Dubai: The UAE’s credit growth saw a solid rise in October, largely driven by improving credit demand from the private sector corporates, according to latest credit data from the central bank analysed by the Economics Team at Abu Dhabi Commercial Bank (ADCB).

Overall credit growth rose by a solid 0.5 per cent month on month in October, supporting a rise in the yearly credit growth rate to 3.9 per cent year on year, up from 3.7 per cent in September.

In absolute terms, private corporate sector credit went up by Dh10.6 billion last month, while the credit to government sector increased by Dh2.8 billion.

“We believe that corporate (private) and government credit demand has likely been boosted by stronger investment activity. Data for credit growth by sector shows that construction saw a solid rise in the first nine month of 2018, likely driven by projects related to Expo 2020,” said Monica Malik, chief economist of ADCB.

The outlook for higher interest rates is also seen as a reason behind corporate sector credit growth as many companies are front loading their fund raising in anticipation of higher cost of funds.

Corporate credit growth last month saw one of its strongest annual expansions so far this year, strengthening to 7.5 per cent year on year in October, up from 2.8 per cent in December 2017. Loans to government related entities (GREs) witnessed further decline of 4.7 per cent month on month in October and are down 12.1 per cent year on year. However, government borrowings picked up pace last month. The sharp acceleration in government annual loan growth in October to 8.5 per cent year on year largely reflects the low base.

“A shift of more expansionary fiscal stance could be driving higher government loan demand. However, the credit data still reflects the challenges facing the economy, including soft consumer demand with retail loan growth only up 0.9 per cent year on year in October,” said Thirumalai Nagesh, an economist at ADCB.

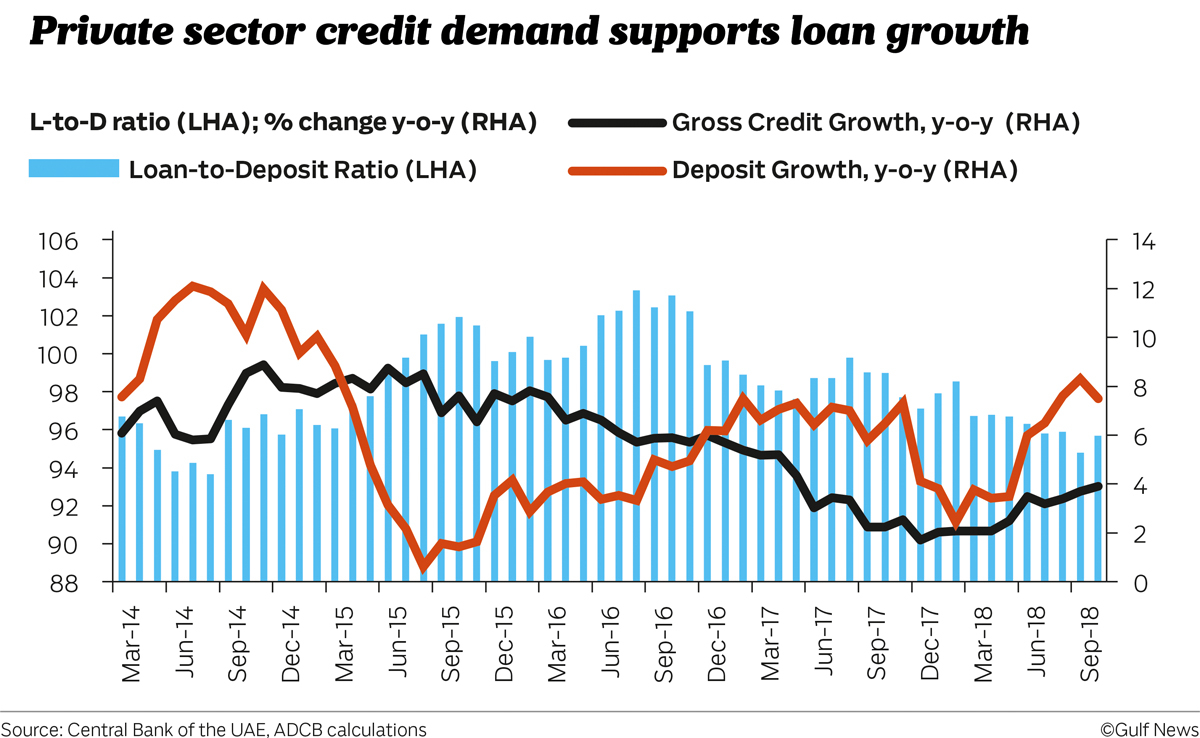

Deposit growth across the UAE banking system fell by 0.4 per cent month on month in October, though this was after five consecutive months of rises. With the monthly contraction, yearly deposit growth decelerated to 7.5 per cent year on year in October from 8.3 per cent in September. The monthly contraction was driven by resident deposits with both the GRE and private segments seeing a drop. Government deposits saw another solid increase last month, rising by 3.9 per cent in October, up by Dh11.1 billion. Government deposits are up 32.8 per cent year on year and 40.1 per cent year to date.

Net government and GRE deposits in the banking sector rose further in October to another multi-year high on the back of a monthly rise in government deposits and a fall in GRE loans.

Liquidity

The gross loan-to-deposit (L/D) ratio rose to 95.7 per cent in October from 94.8 per cent in September on the back of positive monthly credit growth and a fall in deposits.

“Overall system-wide liquidity conditions remain comfortable and the October L/D ratio remains below the August levels. However, the rise in foreign deposits suggests that some banks still require external funding, which tends to be more expensive, possibly due to the concentration of government deposits in certain banks,” said Malik.

The strong liquidity conditions are helping to limit the positive spread between the EIBOR and LIBOR rates from historical levels, though they have widened from the narrow differential seen in early 2018 (sometimes negative).

“We expect to see a further rise in UAE benchmark rates with the central bank expected to follow the Fed with further rate hikes. We see the Fed rates rising by 25 basis points (bps) at the December Fed meeting and by a further 50 bps in the first half of 2019,” said Malik.