The dramatic rise in gold prices has captured the world's attention.

Gold's reputation as a stable and valuable asset during times of uncertainty makes it a go-to investment, driving its price higher.

In recent days, it’s been driven by a potent mix of economic uncertainty, waning consumer confidence, and a shift towards safe-haven assets.

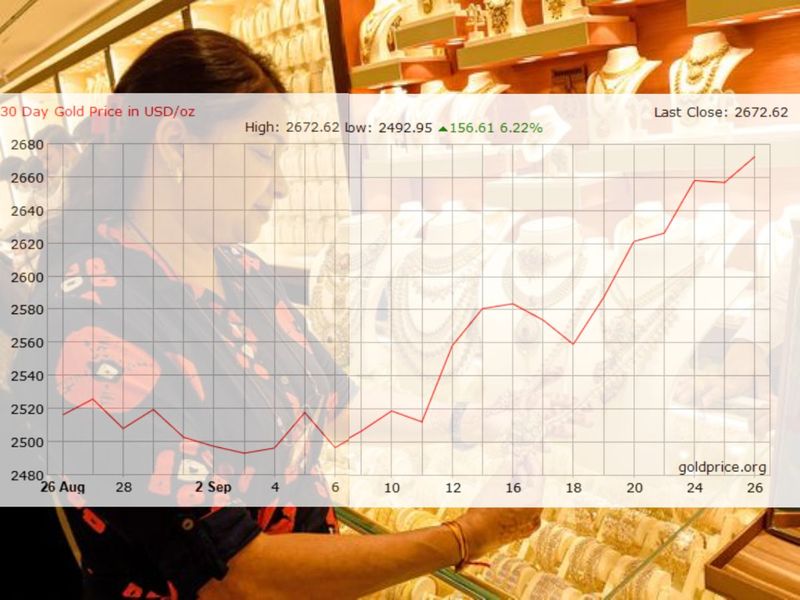

Gold prices have jumped nearly 20 per cent in the last 6 months, and 43.17 per cent in the last one year, and 82 per cent in the last 5 years, according to goldprice.org.

Correction?

Yet, behind this glittering surge lurk questions: Is this ascent sustainable, or are we on the precipice of a market correction?

Gold’s unprecedented climb to a record high of $2,672.62 per ounce as of Thursday (September 26, 2024), from $2,669.70 (on Monday) is fuelled by a striking drop in US consumer confidence, which has reached its lowest point since August 2021.

Uncertainty

According to Rania Gule, Senior Market Analyst at XS.com, this decline stems from growing concerns about inflation, recession, and the labour market.

“As uncertainty increases, gold has become a more appealing haven, raising questions about the sustainability of this rise and whether we are on the brink of a correction,” Gule remarked in a comment emailed to Gulf News.

Supporting this price surge is the decrease in US Treasury yields to 3.73 per cent, and a 0.42 per cent weakening of the U.S. dollar against major currencies.

With lower yields, holding gold becomes less costly compared to bonds, further enhancing its appeal.

However, Gule warns that while these factors have driven gold’s recent momentum, investors must tread carefully.

Tensions

“Will gold prices continue to rise amid these difficult economic conditions, or is a correction looming?” Geopolitical tensions, particularly in the Middle East, are adding another layer of volatility to the mix.

As international instability increases, gold, a classic refuge in times of crisis, grows more attractive. However, the question arises: Will these geopolitical developments stabilise prices or trigger the correction many fear?

More Fed rate cuts?

Moreover, expectations of a Federal Reserve rate cut in November are weighing on market sentiment. A cut in interest rates would reduce the opportunity cost of holding gold, potentially stoking demand even further.

Yet, this is far from a guarantee of long-term stability. As Gule points out, “The rising demand for exchange-traded gold funds and the resilience of the services sector in the US economy may contribute to price enhancement. But will a rate cut be sufficient to support gold prices amid economic changes?”

Market dynamics show that this precious metal continues to push new boundaries, soaring $140 above its previous record in just five weeks. The path forward for gold remains uncertain.

Gule predicts that gold could reach $2,740 by year’s end, as global investors seek shelter from inflation and economic turbulence.

Complex situation

However, the influence of Chinese monetary policy adds complexity to the equation. With the People’s Bank of China cutting its lending rate to stimulate the weakening economy, demand for gold may rise further.

Despite these favourable conditions, Gule stresses caution. “While gold performs strongly under the current circumstances, economic and political challenges remain. Investors should stay updated on market developments, as a correction could be imminent at any time.”

This dramatic rise, while enticing, may ultimately face pressure at psychological levels such as $2,600 and $2,500. For now, gold shines brightly, but how long it will keep its luster remains to be seen.

ًWhy gold prices rise: 10 reasons

Gold prices tend to rise due to a variety of factors, driven by both economic and geopolitical influences. Here are key reasons why gold rates keep rising:

#1. Inflation hedge

Gold is often seen as a hedge against inflation. When inflation rises, the purchasing power of paper currencies declines, making gold more attractive as it retains value over time. This pushes demand for gold higher, causing prices to rise.

#2. Global economic uncertainty

During periods of economic uncertainty or financial instability, investors turn to gold as a safe-haven asset. Events like recessions, financial crises, or geopolitical tensions (e.g., wars, trade conflicts) can drive up demand for gold, leading to price increases.

#3. Weakening of the US Dollar

Gold is typically priced in US dollars. When the dollar weakens, gold becomes cheaper for foreign investors, increasing demand and pushing up prices. Conversely, when the dollar strengthens, gold prices often decline, but in times of dollar weakness, gold generally rises.

#4. Central Bank policies and interest rates

Gold does not provide a yield, so its price is influenced by the opportunity cost of holding it compared to interest-bearing assets. When central banks, such as the US Federal Reserve, lower interest rates or adopt loose monetary policies, the opportunity cost of holding gold decreases, making it more attractive. As interest rates fall, like it did recently, gold prices often rise.

#5. Geopolitical tensions and crisis

Political instability, wars, or major global events like pandemics increase gold's appeal as a store of value. Investors seek refuge in gold during crises, fearing currency devaluation or economic collapse, which in turn drives up prices.

#6. Demand

Gold has cultural significance in many countries, particularly in emerging markets like India and China, where it is used in jewelry and as a form of investment. Rising wealth in these regions increases demand for gold, contributing to higher prices.

#7. Supply

Gold mining is a long and capital-intensive process, and global gold production is relatively limited. Any disruptions to supply, such as mine closures, strikes, or environmental regulations, can reduce the availability of gold, leading to upward pressure on prices.

#8. Speculation

Investors and traders speculate on gold prices in financial markets. Market sentiment, influenced by economic reports, news events, and technical trading patterns, can result in sharp increases in gold prices as investors buy based on expected future demand or price movements.

#9. Government deb, deficits

High levels of government debt, particularly in advanced economies like the U.S., can lead to concerns about fiscal sustainability. Investors may turn to gold as a way to protect against potential government defaults or currency devaluations resulting from excessive borrowing.

#10. Monetary policy

Central banks around the world hold gold reserves. Any moves by these institutions to increase their gold holdings, as part of diversifying their assets or reducing reliance on foreign currencies like the U.S. dollar, can boost demand and push up prices.