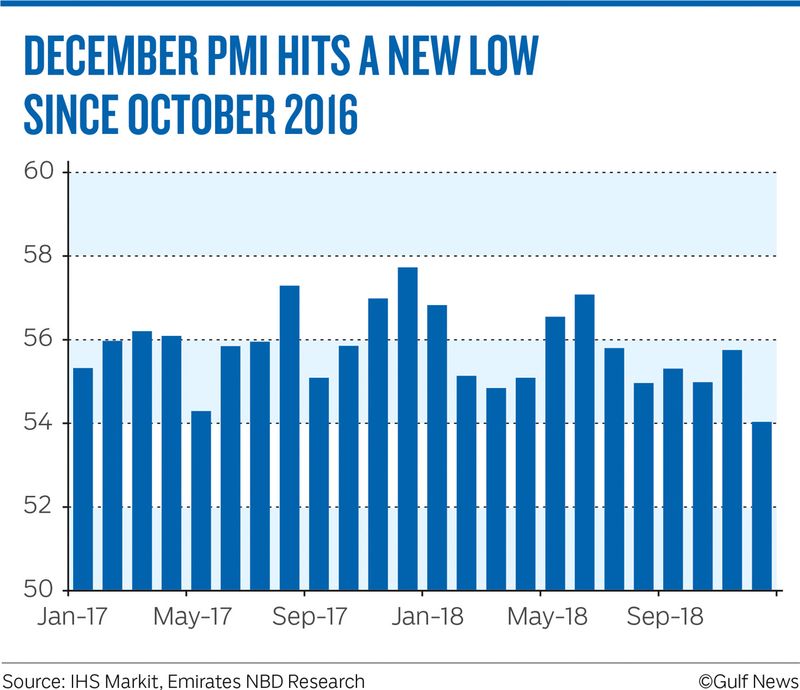

Dubai: The UAE’s Purchasing Managers’ Index (PMI) for December dipped to a two-year low from 55.8 in November to 54 in December signalling slower pace of growth in the non-oil private sector.

December’s headline PMI marked the slowest pace of expansion in the non-oil private sector since October 2016, and has weighed on the 2018 average, which declined to 55.5 from 56.1 in 2017.

“Although the PMI remains in expansionary territory, the sub-components of the survey suggest that this is continuing to come at a cost to businesses’ margins, albeit to a lesser degree than seen in November,” said Daniel Richards, MENA Economist at Emirates NBD.

Both output and new order growth slowed in December, while employment and wage growth were broadly unchanged. Output fell from 60.1 to 58.8 and new orders from 61.0 to 58.3.

A slower pace of growth in new export orders (52.3) suggests that most of the rise in new orders was domestically driven. Firms purchased only what was required to meet output requirements, and the overall stock of pre-production inventories declined in December. This was largely the result of efforts to reduce operational costs at year-end.

Selling prices were reduced for the third successive month. Domestic competition led to sales promotions, according to firms surveyed. However the fall in output prices was mitigated somewhat by a slower pace of growth in purchase costs which at 50.7 expanded at the slowest pace since August. The PMI survey data showed overall input prices rose only marginally in December, with both purchase and staff costs broadly following the overall trend.

Employment was broadly unchanged, following a marginal rise in November. Efforts to control costs discouraged firms from hiring additional workers at the end of 2018, despite increasing new business.

Firms continued to expand their purchasing activity in response to growth of new orders and higher output requirements. Data suggested that purchased items were only used to support higher output, rather than also to build stock holdings. Inventories of inputs decreased for the first time in four months, with some firms linking this to efforts to manage cash flow more efficiently.

Companies generally remained optimistic that business activity will continue to increase over the course of 2019. Optimism was based on expectations of improving economic conditions and success in securing additional sales over the next 12 months.

The lower annual average for the PMI suggests that the rate of expansion in the non-oil private sector slowed from 2017. Official data put 2017 non-oil sector growth at 2.5 per cent.

Emirates NBD’s research team has revised their estimate for 2018 non-oil GDP growth down to 2.3 per cent from 2.7 per cent previously. However, slower growth in the non-oil sectors was offset by sharply higher oil production in the fourth quarter of 2018, with crude oil output rising to 3.35mn b/d in December. As a result, the real GDP growth for 2018 is estimated 2.4 per cent up from 0.8 per cent in 2017.