Highlights

- Here's why inflation data are "game changers" in both the stocks and currency markets.

- In May, a 8.6% jump in consumer price index was the largest year-on-year increase since December 1981.

- A higher inflation rate forces the US Fed to switch to a higher gear, possiblly leading to a decision to further raise interst rates, a.k.a. "policy tightening".

- When interest rates are rising, both businesses and consumers will cut back on spending, triggering a fall in earnings and stock prices to drop.

Global stocks plunged on Monday (June 13), in what some analysts call the "Black Monday", leading to 20 per cent decline from their peak in January so far. The selloff is a sign of growing pessimism on the back of inflation and growth fears of lower corporate earnings.

The June 13 carnage started in Asia, where stocks sank in most national bourses in the region. Europe and American equities soon followed as Asian bourses closed in the red.

Why are global stocks tumbling while the dollar keeps rising?

There are a number of factors at work. First, consider this two-in-one phenomenon: a stock market crash and record spike in US dollar's value against major currencies. Both have become like a flu contaminating the rest of the globe.

The first place to look for clues to this is higher US inflation data, and the resulting higher Treasury bond yields. This is a rather simplified equation, though the process is a bit more circuitous, involving policy actions by regulators and monetary authorities, like the powerful US Federal Reserve.

Why is inflation data such a big deal?

The US consumer price index (CPI) increased at a bigger-than-expected rate of 8.6% last month (May). The fact that it was the largest year-on-year increase since December 1981, as per data that emerged on Friday, is not lost on investors and regulators alike.

That means hopes that US inflation had already peaked in the post-lockdowns era is way off the mark. Now, this realisation has put markets on alert: the US Federal Reserve, America's central monetary authority, may tighten policy again, or long enough, that it could cause a sharp economic slowdown. The next policy decision is two days away, on Wednesday.

Inflation, the rate of increase in the prices of goods and service, is a big part of the current picture. As US inflation ticked higher, this reignited worries about even more aggressive US interest rate increases by the US Fed.

Everytime the Fed raises US Treasury rates up, these governments IOU's become more attractive to global investors. Remember that Treasury bonds (or T-bills) are some the most stable and secure investment vehicles, as payment is guaranteed by taxpayers.

When bonds become the flavour of the week or month for investors, that siphons off money from high-risk stocks.

Higher interest rates tend to negatively affect earnings and stock prices (with the exception of the financial sector). This is because both businesses and consumers generally cut back on spending when interest rates rise. This will cause earnings to fall — and stock prices to drop.

At the same time, when businesses face an economic slowdown (as less money is available in the economy), it means lower corporate earnings in the days and months ahead. Ergo, most investors anticipate a slide in stock prices. As they exit (sell their stock holdings), the sell-off hysteria pushes markets further on a downward spiral.

It's not just market psychology at work. Back in Asia, new mass COVID-19 testing in China sparked concerns of more crippling lockdowns, which could curb demand and economic activity in the mainland, the second-largest economy.

Why is it called 'Black Monday’?

The stock weakness was first seen in Asia on Monday, then extended into US and European trading. MSCI's benchmark Asia-Pacific equity index slumped 2.66%.

Initially, futures pointed to a 1.67% drop for the S&P 500, a 1.4% retreat for Germany's DAX and a 0.77% slide for Britain's FTSE.

As of 8.09pm UAE time, the NASDAQ-100, a US stock market index comprised of the largest companies traded on the NASDAQ (based on market capitalisation), tanked to 11,400.75, its lowest level since November 9, 2020, when it closed at 11,489.

"It is turning into a Black Monday in Asia," Jeffrey Halley, senior market analyst at OANDA, wrote in a client note.

"The R (recession)-word (is) now on everyone's lips" amid "a scramble to reassess Fed hiking expectations," he wrote.

Historically, the "Black Monday" of October 19, 1987 was a day when the Dow Jones Industrial Average fell by 22% and marked the start of a global stock market decline.

Meanwhile, the heightened expectations about Federal Reserve rate hikes drove the Japanese yen to a more-than-two-decade low against the dollar, prompting more concern from authorities about the sharp moves down.

Some traders are even speculating the Fed on Wednesday may raise its key short-term interest rate by three-quarters of a percentage point.

In Asia, the first indications of a stock sell-off emerged early. Then there's also the risk of fresh COVID-19 lockdowns with Beijing's most populous district of Chaoyang announcing three rounds of mass testing to quell a "ferocious" COVID-19 outbreak that emerged at a bar.

