Oil extends decline after report points to rising US inventories

WTI holds above $60, Brent settles at $64+ as US crude inventories rise 6.5m barrels

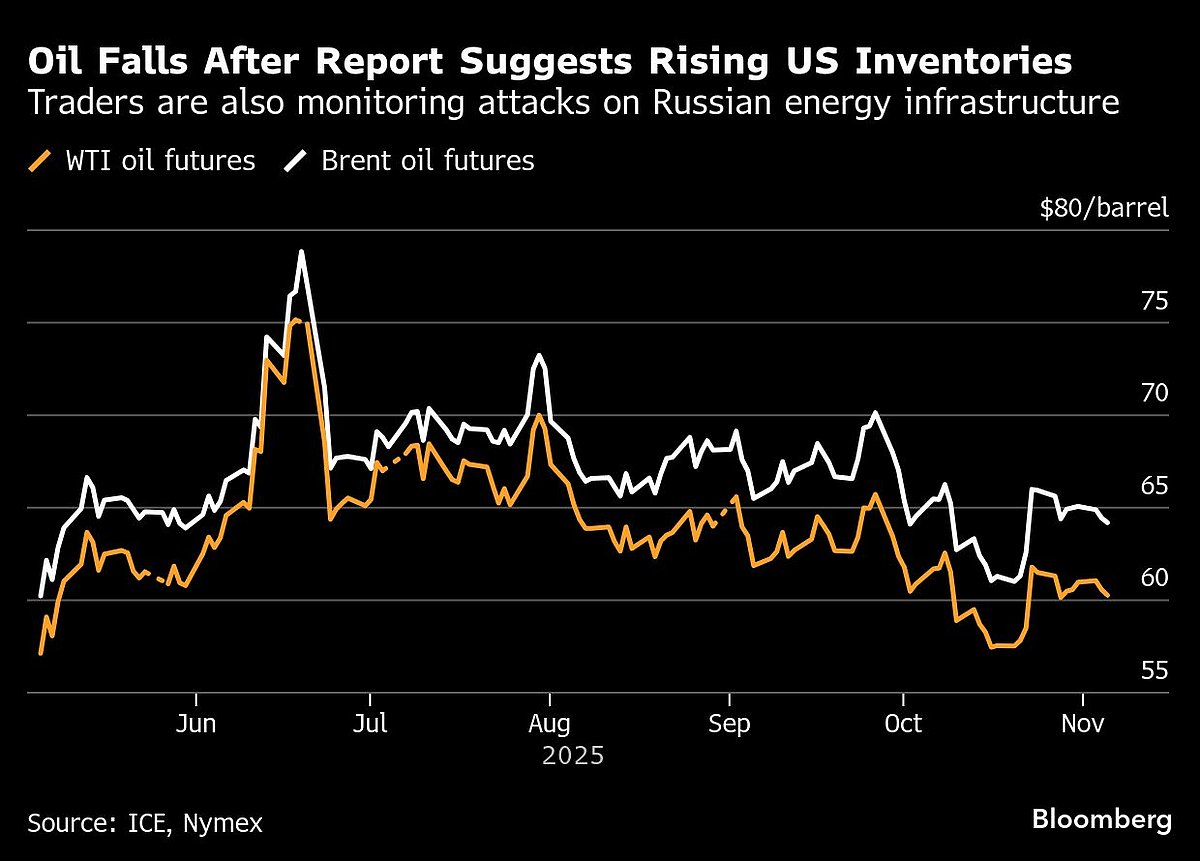

(Bloomberg) -- Oil fell for a second day after an industry report indicated the biggest increase in US inventories in more than three months.

Brent slid toward $64 a barrel, while West Texas Intermediate was near $60. US crude inventories rose 6.5 million barrels last week, according to a document from the American Petroleum Institute seen by Bloomberg. That would be the biggest jump since July 25 if confirmed by official data later Wednesday.

Oil declined Tuesday after a global equities rally hit a speed bump and the greenback climbed to the highest in more than five months, weighing on crude and other dollar-denominated commodities. WTI has fallen 16% this year as increased production from OPEC+ and non-member nations amplified concerns over a forming glut.

Traders were monitoring attacks on Russian infrastructure, after Ukrainian President Volodymyr Zelenskiy announced an intensification late last month.

Kyiv claimed a strike on Lukoil PJSC’s refinery in Nizhny Novgorod province, which processes around 340,000 barrels a day of crude, mainly for domestic use. It has also targeted the Tuapse and Saratov plants over the past week.

Russia’s seaborne shipments fell the most since January 2024 last month, after US sanctions on major producers Rosneft PJSC and Lukoil led major buyers India and China to shun purchases.

“Down the line, you will see that more and more of the disrupted Russian oil, one way or another, finds its way to the market,” Gunvor Group Chief Executive Officer Torbjörn Törnqvist, said Tuesday. “It always does somehow.”

The trading house is currently negotiating to buy the international assets and trading arm of Lukoil.

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.