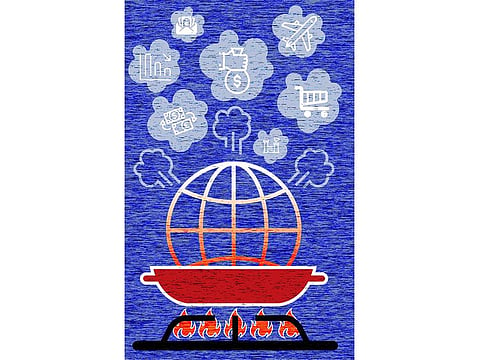

Investor ride is getting downright bumpy

They haven’t had a day’s respite and that word recession gets thrown up all the time

The stock market is having a banner year. The stock market has barely budged in the past year.

Both of those statements are true: The S&P 500 is up about 15 per cent in 2019, a great performance by historical standards, but it is essentially flat since last August. And that is just one of the many paradoxes bedevilling investors this strange summer.

The US economy is humming, with historically low unemployment levels, yet the economy is flashing warning signs, some of which have turned out to be false alarms in the recent past. The Federal Reserve went from raising interest rates to lowering them to now, under pressure from President Donald Trump, appearing poised to cut them again.

From day to day and from tweet to tweet, the country’s trade war with China runs hot and cold and hot again.

The S&P 500 dropped 1.2 per cent on Monday (August 12), jumped almost 2 per cent on Tuesday, tumbled 3 per cent on Wednesday, didn’t move at all Thursday and then closed out Friday with a 1.44 per cent rally. Given all the mixed messages emanating from the economy and central bankers and politicians, the turbulence this past week is likely to continue.

The question is where it will come from. And when it will hit. And how violent it will be.

Everyone will get hurt

This matters to anyone with a 401(k) or a mutual fund. But it especially matters to the president, who has repeatedly used the market’s performance as a proxy for his performance in the White House. As the 2020 campaign intensifies, the market’s ups and downs will therefore take on even greater importance.

It is impossible — or at least unwise — to predict where the market is heading. What’s clear is that some of the powerful engines that propelled stock markets to record highs over the last year have been sputtering.

The Republican tax cuts that took effect in 2018 juiced companies’ earnings and catapulted stocks higher. But the sugar high appears to be fading: Corporate profits at S&P500 companies probably shrank 0.4 per cent in the three months that ended in June, according to FactSet, a provider of financial data.

If that happens, it will put pressure on companies’ stock prices, which will discourage corporate spending, which will weaken the economy, which will erode corporate profits, and round and round we go. This is what economists call a negative feedback loop.

Already, the mighty US economy — in its 10th year of an expansion, boasting the lowest unemployment rate in a half-century — is showing signs of wear and tear. Growth slowed to a 2.1 per cent annual pace in the second quarter from a 2.5 per cent clip last year. Job growth and production in manufacturing are waning.

Sticking to their cash

Americans are also becoming more cautious — a potentially ominous sign for an economy that relies on healthy consumer spending. Making matters worse — certainly less stable — the trade war is dealing a direct blow to the world’s major economies. China’s economy, second only to that of the US, has softened fast, while Germany’s, the world’s fourth largest, has shrunk.

“What we see right now is what we call already an industrial recession,” said Iaroslav Shelepko, an economist with Barclays in London.

Investors have more reasons to be anxious. A financial metric known as the yield curve — basically the difference between interest rates, or yields, on bonds that come due relatively soon and those with longer maturities — is now inverted. That means interest rates on some long-term bonds are below those on shorter-term bonds.

This odd phenomenon signals that nervous investors are hunting for super-safe places (like long-term bonds) to park their money. Inverted yield curves are also one of the most reliable leading indicators of recession. Indeed, every recession in the past 60 years has been preceded by an inverted yield curve.

The fact that an obscure finance metric entered the vernacular this summer is testament to America’s economic jitters — and that is where Trump comes in.

Even before he was sworn in as president in January 2017, Trump was treating the stock market as a yardstick of, and a referendum on, his leadership. Over the nearly three years since his election, the S&P 500 is up 35.5 per cent.

But since last August, the market has been treading water with a 1.7 per cent rise that’s slightly behind the pace of inflation.

The markets do a see-saw

That is not to say things have been calm. In the final months of 2018, markets plunged nearly 20 per cent — the toll coming due for an intensifying trade war and the prospect that central banks, most of all the Fed, would continue to push interest rates higher to prevent the economy from overheating.

Then the Fed signalled it would stop raising rates, and investors celebrated, driving stocks to their best start since 1987. Stocks surged 8 per cent in January and were up almost 18 per cent through April.

By early June, even after trade tensions took a turn for the worse, investors happily — and correctly — anticipated that the Fed would react by cutting interest rates. The central bank said the cut, which it delivered July 31, was “intended to ensure against downside risks from weak global growth and trade tensions”.

By then, the market had fully clawed its way back from its late-2018 meltdown, notching a series of new highs that Trump noted triumphantly.

Now, though, the euphoria has again vanished, amid increasingly hostile trade talk shooting back and forth between Trump’s Twitter account and Beijing and economic data in the US and other countries that hints at tougher times to come.

Whatever the reason, Trump was frustrated. “Our problem is with the Fed,” he wrote on Twitter, as stock markets suffered one of their worst declines of the year. “Raised too much too fast. Now too slow to cut.”

If Jerome H. Powell, the Fed’s chair, suggests that the central bank intends to keep slicing interest rates, investors — and Trump — are likely to smile, or at least relax a little. If he doesn’t, prepare for another round of turbulence.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox