What impact will Make in India have on its automotive industry?

India's automotive industry is in its most exciting phase despite the demonetisation setback last year

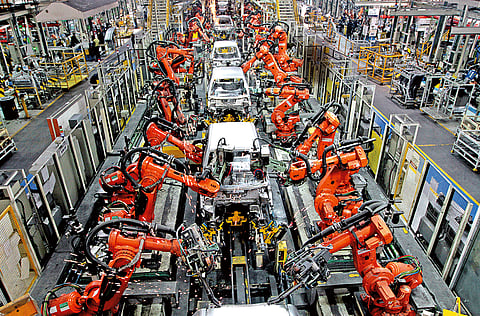

The year 2016 should have been the third year of consecutive growth for the Indian automotive industry, but conditions in the country did not allow it. A ban on large-engine diesel vehicles in Delhi, a change in emission norms, several vehicle recalls, new recycling regulations and the demonetisation campaign of the government hit the sector — where most transactions are made in cash — hard.

However, automakers and dealers are brushing the events off as a temporary setback. Last year was a turning point for India’s automotive industry, as it was saw the first Automotive Mission Plan (AMP) 2006-2016 conclude. The AMP1 was drafted in 2006 with an aim to promote India as a global vehicle-manufacturing destination.

It is now being followed by the even more ambitious AMP2, which runs until 2026 and envisions India becoming a top three global automotive manufacturing hub as part of the government’s Make in India campaign. The revenue target in the entire sector has been set at a whopping $300 billion (Dh1.1 trillion) for 2026.

“[Last year] was a turning point for the Indian automotive industry,” says Tarang Jain, Managing Director of auto component-maker Varroc Group, lauding the Modi administration’s “business-like approach of running the government”.

“It remains to be seen how long the cash crunch due to the demonetisation will continue. However, the long-term outlook continues to be positive.”

Industrial prowess

As it stands, India is the sixth-largest vehicle manufacturer in the world with an annual production of 24 million units in 2016. It has the fifth-largest passenger vehicle and commercial vehicle market and operates four major auto manufacturing hubs across the country. In its review of the AMP1, the Indian Ministry of Heavy Industries and Public Enterprises found the automotive industry represented 7.1 per cent of the country’s GDP, 27 per cent of industrial GDP and 54 per cent of manufacturing GDP, employed 19 million people and contributed 4.3 per cent of all exports — second only to textiles and handicrafts. And there is still a lot of potential in the market.

“The Indian auto sector has the potential to generate up to $300 billion in annual revenue by 2026, create around 65 million additional jobs and contribute more than 12 per cent to India’s GDP,” says Rakesh Batra, Head of Automotive and Transportation at the India branch of consultancy EY, which recently released a report entitled Making India a World-class Automotive Manufacturing Hub, in cooperation with the Confederation of Indian Industry.

“There are forecasts for vehicle sales to grow annually at around 10 per cent over the next decade,” Batra adds. This would in fact make India the third-largest automotive market in the world by volume, behind China and the US, surpassing Japan, Germany and South Korea in the process.

The feasibility of this plan is barely contested. When consultancy Mazars published its 2014 Expectation Survey for the Indian Automotive Industry, it turned out that an overwhelming majority of 300 surveyed auto companies was positive about the growth potential of the sector, with 88 per cent expecting the industry to record double-digit growth over the ensuing five to seven years.

“While there were 500 cars for every 1,000 people in Europe, the ratio was 100 cars in China and below 20 cars in India,” David Chaudat, Global Head of Automotive and Industry Sector at Mazars, said in a comment on the study, adding that “the country has a huge potential for growth and the right fuel efficiency, right product and right price would propel growth”.

FDI push

While large domestic car and truck manufacturers such as Tata, Mahindra, Maruti Suzuki and Ashok Leyland, along with motorcycle makers Hero, TVS and Bajaj, remain the most important drivers for the industry, foreign investment in India’s auto industry is also giving the sector a push.

According to figures released by the Department of Industrial Policy and Promotion, a unit of the Ministry of Commerce and Industry, the Indian car industry has seen foreign investment in plants and operations valued at more than $15 billion in the period between 2000 and 2016. Total investment, including domestic, in the AMP1 period was in excess of $35 billion, of which

$24 billion was contributed by automobile companies and $11 billion by automotive component companies.

Most of the foreign companies operate successfully in India, both for domestic consumers and for export to other emerging markets.

Electric vehicles

India has set ambitious goals with regard to alternative energy in the automotive sector in its infrastructure policy. The target is to put six million electric and/or hybrid vehicles per year on the road by 2020. To that end, a two-year pilot scheme was implemented in April 2015. The initiative is accompanied by government-supported pilot projects including green transportation in cities, last-mile connectivity through electric passenger vehicles and the provision of recharge stations, as well as purchase and tax incentives.

With Mahindra being the first Indian company to produce electric cars (pictured), foreign companies are apparently ready to tap the potential of this market. For example, Swedish electric vehicle maker Clean Motion plans to invest $10 million in India to set up an assembly unit for three-wheelers in a first step, while Nissan is in discussion with the Indian government to bring its electric and hybrid technologies to the country. Overall, it is estimated that electric vehicles sales would amount to 6-7 million units by 2020.