Uber backer Benchmark sues to kick Kalanick off board

Lawsuit is the culmination of a bitter fight between Benchmark and Kalanick

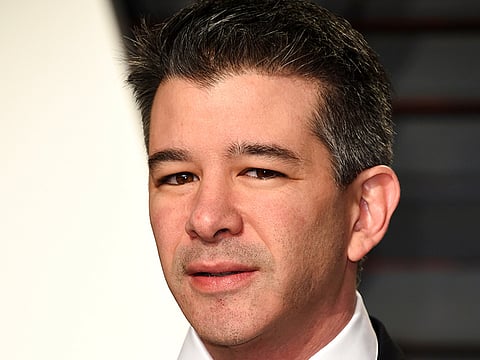

SAN FRANCISCO/WILMINGTON, DELAWARE: Ex-Uber Technologies Inc. Chief Executive Officer Travis Kalanick duped investor Benchmark into allowing him to fill three of the ride-hailing company’s board seats, according to a lawsuit filed Thursday calling for his ouster as a company director.

The lawsuit is the culmination of a bitter fight between Benchmark and Kalanick. Bill Gurley, a partner at the venture capital firm, led an effort to oust Kalanick as CEO in June. Benchmark, an early Uber backer with a 13 per cent stake in the company, says Kalanick sought to pack the board with allies willing to keep him as a director after he resigned.

“Kalanick acquired a disproportionate level of influence over the Board, ensuring that he would continue to have an outsized role in Uber’s strategic direction even if forced to resign as CEO,” lawyers for Benchmark said in the complaint filed in Delaware Chancery Court.

Uber declined to comment. Jimmy Asci, a spokesman for Kalanick, said the lawsuit is “completely without merit and riddled with lies and false allegations.”

“This is continued evidence of Benchmark acting in its own best interests contrary to the interests of Uber, its employees and its other shareholders,” Asci said in an email. “Benchmark’s lawsuit is a transparent attempt to deprive Travis Kalanick of his rights as a founder and shareholder and to silence his voice regarding the management of the company he helped create.”

Uber scandals

A series of scandals have thrown Uber into upheaval this year, including protests over ties to the Trump administration and accusations that the company’s workplace is hostile to women. The company is also battling a lawsuit with Alphabet Inc.’s self-driving car business and a probe by the US Justice Department over the use of technology to deceive enforcement officials. Alphabet is also an investor in Uber.

Benchmark’s lawsuit “is a big deal,” said David Larcker, director of Stanford University’s Corporate Governance Research Initiative. “When your largest and most substantial VC sues the founder for governance concerns, it’s a big problem.”

Benchmark contends that Kalanick “fraudulently gained control” of three board seats by hiding his “gross mismanagement” of the company. In May, Kalanick approached certain investors, including Benchmark’s Gurley, seeking approval to add three new seats to the eight-member board. He repeatedly touted his abilities to manage the company and failed to disclose issues that would have caused Benchmark to question the appropriateness of the additional board seats, according to the complaint.

Vocal critic

Gurley was one of Uber’s earliest investors and biggest fans. Over the years, he played key roles in the company, including helping to recruit many of its executives. In private, though, Gurley became a vocal critic of Kalanick in recent months, people familiar with the matter said in June. That month, Gurley assembled four other major shareholders to endorse a letter asking for Kalanick’s resignation.

The letter, signed by five investors who account for as much as 40 per cent of shareholder votes, cited the Waymo trade secrets suit and Uber’s Greyball technology, used to protect drivers from facing fines or arrests by filtering out ride requests from law-enforcement officials. Both issues are highlighted in Benchmark’s suit.

Benchmark’s complaint comes the same day that Ryan Graves, Uber’s first employee and a longtime board member, stepped down as one of the top officials in the company’s operations department. Graves will stay on the board to help the company search for a new CEO.

In addition to Kalanick’s removal from the board, Benchmark wants a judge to award unspecified damages. The case could be decided within two months, said Larry Hamermesh, a Widener University professor who specialises in Delaware corporate law.

The case is Benchmark Capital Partners VII LP v. Travis Kalanick, CA 2017-0575, Delaware Chancery Court (Wilmington).