India takes step down quantitative easing road with $14 billion bond-buying plan

The debt purchases will start from April 15, central bank Governor Shaktikanta Das said.

Also In This Package

Mumbai: India's central bank formalized a quantitative easing program, pledging to buy up to 1 trillion rupees ($13.5 billion) of bonds in the secondary market this quarter as it sought to keep borrowing costs low to support an economic recovery.

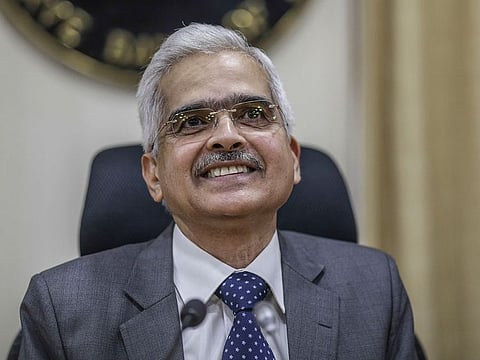

The debt purchases will start from April 15, Reserve Bank of India Governor Shaktikanta Das said Wednesday, after policy makers held the benchmark repurchase rate at a record low 4%, a decision predicted by all 30 economists surveyed by Bloomberg.

Bonds rallied, with the 10-year bond yield dropping 11 basis points from an intraday high of 6.19% to 6.08%, while the rupee fell 0.6% against the dollar. The benchmark stock index extended gains to 1.2% after Das's speech.

While the RBI has been purchasing government securities in the secondary market, it's the first time it has provided details of the bond-buying program as it sought an orderly evolution of the yield curve amid a near-record government borrowing plan. Das had earlier said the bank bought 3 trillion rupees worth of bonds in the previous fiscal year to March 31, and planned similar or more purchases this year.

The plan detailed Wednesday follows a wishlist from investors for a calendar of the central bank's open market purchases to inject more certainty about policy makers' intentions.

"We can definitely see it as a quantitative easing program and markets taking it very positively," said Naveen Singh, head of fixed-income trading at ICICI Securities Primary Dealership in Mumbai. "Still, it would be a challenge to keep absorbing the huge supply at prevailing prices."

QE in EMs

The RBI joins Indonesia, Poland, and Hungary among other emerging-market central banks that have experimented with some form of quantitative easing amid the pandemic. The International Monetary Fund in October estimated that 20 emerging markets had embarked on asset-purchase programs for the first time, judging them "generally proven effective," including by providing some stability to local financial markets.

Aside from providing initial market calm, such programs can be used for further financial easing and funding of fiscal stimulus. The dangers - especially for emerging markets with less credibility than the world's top central banks - are that investors lose patience or faith that the programs will be targeted and temporary.

Policy makers in India have had a tough balancing act, where a desire to do more to support the economy has to be balanced with persistent inflation pressure and rising bond yields. A nascent recovery in Asia's third-largest economy has been disrupted by a jump in virus infections to a record of more than 100,000 this week.

"The recent surge in infections has, however, imparted greater uncertainty to the outlook," Das said, while retaining the 10.5% growth forecast for the fiscal year started April 1. "Localized and regional lockdowns could dampen the recent improvement in demand conditions and delay the return of normalcy."

Price pressures

Although inflation at 5.03% in February was within the central bank's 2%-6% target band, sticky underlying price pressures have been a problem for policy makers. That's because higher fuel and volatile food prices, which make up more than 50% of the consumer price index, are causing second round effects.

The RBI revised the outlook for prices, with inflation seen at 5% in the fourth quarter of last fiscal year. That's above the 4% midpoint of the central bank's target band.

"The key takeaway in today's policy announcement has been a step taken to manage long term yields by announcing G-Sec Acquisition Program which is akin to an OMO calendar," said Shubhada Rao, founder of QuantEco Research in Mumbai. "It becomes imperative in the context of a large government borrowing program."