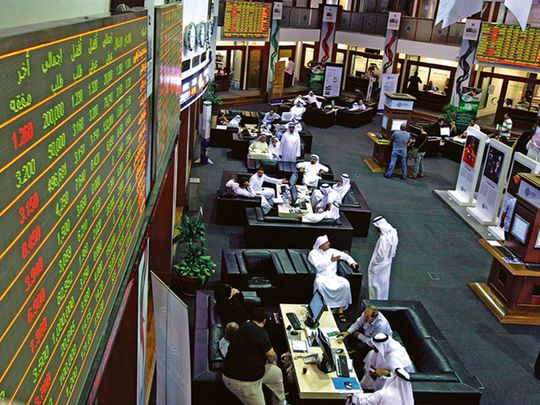

Dubai: Stock markets in the Gulf, which are shut for Eid holidays, could be in for extensive profit-taking when they open next week. If so, this would mirror the worsening sentiment recorded by equities globally, which are witnessing falls due to a confluence of negative factors such as trade war worries and recessionary fears amid falling oil prices.

The Dow Jones Industrial Average (DJIA) has shed more than three per cent in the past five sessions, while the S&P 500 index dipped 2.6 per cent. The DJIA and S&P 500 index had closed more than one per cent lower on Friday.

“Mena equities will react to the cumulative moves in global markets over the week when they reopen Sunday next,” said Vrajesh Bhandari, senior portfolio manager with Al Mal Capital. “An increasingly aggressive US trade policy is fuelling fears that we are heading for a significant economic slowdown.”

The DFM index had closed 0.79 per cent higher at 2,620.33 on Friday, while Abu Dhabi Securities Exchange general index gained 2.82 per cent on Thursday, its sharpest rally in weeks, to be at 5,003.59.

Local equities had been on a gaining streak in recent weeks. The Dubai Financial Market general index made gains in five out of eight sessions and is up 4.2 per cent since May 20. The Abu Dhabi index has shot up 15 per cent in the past one year, mainly due to a rally in First Abu Dhabi Bank shares.

The Saudi Tadawul index gained on Thursday after witnessing busy profit-taking, closing 1.22 per cent higher to 8,516.48. The index is 8 per cent up so far in the year and has been the best performing gauge in regional markets.

“The sentiment will be dominated by developments in the regional geopolitical environment and rising trade tensions between the world’s two largest economies,” Allied Investment Partners said in a note.

Prices of oil, from which majority of the Gulf states derive their revenues, fell more than 12.58 per cent in May, its sharpest in 2019. Brent prices have weakened on expectations of lower demand due to the impending trade war and amid lower supplies.

“The major impact for Middle Eastern stock markets would be from the sharp drop in oil, which has now fallen almost 20 per cent from a high in late April,” Bhandar said.