Get ready to pay higher banking service charges in India from new year

Cost of ATM transactions, deposits, withdrawals and credit card loan processing to go up

Dubai: Starting January 1, 2022 a host of charges on banking services in India will go up ranging from cash withdrawals, deposits ATM usage and credit card debt processing charges.

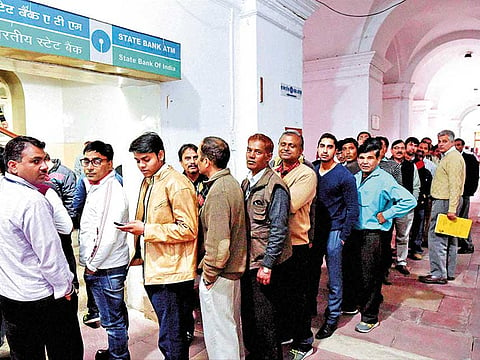

From next month, customers will have to pay more if they exceed the free ATM transaction limit.

In June, the Reserve Bank of India (RBI), India’s central bank had permitted banks to increase charges for cash and non-cash ATM transactions beyond the free monthly permissible limit from January 1, 2022.

In line with the RBI guidelines, the financial transaction fee above the free limit of bank ATMs will be ₹21 + GST [goods and services tax].

“To compensate the banks for the higher interchange fee and given the general escalation in costs, they are allowed to increase the customer charges to ₹21 per transaction. This increase shall be effective from January 1, 2022,” the RBI had said in a circular.

Limits on ATM use

Customers will continue to be eligible for five free transactions (inclusive of financial and non-financial transactions) every month from their own bank ATMs. They would also be able to do three free transactions from other bank ATMs in metro centres and five in non-metro centres.

Apart from this, the central bank had also allowed the banks to increase interchange fees per transaction from Rs15 to Rs17 for financial transactions and from Rs5 to Rs6 for non-financial transactions in all centers.

What is interchange fee?

The ATM interchange fee is paid by the bank that issues the card to the bank whose ATM is used to withdraw cash. The card-issuing bank is called the issuer, while the latter is called an acquirer. This charge is divided between the acquirer and the firm maintaining the ATM, which is why banks discourage customers from using ATMs of other banks. Banks had been seeking the RBI’s permission for long to increase the interchange fees. The recent hike in interchange fees is expected encourage banks to install more ATMs across the country as the new fee structure will make ATM operations more profitable.

More in the pipeline

From January 1, customers of India Post Payments Bank (IPPB) account holders will be charged more for depositing cash as well as withdrawing cash over and above the set limit. As per the bank’s site, it will offer 4 transactions per month and post that charges shall apply @ 0.5 per cent of value, with minimum charges of Rs25 per withdrawal transaction.

In the Savings (other than Basic SA) and Current Accounts, the cash deposits will be Free up to Rs10,000 per month and thereafter, a charge of 0.50 per cent of the value subject to a minimum of ₹25 per transaction will be levied.

In the savings and current accounts, the cash withdrawal will be free up to Rs25,000 per month and thereafter, post the free limit, a charge of 0.50 per cent of the value subject to a minimum of Rs25 per transaction will be levied.

A number of banks including India’s largest bank, State Bank of India (SBI) has either hiked or are in the process of increasing processing fees on equal monthly installments (EMI) on credit card debt,

From December 1, SBI credit cardholders are charged a processing fee of Rs99 in addition to the tax for EMI transactions. Processing fee is levied for all EMI purchase transactions done at merchant outlets, e-commerce websites and app using SBI credit cards.

While many banks are already charging processing fees on EMI transactions on credit cards, private sector banks such as HDFC banks and ICICI Bank are charging processing fees as high as Rs199 per transaction.