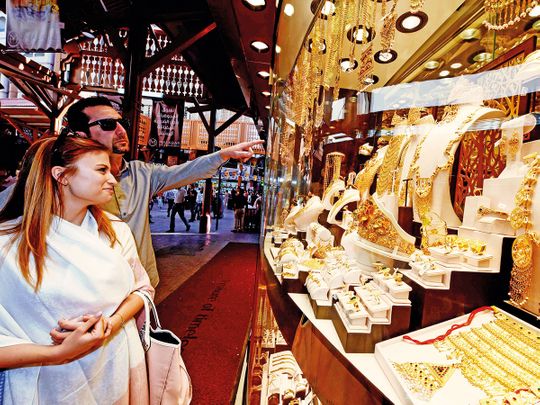

Dubai: Jewellery demand in the UAE fell to its lowest levels in nearly 10 years during July to end September as the $1,500-an-ounce price tag scared off shoppers.

In these three months, jewellery demand was at 5.4 tonnes, well below the 10.7- and 9.3-tonnes generated in the first and second quarters of this year, respectively.

The UAE was not unique in seeing global jewellery demand dip to such a low.

Overall global offtake of gold-based jewellery was at 460.9 tonnes, down 16 per cent from third quarter 2018’s 546.2 tonnes, according to figures released by World Gold Council on Tuesday.

This is the lowest tally since 2010.

“What’s most surprising was that apart from the weakness in jewellery demand, there was also less demand for bars and coins,” said John Mulligan, Director of Member and Market Relations at London-headquartered WGC.

“It was a surprise because usually, you do see private investors moving into bars and coins even when jewellery demand takes a hit. It didn’t happen this time.”

Six-year-high: Price shock

For reasons, one needn’t look beyond gold prices since August, when they soared to a six-year high by crossing the $1,500 an ounce.

And this time, it sort of stuck to those levels, whereas previously in those six years, such spikes would drop off well before touching $1,500.

That put an immediate halt to consumer demand for gold and jewellery in the UAE during August and September before recovering slightly ahead of the October 27 “Diwali” festival.

Consumers by and large are maintaining a wait-and-see mentality. Apart from the price bubbling around $1,500, there’s also the local currency weakness in key consumer markets such as India, which makes buying an even more expensive proposition.

Some shoppers also came back fearing that gold could even push higher, to $1,600-$1,700 levels if the global economy shows more weakness.

“Consumers by and large are maintaining a wait-and-see mentality,” said Mulligan. “Apart from the price bubbling around $1,500, there’s also the local currency weakness in key consumer markets such as India, which makes buying an even more expensive proposition.

“So far, I have not heard of anything strong by way of positive sentiments from the latest buying trends.”

Government intervention

UAE jewellery retailers are looking to the government to provide them with some much-needed boost.

Last last month, the UAE Cabinet assigned the local bullion sector high priority. The sector represents 20 per cent of the GDP, and the Cabinet’s move is aimed at consolidating and expanding the base already set.

A major incentive for the gold trade would be a scaling back of the 5 per cent import duty on jewellery, said Anil Dhanak, Managing Director of Kanz Jewels.

“The industry realises that within the VAT (value added tax) area, there is not much more that can be done on that 5 per cent,” he added.

“But customs duty is one where changes could be made to make buying gold jewellery less expensive. Some relaxation would put demand volumes back to earlier levels.

“The retail trade’s October numbers are down at least 20 per cent from last year.”

No UAE import duty on bullion

Currently, there is no import duty on bullion.

But within the many jewellery categories, nearly all of 18K pieces are imported, and this is the category much favoured by a younger consumer and also by non-Asian shoppers.

On 22K, despite domestic manufacturing, there is still a sizable portion of local demand that are met through imports.

If some ways can be found to reduce the retail price of gold, I have no doubt demand can improve significantly.

“If some ways can be found to reduce the retail price of gold, I have no doubt demand can improve significantly,” said Dhanak.

“The average visitor to Dubai/UAE still has a visit to the gold market on his or her schedule. But there’s so much competition among countries to attract tourists - Thailand announced visa-on-arrival for Indian nations.

"They used to charge 1,000 baht, but they have waived the fees and we have heard about a lot of trips being diverted to Thailand where earlier they used to come to Dubai.”

Small players beware

A shrinking jewellery market will flash warning signs for the smaller gold retailers. Any operator carrying too much of debt on their books will be at risk.

Chandu Siroya of Siroya Jewellers, the wholesaler, as well as board member of Dubai Gold and Jewellery Group, warns: “When sales drop, even bankers and suppliers lose confidence, thereby creating more pressure on retailers.

"The smaller players find it more challenging as they do not have the economies of scale… and they will have to bear the expenses on reduced revenues.”

In India, demand tanks

The WGC puts the drop in demand to the generally weaker consumer confidence.

“Given the slowdown across a range of sectors, there was no way demand for gold could be free from the generally weak consumer confidence,” said John Mulligan of World Gold Council.

“Apart from the record high domestic price of gold, there were other factors such as heavy monsoons and the lack of more auspicious days in the (Hindu) calendar.”

"Gold prices were at 38,795 rupees per 10 grams by end August before “reaching an all-time high of 39,011 rupees during the first week of September,” WGC reports.

- Demand for the yellow metal in Indian dipped by 32 per cent during the third quarter, to 101.8 tonnes.

- Offtake of gold bars and coins were at 150.3 tonnes at the end of September, half of what it was 12 months earlier. "Higher prices across many key currencies were the main cause of the decline to a multi-year low, as retail investors across the globe opted to defer purchases and lock in profits."

- But central banks kept adding to their gold reserves. In the year-to-date, they have purchased 547.5 tonnes on a net basis, 12 per cent higher year-on-year.