Trial of disgraced crypto star Sam Bankman-Fried begins in New York

The first day of the trial was devoted to jury selection

New York: The trial of Sam Bankman-Fried, former CEO of one of cryptocurrency's biggest exchanges, began Tuesday with a jury set to determine if he committed massive fraud by stealing billions of dollars from clients.

The 31-year-old - once one of the most respected figures in crypto - now faces decades in prison and could see his name stand alongside Bernie Madoff and Elizabeth Holmes as the era's most prominent fraudsters.

The first day of the trial was devoted to jury selection for a case that is set to last about six weeks. Bankman-Fried faces seven counts including wire fraud, securities and commodities fraud, and money laundering.

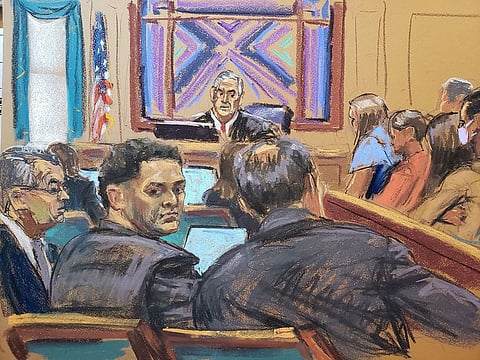

Bankman-Fried entered the courtroom alone - without being escorted by security guards - uncuffed, and took his place alongside his lawyers, an AFP journalist observed.

Dressed in a gray suit and striped tie, his usually long curly hair was cut short.

In just a few years, the Massachusetts Institute of Technology graduate turned his FTX platform into the world's second biggest crypto exchange, making him a tech world billionaire wunderkind.

FTX became a global name through a marketing campaign that included celebrity partnerships with stars such as supermodel Gisele Bundchen and basketball legend Stephen Curry, and buying the naming rights for the Miami Heat's home arena.

Bankman-Fried also stepped in as a kind of savior of the industry when other crypto companies faced difficulties, with FTX swooping in to offer a financial lifeline.

At the height of his career, Bankman-Fried was thought to be worth $26 billion as he attracted droves of small investors to invest in cryptocurrencies such as bitcoin or ethereum.

But his steep rise was matched by his ignominious downfall, which saw him escorted last year by police from his luxury apartment in the Bahamas and extradited to face charges in the United States.

'Gambling at own casino'

His empire began to crumble last November when a news report pointed to unhealthy ties between the FTX platform and Alameda Research, Bankman-Fried's personally owned trading company.

The revelations kept growing and major investors pulled their money out of FTX, sinking it swiftly into bankruptcy.

Once the dust had settled, some $8.7 billion in client funds was still unaccounted for and Bankman-Fried was accused of using FTX deposits to buy luxury real estate or donate more than $100 million to US politicians through Alameda.

"He was gambling in his own casino and it created conflicts of interest," Michael Lewis, an author who followed Bankman-Fried closely during the period, told CBS.

Everything "unravels because the depositors at FTX want their money back and it's not all there," he added.

The climax of the trial is expected to be when his former friends and colleagues take the stand, including Carlonie Ellison, his one-time romantic partner and Alameda executive, and Gary Wang, his closest associate.

Ellison and Wang have also been indicted in the case and agreed to cooperate with US authorities, which may prove Bankman-Fried's undoing.

After his spectacular arrest in the Bahamas, Bankman-Fried was initially held under house arrest but was ordered behind bars in August over alleged attempts at witness intimidation.

According to prosecutors, while holed up at his parents' home in California, Bankman-Fried spoke regularly to journalists and passed documents to The New York Times in an effort to influence the testimony of Ellison.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox