots.

That's why I say — the most important thing is not just having the best airplane only. It's about having the best aircraft available — that's all that matters.

So, although the present economic situation in Europe and the US might not be positive, the long-term outlook is good. And then there is demand in other parts of the world — China, India and the emerging markets.

How do you see aircraft demand shaping up globally?

Airline demand grows at 1.5 times the global GDP growth.

So, it is going to grow at between 5-6 per cent, which is not bad. However, once global economic growth picks up, this is going to accelerate further.

Air traffic growth in the Gulf region has been 15 per cent in 2009, 18 per cent in 2010 and 8.6 per cent in 2011 so far. So, this is a relatively high growth region, as far as airlines are concerned.

Where do you see the demand coming from?

In the 1990s, orders from the European carriers used to represent 72 per cent of all of our sales. However, things have changed now. Europe currently represents 50 per cent of our sale.

We see more demand coming from Asia, Africa, the Middle East and the emerging markets.

In terms of the product mix, how do you see the demand change between wide-bodied and single-aisle aeroplanes?

It's almost evenly placed at around 45 per cent each for single aisle and wide-bodied while the regional jets will make up the rest. It's going to remain pretty much the same for some time.

We have a very diverse order backlog.

Could you shed some light on the Boeing's new products — especially the B737MAX and B777X?

With the 737MAX and the 777X — we are building a bridge from where we are today to the future. We have the 737NGs sold out till 2016 and the 777s also sold out pretty much the same — till 2016. We are producing 10-11 B777s a month.

The 737MAX will deliver about 7 per cent more efficiency than its rival Airbus A320s.

Are you sure? What about the Airbus A320 neos? Airbus has sold more than 1,200 since its launch.

The efficiencies and benefits are proven scientifically. This is now something that we just tell people. This is what the aircraft is designed to deliver and we are pretty sure about that.

But don't get me wrong. Airbus also makes good aircraft and they are doing a pretty decent job in that as well. They have already captured about 50 per cent of the new build commercial jet market — you can't do that if you are not very good. I am talking about the 737MAX's performance.

How many 737MAX have you sold so far?

It's about 700 plus. However, don't forget 737MAX came to the market a year after the A320 neos. We will soon catch up with the A320 neos.

With the current debt crisis in Europe and the US, are you planning to revamp Boeing Capital? How do you see your aircraft finance arm supporting sales going forward?

Yes, we are working closely with the Boeing Capital management to make it a more strategic partner of our business. There will be certain changes in its functioning and it will play a more strategic role in our business.

We have $3 billion spare cash that will help Boeing Capital to support our customers in the coming years.

Our strategy is going to be that Boeing Capital is much more than a lender of last resort...when our customers come to us and want help with financing, you will see Boeing Capital be much more strategic

What are your thoughts on setting up a production plant outside the United States?

Might be, but not in the near future.

How will Boeing end up this year in terms of deliveries and how does that compare with Airbus?

We are positioned to deliver between 480-485 while I think Airbus will end up delivering between 520-530. I pretty much see parity in terms of market share among the new builds between the two manufacturers and it's going to remain that way for some time.

Finally, what is your view on the Middle East's avitation market?

The economies in the Middle East are resilient. Our long-term view is very positive. We have already 1,000 aircraft in service in the Middle East and a further 350 on order.

Over the next 20 years, the region will absorb about 2,520 aircraft worth $450 billion. So, we are firmly committed to this market.

profile

at the helm of affairs

James F. Albaugh, 61, is executive vice-president of The Boeing Company and president and chief executive officer of Boeing Commercial Airplanes. He is responsible for all the company's Commercial Airplanes programmes and services, is a member of the Boeing Executive Council and serves as Boeing's senior executive in the Pacific Northwest. He was named to this position in September 2009.

Before assuming his current role, Albaugh was president and chief executive officer of Boeing Integrated Defence Systems, a business unit providing integrated solutions to meet the needs of defence, space and intelligence customers in the US and around the world.

Previously, Albaugh was president and CEO of Boeing Space and Communications (S&C) for four years.

Before leading Space and Communications, Albaugh was president of Boeing Space Transportation, a predecessor unit of S&C. He assumed that position after serving as president of Rocketdyne Propulsion & Power, part of the Rockwell aerospace and defence businesses acquired by Boeing in 1996.

A Washington state native, Albaugh joined the company in 1975 as a project engineer at its Hanford, Washington, operations.

He is an Honorary Fellow of the American Institute of Aeronautics and Astronautics and an elected member of the International Academy of Astronautics. Albaugh currently serves as board chairman of the Aerospace Industries Association (AIA).

In 2010, Albaugh received the Forrestal Award from the National Defence Industrial Association for leadership in preserving a strong US defence industrial base. He also was appointed to the board of the National Competitiveness Centre, an independent organisation that helps Saudi Arabia compete more effectively in the global economy.

In 2009, Albaugh was named to the Board of Visitors of The Fu Foundation School of Engineering and Applied Science at Columbia University.

Albaugh, a Gold-and-Silver-Knight of the National Management Association, was that organisation's Executive-of-the-Year in 1999. He also is a member of the American Astronautical Society, the Air Force Association and the Washington Roundtable, and sits on the boards of a variety of corporate and charitable organisations.

Albaugh holds bachelor's degrees in mathematics and physics from Willamette University and a master's degree in civil engineering from Columbia University.

— S.R.