Dubai: The Dubai Land Department has revealed that sales of land and property rose 20 per cent in 2011.

The department recorded 35,297 transactions worth Dh143 billion last year, a 20 per cent increase over 2010, and government officials predicted that the market was set to bring in more foreign investment in 2012.

"The 2011 results demonstrate Dubai's ability to fully recover from the challenges of the international crisis and prove once again the strength of its economy," the department said in a statement yesterday.

Upbeat outlook

Sultan Butti Bin Mejren, Director General of the Dubai Land and Properties Department, told Gulf News that the department was upbeat about 2012.

"We can't say that the real estate sector has completely recovered, but the worst of the crisis is behind us and the market still needs a few more years to regain the solidity it used to have a few years ago," he said.

Bin Mejren also criticised recent reports by real estate consultancies and analysts for presenting a negative image of Dubai's property market.

He said that "unofficial" overviews sold the emirate's real estate market short, and pointed to the recent figures as evidence that sales of property are increasing across the board.

"What has been said and reported about the real estate sector in Dubai from various field companies is baseless to facts and figures (and) have portrayed a bad image about this sector's future," he said.

A number of negative reports were released in 2011 which claimed that Dubai's property market was oversupplied and rents and prices would continue to plummet as projects came online.

Increase in mortgages

The figures revealed said that last year saw a 12 per cent increase in mortgages compared to the value recorded in 2010.

The mortgages represent 60 per cent of the transactions conducted in 2011, which indicates the recovery of property financing.

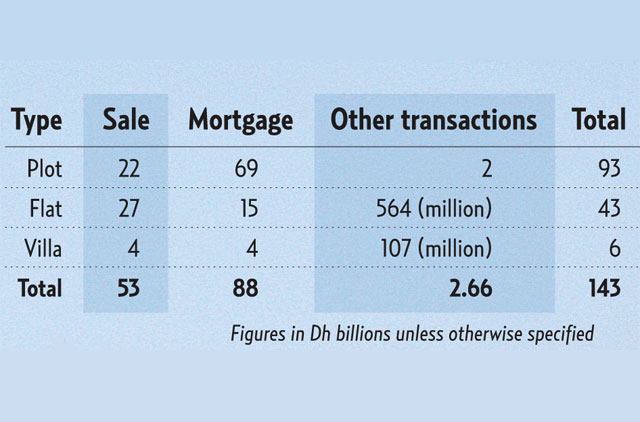

Transactions for apartments totalled 26,465, valued at Dh43 billion. Out of these, only 5,568 were mortgages worth Dh15 billion.

Over 60 per cent of the apartment sales in Dubai in 2011 were done in cash, with the Land Department registering 20,426 units worth Dh27 billion.

Land sales dominated the year with plot sales and mortgages amounting to Dh94 billion.

Plot sales saw 2,961 transactions valued at Dh22 billion, while 3,315 mortgage transactions worth Dh69 billion were registered in 2011.

Total transactions for villas last year touched Dh6 billion. As many as 1,179 villa sales were reported last year worth Dh4 billion, while 655 mortgages worth Dh2 billion were registered.

While Bin Mejren believes that the prices in this sector showed stability in some areas, he said that there are other segments in Dubai that might suffer further declines.

"This doesn't mean weakness. Real estate markets always show declines and hikes. It can't be (a) flat rate. All is dependent on demand and supply," he said.

Craig Plumb, head of research at Jones Lang LaSalle Mena, said that the Dubai real estate market was experiencing "selective stability".

"As long as the prices are getting closer to the bottom, the more the market is regaining stability," he added.

Further declines

"Some portions of the market are now seeing prices stabilise or even increase marginally, but these sectors are relatively limited and confined to a few select locations.

The average price and rent across the whole market has continued to decline and is likely to decline further for the rest of 2012," Plumb added.