Mutual collaboration on regulatory technology platform

Dubai Insurance and AJMS Group announce integration of DIGI-Comply

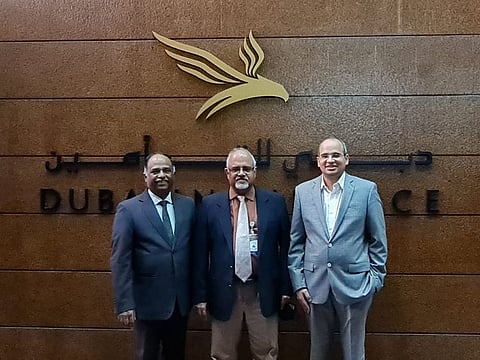

Dubai Insurance (DIN) and RETL, group entity of AJMS Global, have announced the integration of DIGI-Comply, a proprietary Sanction Screening and Risk Assessment tool, with their core insurance software. The AI driven solution automates the Sanction and PEP Screening process, thereby enabling real time compliance management. Through its proprietary methodology, the solution also helps FIs to reduce ‘false positives’ and implement a robust AML/CFT Risk Assessment process thereby ensuring compliance with in-country regulations.

Abdellatif Abuqurah, CEO of Dubai Insurance, while complementing the team of RETL, mentioned that the system was very cost-effective, user friendly and was therefore quickly accepted by the staff as well. He mentioned that DIN Team had brought to his notice that implementing the additional software has not increased the TAT or impacted their productivity, which was noteworthy. Given the strength of AJMS Group in AML / CFT domain, he was confident that the product would serve DIN well over the period. He expressed his appreciation for the effort put in to provide a user-friendly product as per the requirements of the regulators and the end users.

Commenting on the successful implementation, Abhishek Jajoo, Founder and Group CEO of AJMS Group said that, when he founded RETL, the core objective was to launch a user friendly fully integrated compliance solution which complies with AML Compliance requirements in UAE and supports the Nation’s vision on safeguarding financial system. He was proud of his team to launch a No-Code platform for AML Sanction and Risk Assessment, where the Compliance officer of any organisation can customise their internal methodology into system without the involvement of any IT personnel. As part of this journey, we are happy to be associated with Dubai Insurance, one of the largest Insurance players in the country, which decided to select DIGI-Comply for end-to-end compliance.