Dubai: UAE-based proptech Silkhaus, a platform for short-term rentals, has garnered $7.75 million in seed round funding, making it one of the biggest such in the region. The short-term let market is in for another round of acute demand, first from the FIFA World Cup fan base landing in Dubai and later through the end-of-year holiday festivities.

For property investors, STRscreate ‘flexibility in maximising returns’, without being locked into long-term tenancy contracts. While demand for STRs has been aggregated by online platforms, the supply ‘still remains hyper-fragmented and largely offline in nature’.

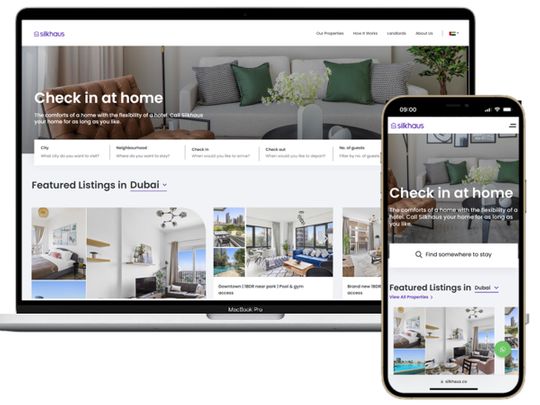

“We are building the operating system for property owners - large or small - to operate high quality short-term rentals and deliver memorable guest experiences,” said Aahan Bhojani, founder and CEO of Silkhaus.

With the backing of our global investors, we are excited to build Silkhaus into a global category-leader.

Founded in 2021 by Aahan Bhojani and Ashmin Varma, Silkhaus has grown over 10x over the past 12 months. It has identified a $13 billion as its addressable market across MENA, South Asia and Southeast Asia to ‘unlock opportunities for asset owners’.

Silkhaus allows owners to list multiple or single units on the platform, while guests can easily access quality, well-maintained properties, whether they are travelling for business or leisure.

“We are witnessing a significant increase in alternative accommodation and short-term rentals,” said Bhojani. “However, the management of short-term rentals is highly fragmented and largely offline. Property owners lack the technology and know-how to deliver a world-class and standardised experience.”

“Aahan and Ashmin have differentiated themselves in the right ways with an early emphasis on solid unit economics, market leading NPS (Net Promoter Score), and a value add for all of their stakeholders, including guests and property owners.”