Mumbai: As the billionaire Mistry clan and the Tata conglomerate head for a bitter split, they are already bracing for their next fight - the value of a stake in Tata Sons Pvt., which is at the centre of India's biggest corporate feud.

The Mistry family-owned Shapoorji Pallonji Group holds 18.4 per cent of the holding company of the software-to-trucks Tata empire, and wants to sell it to raise funds for its own cash-strapped businesses. It had previously sought to pledge the shares as collateral, but was blocked this week when Tata told the Supreme Court it was open to buying the stock itself if Mistrys needed money.

But the years-long dispute could now shift to what each party thinks is the fair valuation of the stake. While court filings peg it at more than 1.5 trillion rupees ($20.3 billion), the eventual deal value will depend on which side can drive a hard bargain. The indebted SP Group, with upcoming debt maturities, may prefer a quick deal.

Not easy coming up with the money

Even at depressed valuations, it won't be easy for the Tata Group or any other investor to fork out such a sum at a time when many economies, including India's, has been ravaged by the coronavirus pandemic. For outside investors, the charm of buying into the holding company of the $113 billion conglomerate quickly fades when they see Tata Sons is closely held and won't give an easy exit to private equity investors or sovereign funds that keep a sharp focus on generating returns.

Who blinks first

"The parting of ways will lie in the details as it is not clear they will quickly agree to a valuation," said Shriram Subramanian, founder of proxy advisory firm InGovern Research Services Pvt. in Bangalore. "Additionally, Tata group is in no hurry while the SP group is hard-pressed for funding."

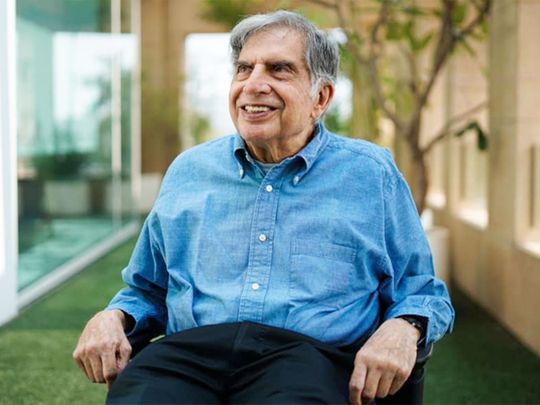

Any stakeholder in Tata Sons, under the amended Articles of Association, may be first required to offer its equity to Tatas before seeking out other investors. Tata Trusts - a collective of charities headed by Tata Sons Chairman Emeritus Ratan Tata - owns 66 per cent in Tata Sons but isn't legally allowed to buy more shares on their own.

A reaching out

Ratan Tata, 82, is drawing up plans to seek a partner that could buy out the Mistry family's stake in Tata Sons, people familiar with the matter said, asking not to be identified as the information is private. The tycoon is planning to reach out to potential investors to gauge their interest.

The potential disagreement over the stake value is the latest chapter in a four-year-old wrangle that started with a boardroom coup in 2016 at Tata Sons. It led to the abrupt ouster of Cyrus Mistry - son of billionaire Pallonji Mistry, 91, who owns the SP Group - as Tata Group chairman and sparked India's biggest corporate battle.

Cyrus, 52, chosen as chairman of the Tata group to succeed Ratan Tata in 2012, sought to reduce the conglomerate's debt in ways that threatened to undo the legacy of the Tata patriarch. Since his shock ouster, Cyrus has filed legal challenges to his removal from the board of Tata Sons and argued against Tata Sons turning into a private limited company - a move that has restricted the Mistry family's ability to sell its stake freely.

Pallonji Mistry has a net worth of $22.4 billion, most of it due to his holding in the Tata Group. India's Supreme Court on Sept. 22 barred the Mistrys from pledging or selling any Tata shares until October 28, after Tata told the court it can buy the Mistry family's stake if the latter needed funds.

Hours later, the 155-year-old SP Group signaled its intent to sell, calling the Tata move "vindictive" and saying it "believes that a separation of interests would best serve all stakeholder groups". The SP Group had 92.8 billion rupees in external debt at its main holding vehicle, Shapoorji Pallonji and Company Pvt., as of end-February, according to Care Ratings Ltd., while the group-wide debt was estimated to be more than 300 billion rupees as of March 2019.