Dubai: The oil price surge that began in early this year is likely to head further north and could hit $100 a barrel, according to a forecast by global financial group MUFG.

Many other analysts too are forecasting a spike above $90 towrards the year end.

According to MUFG, the current production capacity is inadequate to meet today’s vaccine-led demand recovery. During the pandemic, several members of the Opec+ group of producers cut output and have since been having trouble ramping up to meet recovering demand.

“Whilst not our base case, these factors [affecting supply and demand] could well spur oil prices, albeit transitorily, towards $100/b as markets have pivoted from pricing demand recovery to now pricing supply scarcity,” Ehsan Khoman, Head of Emerging Markets Research EMEA at MUFG wrote in a note.

“It is not the market is cyclically tight but critically structurally underinvested as energy transition and ESG [Environmental, Social, and (Corporate) Governance] considerations after oil’s golden era between 2010-14 has capped capital expenditures.”

Demand surge

Goldman Sachs in a recent report said that a strong rebound in global oil demand could push Brent crude oil prices above its year-end forecast of $90 per barrel. The US investment bank said it expected oil demand will shortly reach pre-COVID-19 levels of around 100 million barrels per day (bpd) as consumption in Asia rebounds after the Delta COVID-19 wave.

Tight global supply and strong demand have pushed oil prices to multi-year highs last Monday. Brent crude futures to settled at $85.99 a barrel. The contract reached a session high of $86.70 a barrel, its highest level since October 2018. The US West Texas Intermediate (WTI) crude futures reached a high of $85.41 a barrel, the highest since October 2014. But both Brent and WTI crude oil benchmarks declined on the week. Brent crude settled at $84.38, while US WTI was at $83.57 on Friday in New York.

Whilst not our base case, these factors [affecting supply and demand] could well spur oil prices, albeit transitorily, towards $100/b as markets have pivoted from pricing demand recovery to now pricing supply scarcity.

MUFG sees the tight supply is being compounded by the acute physical supply constraints – tepid OPEC+ production hikes, accelerated gas-to-oil substitution, China’s power crunch and the inability of producers outside OPEC+ to meet surging reopening-induced demand – which are biting at a time the speed of inventory declines are accelerating resulting in higher prices.

Transitory gains?

“With pandemic inventory buffers exhausted, our modelling estimates signal that oil prices between $100- 110/b will be negated by demand elastic destruction as the balancing market mechanism of last resort, i.e. the cure for high prices is high prices – a self-correcting process,” said Khoman.

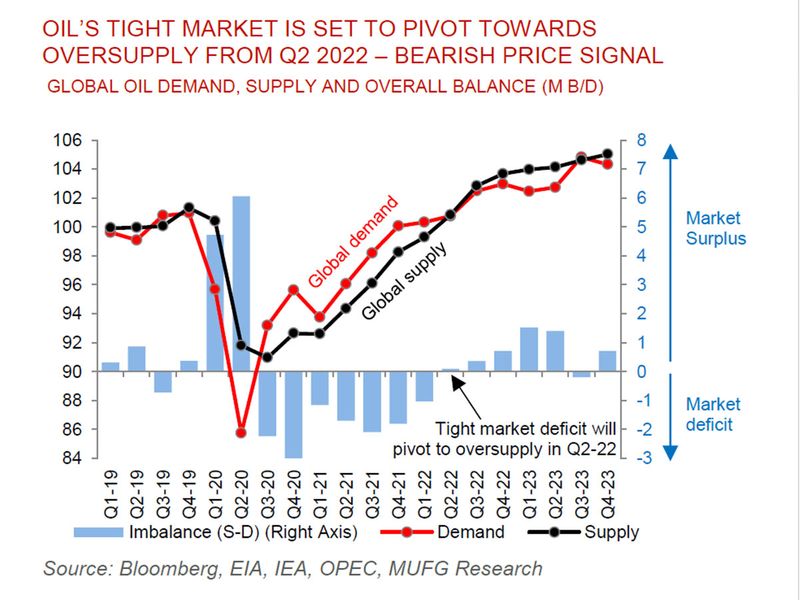

According to MUFG forecasts, prevailing market deficit, which started in June 2020, will not pivot into oversupply until Q2 2022. Given the tight oil market, MUFG has forecast Brent ending Q4 2021 and Q1 2022 at $85/b and $82/b, respectively. Thereafter, as the market is expected to return to a mild surplus, to price moderation to $74/b, $72/b, and $66/b in Q2, Q3 and Q4 2022, respectively.

Key drivers of price

Core drivers of the acute physical supply constraints include (i) tepid OPEC+ production hikes, (ii) accelerated gas-to-oil substitution, (iii) China’s power crunch and (iv) the inability of producers outside OPEC+ to meet surging reopening-induced demand.

For the longer term, MUFG expects the market to return to a structural deficit by 2023 as the forces of ESG gain traction.

“Indeed, if policymakers’ objectives of a large-scale buildout in green infrastructure are to be met, oil (and broader energy commodity) prices will need to significantly overshoot to the upside to provide the incentive for renewable investments to considerably rise. This is needed to compensate for the growing risks involved in long-cycle capex projects and the inherent complexities surrounding the energy transition,” said Khoman.

Non-linear trend

Simply put, the argument higher longer term oil prices centers around the premise that the less popular oil (and broader fossil fuels) become, the more they will cost, as crimping supply without tackling demand (which will unlikely peak until the 2030s) will only cause oil prices to rise.

“we do not believe that oil prices will follow a linear line up, but instead occur in a series of ever-increasing spikes in the coming decade, given the push-and-pull dynamics between demand and supply,” said Khoman.