Dubai: Tightening liquidity conditions worldwide, high geopolitical risks in the Middle East, and challenges inherent to sukuk issuance are likely to dampen the performance of the global sukuk market this year.

Despite the emerging challenges, the GCC, and the UAE in particular, are likely to keep issuances growing, thanks to huge funding demand in the context of lower oil prices and expansionary fiscal stance.

“We expect higher demand for funding in most GCC countries, given our reduced oil price assumptions compared with last year’s out-turn of $71 for Brent,” said Mohammad Damak, global head of Islamic Finance at Standard & Poor’s (S&P).

Globally, S&P anticipates total issuances between $105 billion and $115 billion (Dh385.67 billion and Dh422.4 billion), constituting $28 billion to $32 billion in foreign currency issuances and $85 billion to $95 billion in local currency issuances.

The GCC region is expected to maintain issuance volumes around $48 billion, close to the $48.5 billion issued last year. The UAE is projected to issue more than $8 billion in sukuk, compared to $8.5 billion last year.

Last year, new sukuk issuances totalled $91.4 billion. The decrease, at 15.1 per cent, was more visible for foreign currency sukuk issuances, primarily in US dollars.

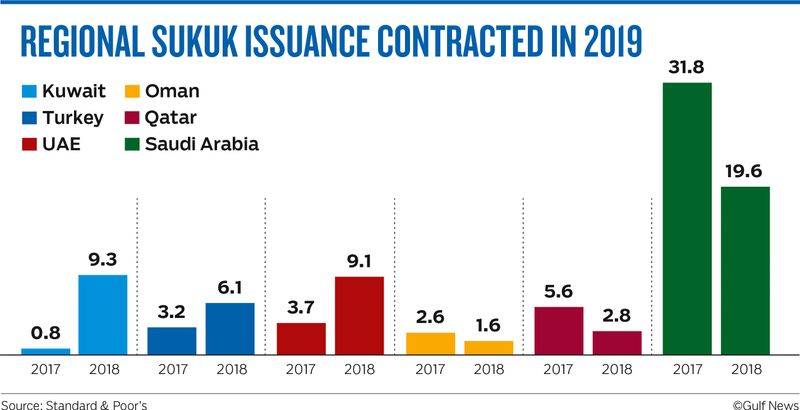

A significant drop in issuances was reported from Saudi Arabia and Qatar. However, this was partly offset by issuances from the Central Bank of Kuwait and a hike in private sector issuances in the UAE. Activity in Malaysia and, to a lesser extent, Indonesia continued to support the market. Issuers in Turkey also stepped up their issuances to diversify their investor bases amid substantial reliance on external debt and reduced access to global capital markets in the second half of the year.

“Sukuk issuances from Kuwait, the UAE, and Turkey helped the market avoid a steeper decline last year, in our view. For example, Kuwait’s central bank started to offer sukuk as liquidity management instruments for domestic Islamic banks. And, in the UAE, private-sector issuers front-loaded some of their issuances to face upcoming maturities, in anticipation of less supportive market conditions,” said Damak.

Liquidity

S&P expects tightening global liquidity conditions to subdue total global issuances this year. European and US-based investors generally account for around one-quarter to one-third of sukuk holders.

Major central banks are expected to gradually continue closing the liquidity tap this year, leaving investors with less funds to invest in sukuk and resulting in a higher cost of funding for issuers.

Although liquidity conditions in the GCC improved in 2018, lower oil prices have made the liquidity outlook uncertain in 2019.

S&P assumes oil prices will remain flat at $55 in 2019 and beyond.

Local and regional factors such as geopolitical tensions, some recent litigation and lack of standardisation are also likely to pose challenges to new issuance.

“About one third of sukuk investors are from Europe and the US. Regional geopolitical tensions and litigations like the one happened in the case of Dana Gas are likely to dampen demand for typical fixed-ncome investors,” Damak said.

Sukuk standard-setting bodies agreed in the last quarter of 2018 to work together to devise a smoother issuance process. While this is a significant development, realising this goal is still far off.

Dana Gas a wake-up call

What happened with Dana Gas acted as a wake-up call for investors and put the standardisation debate back at the top of the agenda for standard setters and policymakers, according to S&P.

Dana Gas reportedly defaulted on its sukuk, alleging a lack of Sharia compliance, which triggered lawsuits in the UK (of which the court rulings were in favour of sukuk holders) and in Sharjah. In the end, holders of Dana Gas sukuk decided to settle with Dana Gas rather than try to enforce the UK judgement in Sharjah.

“Among other things, the Dana Gas case illustrates the potential issues that arise when trying to enforce foreign judgements in local jurisdictions, especially when Sharia is the ultimate source of the law. We think the standard setters will keep that in mind as they strive toward greater standardisation,” Damak said.