Record gold prices turn this Diwali into the costliest one yet

Despite record highs, gold demand shines bright across Dubai this Diwali

Dubai: Gold recently crossed the historic $4,000-an-ounce threshold, marking a rise of more than 50% over the past year. In the UAE, 24K gold has broken Dh500 per gram. For the Indian community in Dubai, preparing for Diwali places tradition under pressure. Buying gold during Diwali is both an act of adornment and a symbolic ritual. Yet with gold at approximately $4,164 per ounce, many are questioning whether that ritual can still fit the budget.

In the UAE, gold prices have surged past Dh500 per gram after a prolonged rally. While that kind of momentum often deters retail buyers, the Diwali season is proving exceptional. According to Farhan Badami, Business Development Manager at eToro, central banks and retail investors are now racing to accumulate gold as a hedge. He pointed to global turmoil, trade wars, and currency volatility as forces pushing institutions to hoard gold, the same impulse that motivates families during festive buying.

Yet Diwali 2025 is unlike any before it. The festival has coincided with record highs in gold. Buyers are responding not by stepping back entirely but by shifting strategy.

Smarter buying under soaring rates

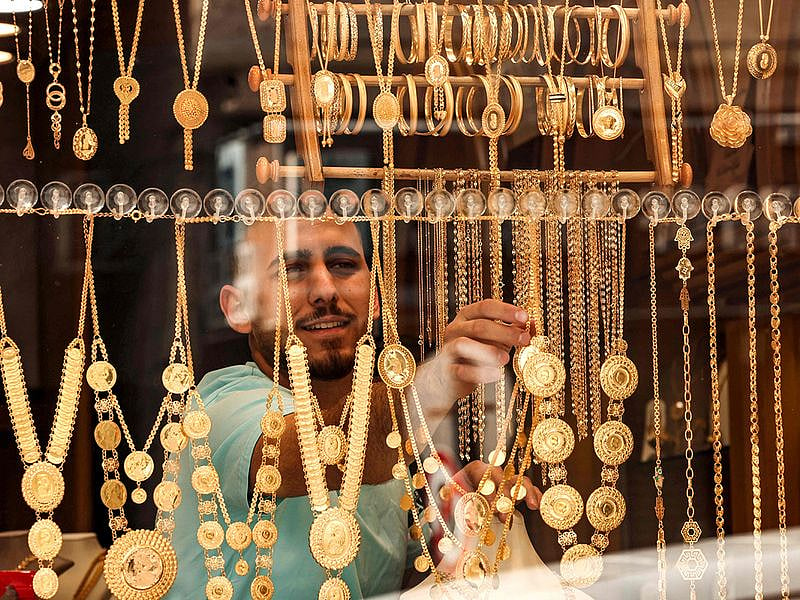

Jewellers across Dubai report that business is brisk, but buyer behaviour has changed. In the Gold Souk and beyond, shoppers are opting for lighter jewellery, smaller gold coins, or spreading purchases out across months rather than making heavy investments all at once.

For jewellers, it’s a rare silver lining. High margins on earlier acquired inventory make the festival season especially profitable, even if volumes moderate.

Dubai as a global indicator

Dubai’s Diwali buying season acts as a barometer of Indian gold demand worldwide. The city’s VAT structure, purity assurances, and retail depth make it a preferred destination for purchases, even when prices soar at home.

What happens here during Diwali often foreshadows broader trends, that gold demand, even under strain, can remain resilient if buyers adapt wisely.

Why does demand hold in a time of excess?

Global factors are key. Geopolitical tension, especially between the US and China, along with speculation on US rate cuts, has strengthened gold’s safe haven appeal. Central banks are adding to their reserves. Even as silver and other precious metals tighten, gold remains the focal point of accumulation.

The usual theory of bubbles, where supply overshoots demand, seems weak in this cycle. Infrastructure is running at capacity. If anything, demand remains the bottleneck.

That said, the rise in gold prices carries risks. Buyers may delay purchases entirely if prices pull back sharply. The festival’s emotional pull, however, often overrides that hesitancy. For many buyers, Diwali is about fulfilling a cultural contract.

Tradition has not vanished. Buyers are simply investing in lighter, versatile pieces with intention. As long as that balance holds, this Diwali may remain radiant, just more expensive than ever before.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.