Shanghai conducted mass testing to contain a jump in cases tied to a hair salon. Chinese blue chips dropped 1.42% and Hong Kong's Hang Seng suffered a 3.29% slide.

Japan's Nikkei slumped 3.03% and South Korea's Kospi declined 3.27%. Australian markets were closed for a holiday.

"Anyone trying to pick the bottom in China's growth and equity markets on the basis that China was 'one and done' on lockdowns is naive," OANDA's Halley said.

China's Growth shares sagged, with tech giants listed in Hong Kong slumping 4.45%. Index heavyweights Alibaba , Tencent and Meituan were each down between 4% and 6%.

How does anti-inflation moved by the Fed affect currency markets?

In currency markets, the dollar climbed as high as 135.22 yen, its highest since October 1998, buoyed by a rise in Treasury yields that continued into Tokyo trading.

The 10-year Treasuries reached a more than one-month peak of 3.202%, putting it just a tenth of a basis point from the highest since November 2018.

That put upward pressure of Japanese government bond yields, with the 10-year pushing to a six-year high of 0.255%, half a basis point above the Bank of Japan's 0.25% tolerance limit under its yield curve control policy. That's even amid the BOJ's standing offer to buy unlimited amounts of the 10-year note since April.

The breach of its ceiling spurred the central bank to announce an additional, unscheduled purchase operation. When US interest rates are raised, the law of supply and demand kicks in, as the demand for US dollars usually go up, and explains the spike in the greenback's value.

Why is inflation data such a big deal?

"The inflation data are game changers that force the Fed to switch to a higher gear, front-loading policy tightening," Jefferies strategist Aneta Markowska wrote in a research note, lifting a call for this week's decision to a 75 basis point hike.

Markets currently price 80% odds of a half point increase, and 20% odds for 75 basis points.

Two-year Treasury yields, which are very sensitive to policy expectations, leapt as high as 3.194% in Tokyo on Monday, a first since December 2007.

How a slump in stocks boosts the US dollar

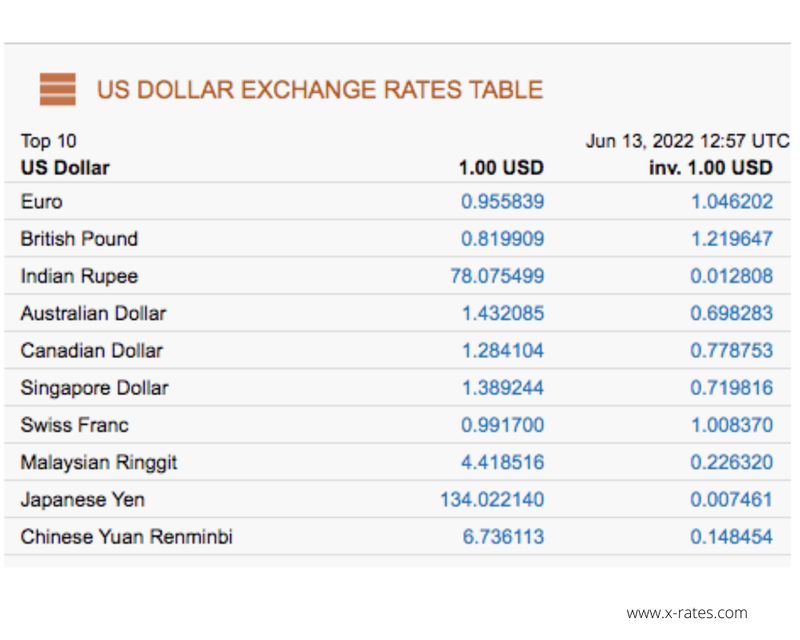

The US dollar index, which measures the currency against six major peers including the yen, ticked as high as 104.58 for the first time in almost a month. The euro slid as low as $1.04755 for the first time since May 19.

And as investors sold stocks, the US dollar has hit a 20-year high. Analysts explain that the US greenback’s push to multi-decade highs for the greenback is happening amid surging bond yields.

Leading cryptocurrency bitcoin slumped to the lowest since December 2020 at $24,888.88.

Meanwhile, crude oil dropped, with Brent crude futures down $1.81, or 1.48%, to $120.20 a barrel and U.S. West Texas Intermediate crude at $118.81 a barrel, down $1.86, or 1.54%.

(With inputs from Reuters)