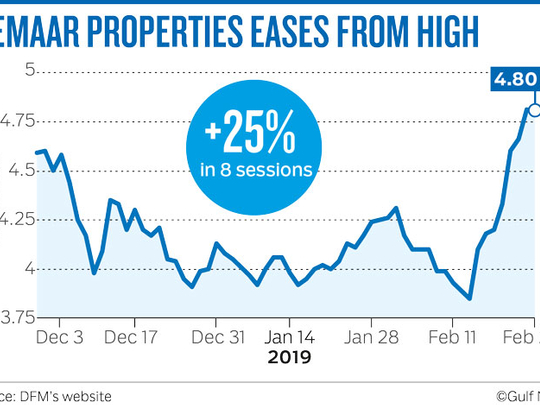

Dubai: Shares of Emaar Properties are languishing after a solid start since February.

Emaar Properties, which had been trading sideways for the past six sessions, breached a key support level, forcing investors to book early profits. Emaar Properties shares have shed 5.8 per cent from a four-month high of Dh5.02 that was stuck on February 27. This followed a strong performance in the stock since Feb 13 accumulating 28 per cent in gains.

But, fundamental and technical analysts are at loggerheads on what direction Emaar shares might take with most of the traders buying the stock at the top end of the range above Dh4.6.

““Dubai index is possibly seeing some profit booking after a relatively strong pullback from mid-Feb. Names like Emaar Properties have rallied 30 per cent recently and accordingly some profit booking is not surprising given that fundamental outlook on real estate is still not very clear,” Nishit Lakhotia, head of research at SICO Bank told Gulf News.

First Abu Dhabi Bank Securities (FABS) had a sell on Emaar Properties for a target of Dh4.55 on February 25. “We may see some profit taking from current levels which may trigger a drop to the lower support zone at Dh4.55/4.40 in the near term,” said Shiv Prakash, senior analyst with FABS in a note.

Dubai index fell for a seventh session on Thursday. The Dubai Financial Market general index closed 1.20 per cent lower at 2,594.52, after losing 3.26 per cent in the past seven sessions till Thursday. Banks weighed on sentiment in Dubai and Abu Dhabi. Dubai Islamic Bank closed 1.15 per cent lower at Dh5.17. Emirates NBD closed 1.6 per cent lower at Dh9.25. The Abu Dhabi Securities Exchange general index closed 1.26 per cent lower at 4,914.39. First Abu Dhabi Bank closed more than 2 per cent lower at Dh13.90. Abu Dhabi Commercial Bank closed 0.85 per cent lower at Dh9.34.

Saudi Tadawul index fell after a report suggested doubling of Zakat or tax on local banks to 20 per cent. Saudi Arabia’s Tadawul index closed 0.60 per cent lower at 8,482.64. “Possibility of increase in Zakat rate from 10 per cent to 20 per cent is an overhang for the Saudi banks, especially one where foreign ownership is low, as the magnitude of zakat impact on them will be higher. However, the news is still speculative,” Lakhotia said, Saudi banking index was down 1.14 per cent at 8,025.49.

Al Rajhi Bank closed 2 per cent lower at 97.90 riyals. “There was no major sell—off today on this news, but only some weakness. This possibly highlights that investors and traders alike still believe banks and overall Saudi equities still remain attractive at current levels to benefit from inclusion related flows, which will start from next week,” Lakhotia added,

Saudi Tadawul will be included in FTSE Russell emerging market index from March 14 in a phased manner in five tranches, and at the end the index will represent 3 per cent of the index. FTSE Russell expect an inflow of $6 billion into Saudi equities.