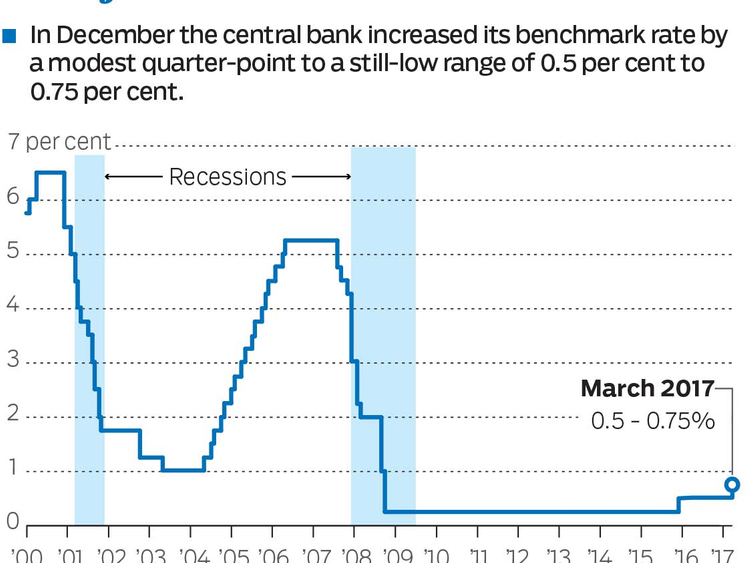

Dubai: An expected Fed rate hike this week and a potential guidance pointing to further hikes more than the earlier guidance may add to the existing challenges for the GCC economies in terms of lower growth, according to analysts.

Faltering recovery in oil price despite recent output cuts are expected to add further budgetary constraints to GCC governments as the external borrowing costs are set to rise.

Additionally, the increase in funding costs are likely to make its way to corporates and consumers via higher interbank rates affecting both investment and consumer demand.

Analysts say domestic liquidity conditions and the spread of interbank rates over Libor will be largely determined by the oil price and the extent of the recovery in oil export receipts. If the recovery in oil prices can’t be sustained, a steeper US tightening cycle amplifies liquidity pressures. Though some central banks kept the lending rates unchanged in response to the previous rate hike in the US in order to keep the liquidity in their economies comfortable, rate hikes from now will have to reflect on in interbank rates and eventually lead to higher borrowing costs.

“When interest rates go up, basically, it’s borrowers and consumers who suffer. The top line of certain companies is also adversely impacted. One increase does nothing, but if you’re talking about three in 2017, that will impact the revenue of consumer companies, and companies that borrow will also suffer,” said Sanyalaksna Manibhandu, director of research at the National Bank of Abu Dhabi Securities.

Higher rates are expected to have an adverse impact on the borrowing costs of regional sovereigns and corporates. Faced with fiscal deficits, a number of GCC sovereigns have been tapping the global debt markets. Higher Fed rates could effectively increase their funding costs. “Cost of borrowings for sovereigns and corporates will indeed go up though some buffer can be provided by higher return on their investments,” said Anita Yadav, Senior Director - Global Markets & Treasury, Head of Fixed Income Research at Emirates NBD.

Stronger dollar is likely to create headwinds for the local economy, particularly with real estate, retail and tourism suffering somewhat. A sharper rise in US interest rates is expected to manifest in dollar strength effectively reflecting in the appreciation of GCC currencies, impacting competitiveness of many sectors such as trade, tourism, hospitality and real estate.

The dollar appreciation would lead to further real appreciation in the GCC’s pegged currencies, reducing their competitiveness and increasing their purchasing power abroad. “Strengthening of local currencies could encourage capital outflow as regional investors seek to diversify their portfolios internationally through purchase assets abroad,” said Elena Sanchez-Cabezudo, co-head of financials & banking and equity research, EFG Hermes.

The Saudi Arabian riyal (SAR) and the UAE dirham have both appreciated by about 10 per cent in real terms since end-2014. The Kuwaiti dinar (KWD) has appreciated by 7.5 per cent during the same period.

The real effective exchange rate of GCC currencies has already appreciated and are expected to appreciate further. While the region’s goods export base outside of oil and oil-related goods is quite narrow, nonetheless services exports may deteriorate as a result of the strengthening in the currencies. This is most relevant for the UAE where services export receipts stand at around 7 per cent of GDP.