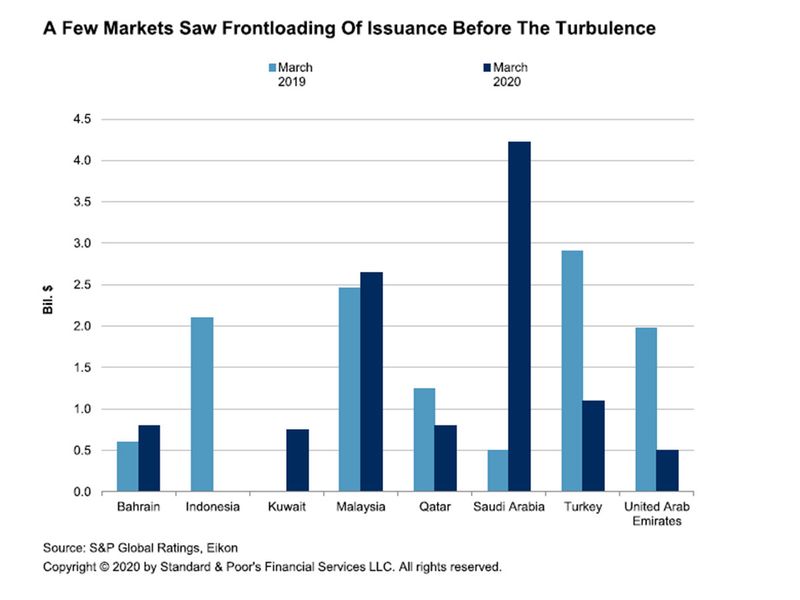

Dubai: The drop in oil prices and restrictions related to the COVID-19 pandemic is expected to hurt sukuk issuance from core Islamic finance markets that include GCC countries, according to rating agency Standard & Poor’s.

While the virus outbreak is taking a toll on important sectors in core Islamic finance countries, including real estate, hospitality, and consumer-related businesses, the rating agency said government measures will result in lower issuance from both corporate entities and central banks.

“We believe most government issuers may turn to conventional bond markets rather than issue sukuk as they grapple with the impact of weaker economic environment on their budgets. Sukuk issuance is still more complex than for conventional bonds,” said Mohamed Damak, director of research at S&P.

Rising risk aversion

Adding to the woes of sukuk market will be investors’ increasing risk aversion in the uncertain environment and widening spreads, which imply that financing conditions will be extremely tight for issuers with weak credit quality.

The rating agency expects a market recovery only from the third quarter of 2020.

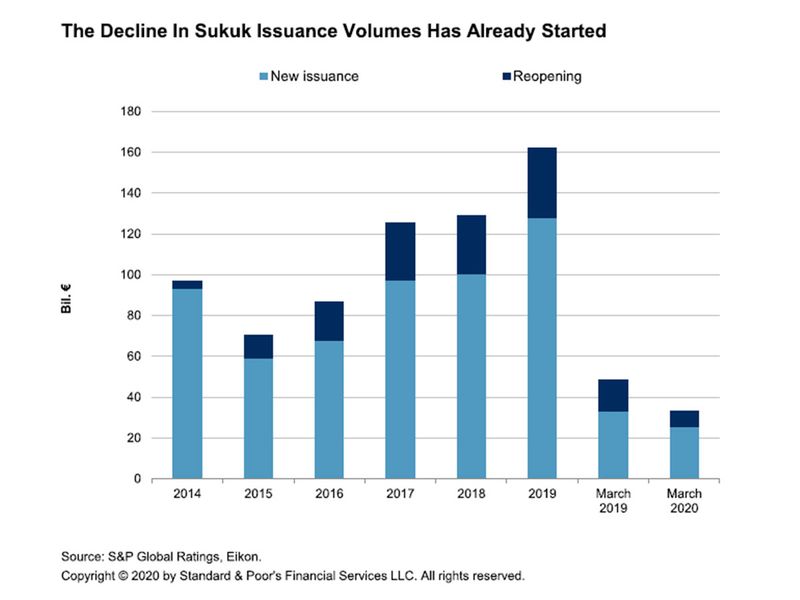

“We don’t think issuance in the rest of 2020 will be sufficient to compensate for the first-half decline. Sukuk issuance volumes fell 32 per cent in the first quarter of this year and we expect the decrease to be even steeper in the second quarter, since most core Islamic finance countries started implementing measures related to COVID-19 in March,” said Damak.

Overall, S&P forecasts around $100 billion of sukuk issuance this year, about 40 per cent lower than $162 billion issuance in 2019. In the current environment, the number of defaults among sukuk issuers with low credit quality will likely increase.

New liquidity

According to S&P analysts, in response to low oil prices and sluggish economic activity, several countries have implemented measures to unlock banking sector liquidity and help corporations cope with the adverse impact.

This means corporates will have a lower need to enter the sukuk market this year, even assuming an economic upswing from the third quarter.

“We think most of their financing will come from the local banking systems, which have received incentives to provide funding from their respective governments or regulators,” said Damak.

Central banks have few reasons to issue this year. Since they have opened liquidity taps through the banking sector, there is limited need for local currency liquidity management via sukuk. In 2019, central banks accounted for 17.5 per cent of total sukuk issuance.

Substitution of instruments

While some issuers are likely to wait for market conditions to improve and get the right window for their sukuk issuances or they could turn to other instruments that are easier to bring to the market.

These could range from bilateral/multilateral lending agreements, syndicated loans, or issuance on conventional bonds.

Risk of defaults

Given the shocks to the economic environment and rapid change in market conditions, S&P expects credit risk to increase sharply, including higher default rates among sukuk issuers, especially those with low credit quality or business plans that depend on supportive economies and market conditions.

Investors generally do not have access to the sukuk’s underlying assets in the event of a default, except when those assets were sold to the special purpose vehicle issuing the sukuk, which is an exception rather than the norm.