Dubai: Higher winter demand may provide the necessary floor to crude oil prices in the short-term, even as Russia looks to India to fill the gap post the western sanctions, a senior official at Platts told Gulf News.

On Friday, Brent for January settlement fell 57 cents to end at $69.07 per barrel, the lowest close since Oct. 7, 2009. Prices have slipped 38 per cent in 2014. Market has been on a decline mode as traders eye surplus oil supplies to meet weak oil demand post the Opec decision to maintain output.

But after a free fall in prices, “the expectations are the higher winter oil demand in the northern hemisphere might provide a temporary floor, with a downward drift resuming in Q2 next year,” Vandana Hari, Asia editorial director at Platts told Gulf News.

The May quarter has been the traditional slow demand season, when 5-6 million barrels per day of refining capacity worldwide is expected to go offline for seasonal maintenance, she said.

Bearish on demand:

Platts' expert feels weak demand for crude oil to continue from Europe, which is still reeling under recession.

Factored into the current market bearishness is expectation of European demand continuing to drift sideways or even slide lower in the coming months, as the economic headwinds remain in place, said Hari.

The sharp slowdown in European economies through this year led to sharper declines in oil demand from that region than was expected as we entered 2014, and contributed to the Atlantic Basin supply glut and the sustained OECD stock build of recent months.

Meanwhile, China’s oil intensity is lower, and reduced industrial demand is seeing continuing to crimp consumption of gas oil, the biggest part of the barrel in that country as the economy swing away from export-oriented industrial production. So Chinese demand might grow are relatively moderate rates of around 2 per cent annually, but it is growing nonetheless, said Hari.

But lower prices can boost stockpiling.

“Low prices could provide a boost to consumption, as well as strategic stockpiling, boosting the country’s imports in the coming months. Japanese demand is past its historical peak, and only expected to continue sliding in future,” Hari added.

Fill the demand gap:

Russian president Vladimir Putin is due to visit India from December 11, as the biggest non-OPEC producer grapples with a weaker rouble after the western sanctions.

“Reeling under the impact of the Western sanctions, Russia is most certainly pivoting east. China is already a major market for its crude and natural gas, the next logical stop for Moscow has to be New Delhi,” said Hari.

India has been looking to diversify its crude oil supplies and source more crude from Russia and Latin America, its oil minister said recently.

India is examining the feasibility of building a $40 billion pipeline to bring gas from Russia to India either through Central Asia or from Russia’s southern border through the Himalayas, according to a report.

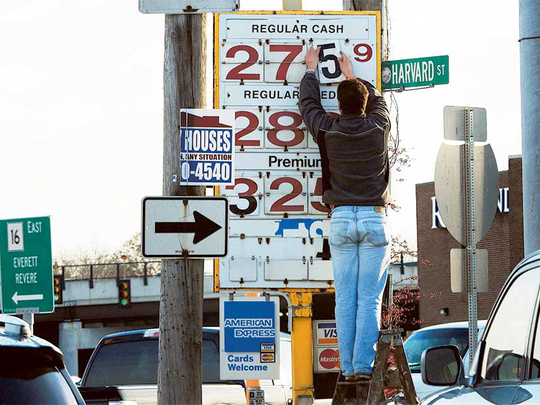

Indian oil demand growth has outpaced that of China this year, with consumption in the first ten months of 2014 growing 4 per cent over the corresponding period of last year. The declining gasoline prices at the pump and softer diesel despite the removal of state subsidies on the latter could give a leg-up to the country’s oil demand in the coming months.

“If the Modi government’s “Make in India” plan takes off and spurs oil demand for manufacturing, we might even see Indian demand growth climbing to high single digits, though that will take a few years,” said Hari.

India is also in talks with Saudi Arabia, the largest Opec producer, to invest in strategic crude oil storages and downstream facilities.