DDF sees Dh140m-hit from runway closure

Passenger traffic falls by 1.9m at Dubai Duty Free as airlines cancel, readjust flights

Also In This Package

Dubai: The 45-day closure of one of the two runways at Dubai International Airport had a Dh140 million hit on sales at Dubai Duty Free (DDF) as passenger traffic fell by 1.9 million people during the period.

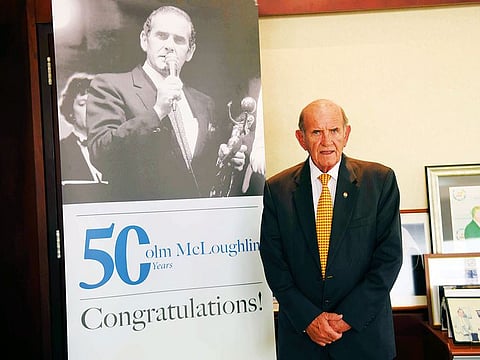

Colm McLoughlin, executive vice-chairman and CEO of DDF, said sales at the duty free area so far this year are 1.5 per cent lower than this time in 2018, mostly due to the runway closure. He expects to recoup lost sales later in the year.

The southern runway at Dubai International closed from April 16 to May 30 for refurbishment, forcing some airlines to cancel or readjust flights. Emirates, for example, had to reduce the number of flights it operates by 25 per cent, while flydubai moved some flights to the city’s second airport, Al Maktoum International.

“There was a drop in traffic during the closure of the runway of 1.9 million passengers, although some flights were facilitated at Al Maktoum International Airport. This affected us — 1.9 million passengers would be around Dh140 million sales,” McLoughlin said.

He added that that DDF’s retail space in Al Maktoum International offset the drop in sales “to a certain extent”, and that he expected the business to record Dh7.4 billion in sales this year. The figure would represent a flat year-on-year growth from 2018, when DDF saw Dh7.35 billion ($2.01 billion) in sales.

The forecast for sales is based on projections by operator Dubai Airports that passenger traffic will remain stable in the year, at just over 89 million people. In an interview with “Gulf News”, McLoughlin said the target of 92 million passengers for 2019 has been revised lower.

Impact of taxes

Besides the runway closure, DDF has been impacted over the last year by the implementation of Value-Added Tax (VAT) and excise tax across the UAE. VAT was rolled out nationwide on January 1, 2018, while excise tax was implemented in October 2017 on tobacco, energy drinks, and carbonated drinks.

“Our sales in arrivals have dropped in the last one year, due to VAT — but it’s more than compensated for in departures where there’s no VAT,” the CEO said.

He added that DDF’s outlets in departures now sell more items per person, and sell to a larger number of customers — factors that have helped sales in departure terminals climb.

So, who’s spurring that rise in sales? The Chinese, it seems.

McLoughlin said that Chinese passengers accounted for 17 per cent of sales at DDF, and that they tend to purchase cosmetics, make-up, luxury watches and handbags. He described Asia, in general, as a “big market” for DDF, followed by Europe.

The CEO expects to see continued growth in the business.

“We expect over the next five years to increase our business to $3 billion (in sales). We expect to be employing between 9,500 and 10,000 people at that time. Right now, we have 6,100 staff,” he said.

McLoughlin said he expected that growth to come from a rise in passenger traffic at Dubai International as well as added retail space at Al Maktoum International. DDF currently has 4,400 square metres of retail area at Al Maktoum, but that is projected to spike to 80,000 square metres as the airport expands to house two new concourses and a total of three runways.

“The date on that is movable — that could be seven, eight, or nine years’ time,” he said.

But it’s not just retail at airports where DDF expects to generate revenues. Irish Village, one of the subsidiary businesses under DDF, is set to open a third location soon, in Dubai’s Studio City, and later, a fourth one at the site for Expo 2020.