GCC Islamic funds enjoyed the highest fund flows post financial crisis

The key challenge to grow the AUM is the lack of institutional investors

Gulf Islamic funds have bucked the global trend of declining assets under management (AUM) in the same space in the past few years, according to Thomson Reuters Global Islamic Asset Management Report 2014.

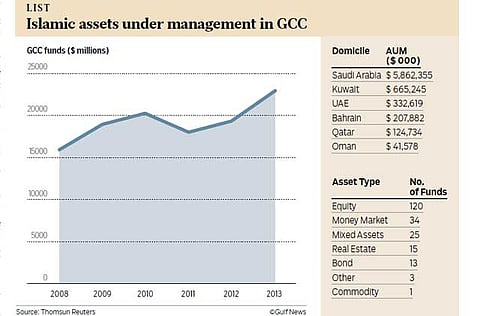

Assets under management of GCC Islamic funds have been increasing, post global financial crisis and the 2011 political turmoil in the Arab world, even though AUM have been decreasing for the global Islamic fund industry, the report states.

While Islamic funds globally have doubled since 2007, the AUM have marginally gone up in the last few years, and have in fact declined 1.7 per cent in 2013. The full report will be released next week at the Global Islamic Economy summit in Dubai.

“We can conclude that GCC funds have persevered against the direction of the overall industry,” Sayd Farook, Global Head of Islamic Capital Markets at Thomson Reuters told Gulf News in an email. “The GCC has also enjoyed the highest fund inflows compared to other jurisdictions confirming that liquidity still remains within the Gulf.”

Of the total $62 billion assets under management, Malaysia, Saudi Arabia Luxembourg comprise the top three Islamic fund hubs. Saudi Arabia, which has the region’s biggest and most liquid stock market, represents almost five per cent of global AUM. Kuwait and the UAE follow with $665 million and $333 million respectively (see table).

Globally and not surprisingly, equity funds have been the most favourable asset class. Money market funds have been the most successful asset class to attract scale in the industry, topping $20 billion this year worldwide.

While the Islamic asset management space continues to lag behind in terms of growth compared to Islamic banking, the involvement of Islamic banks is one of the critical factors required for the sustainability, growth and development of the industry, said Farook.

“Today, the industry is overreliant on the retail sector — 80 per cent of Islamic fund investors are retail customers and this is one of the main reasons that the industry is struggling to achieve scale,” said Farook.

“By increasing the role of Islamic banks and other Islamic institutions, the industry will enjoy larger flows of funds not to mention, having long-term funds invested versus the short-term nature of retail investors. The latter would mean that the industry (given favourable economical and financial factors) would benefit from a gradual and sustainable increase of scale.”

The key challenge to grow the AUM is the lack of institutional investors. The other challenges include, the report says, is underdevelopment of takaful (Islamic insurance) operators and pension funds in Islamic countries.

But with development of pension assets in Islamic countries — GCC pension is estimated to be about $180 billion — the chances of growing the pie is considerable.

“The challenges presented are a direct effect of the current state of the industry,” said Farook. “Given the small size of the industry, compared to the sukuk and money market sectors, asset managers will be involved in more than one line of field. This entails the lack of appreciation for those involved, not to mention the lack of specialized opportunities available within the Islamic finance market.

“Additionally, the lack of volatility and growth would mean that wealth managers and portfolio managers would suffice for the majority of institutions, thereby decreasing the demand for qualified asset managers.”