Dubai: The UAE’s pro-diversification efforts in the past are yielding results in terms of sustainable growth outlook and results will be more visible as the regional economies face structural changes from prolonged lower oil prices, according to economists and analysts.

While the decline in oil prices would partially impact future growth, the contribution of non-oil sector is expected to further expand to 71 per cent by 2020 as compared to 68.8 per cent in 2015.

“Results of the country’s diversification is already visible with 4 per cent growth during 2015 as compared to low single digit growth in most of the other GCC economies. Dubai remains the engine of (non-oil) growth for the UAE with most of the investment projects, both public and private, coming in this region,” said Faisal Hasan, Head -Investment Research at Kamco.

The UAE’s PMI data for the past eleven months have been largely range bound after peaking at 55.3 points in July indicating slow down growth in job creation and export orders, but overall the private sector output continued to expand although at a declining pace.

The UAE is arguably the most diversified economy within the GCC, and thus the least vulnerable to the low oil price environment of the past two years, according to Citi Research.

“That said, significant differences are apparent between the seven emirates that comprise the UAE, with Abu Dhabi standing out as the economy most exposed to oil markets. Moreover, while the Northern Emirates (led by Dubai) are far less directly dependent on oil, their economies are still highly correlated with regional economic activity and trade,” said Farouk Soussa, Middle East chief economist of Citi.

Abu Dhabi’s public finances have been impacted by the fall in oil revenues, and the government has embarked on a medium-term (5-year) fiscal plan to eliminate the deficit. However, like other regional oil exporters, the emirate has accumulated significant fiscal reserves in recent years and benefits from these both as a fiscal cushion (source of deficit financing) and a source of non-oil income.

Analysts say the UAE’s relatively cautious approach to spending during the oil boom years has meant that the near-term fiscal imbalances are not nearly as acute as in some other GCC countries, and that the corresponding adjustment process will not be nearly as painful.

“Data shows that all the components of GDP has seen positive growth for the second consecutive year, with the only exception of government services, which we believe is a positive sign considering rising government services trend in other economies,” said Hasan.

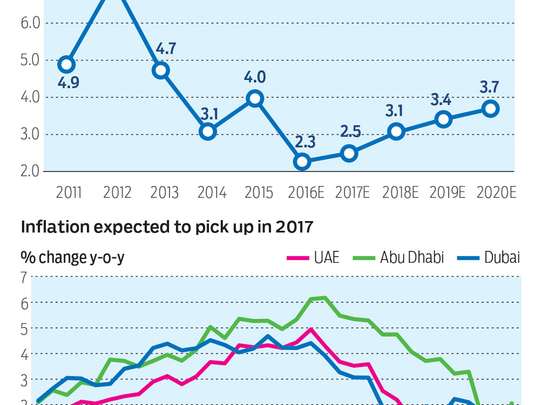

The non-oil growth in the UAE economy is expected to pick momentum in 2017 as Expo 2020 related government spending in Dubai and relatively modest level of fiscal consolidation measures in Abu Dhabi to boost overall spending.

“The expected pickup in non-oil growth next year is supported by a broad range of drivers in both Abu Dhabi and Dubai. For Abu Dhabi, the front-loading of fiscal adjustment in 2015-16 implies less need for fiscal consolidation next year. As such, we expect the government to increase social infrastructure spending, boosting consumption and investment,” said Dima Jardaneh, Head of Economic Research Mena, Standard Chartered.

Economists expect the Dubai government to maintain an expansionary stance next year, with construction and development related to Expo 2020 picking up speed. Downside risks to growth could materialise from a further weakening of the global environment and difficulty securing financing for infrastructure projects. Indeed, economic activity in Dubai slowed in H2-2016 on lower aggregate demand domestically and externally.

“We expect non-oil growth to pick up to 4 per cent in 2017. Factoring in a decline in oil production of 139,000 barrels per day in the first half of 2017, in line with the Opec agreement reached on 30 November, we estimate that oil GDP will contract by 2.3 per cent in 2017,” said Jardaneh.