Pravasi Protection Plan offers critical cover for the UAE's expat workforce

Annual premiums start from Dh37 going up to Dh72

The recently launched Pravasi Protection Plan (PPP), a collaborative effort between the Indian consulate, Orient Insurance, and Gargash Insurance Services, is specifically tailored for the Indian workforce in the UAE who often lack a safety net.

Essentially, the Pravasi Protection Plan (PPP) offers a group life cover extending its coverage beyond workplace accidents to include natural deaths and accidental disabilities, ensuring worldwide coverage that safeguards beneficiaries. The plan is initiated by the Indian consulate in Dubai.

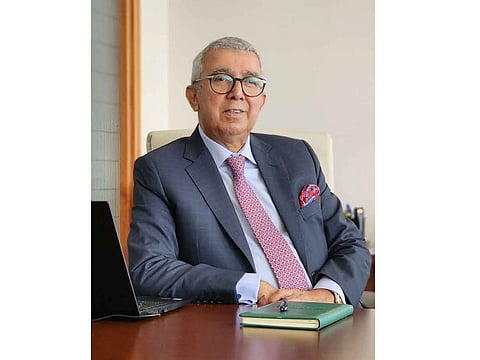

“The Pravasi Protection Plan (PPP) provides a substantial way to enhance the welfare of the Indian workforce in the UAE. Over 60 per cent of Indians in the UAE, at around 1.5 million, are blue-collar workers. Most of these workers do not have any form of life insurance, which leaves their families vulnerable in case of an untimely death. We have ensured our plan is affordable for large corporates and SMEs alike, and we hope that companies will integrate it into their employee welfare offerings,” said Mustafa O. Vazayil, Managing Director, Gargash Insurance Services.

He further added that though the scheme is primarily targeted at Indian expatriates, an employer can add his workforce of other nationalities as well.

According to a study by the Indian Consulate, about 1,500 to 2,000 Indian workers in the UAE succumb to natural causes or illnesses annually, leaving a large number of families financially vulnerable.

The insurance coverage signifies not only financial security but also a broader vision of inclusivity and care for the worker community in the UAE.

Annual premiums start from Dh37 going up to Dh72, offering benefits like worldwide coverage for employees with UAE employment visas. The policy also covers permanent total/ partial disability due to accidents, repatriation expenses (death only) up to Dh12,000 per person, and compensation ranging from Dh35,000 to Dh75,000, depending on the coverage.