The retail banking portfolio of Bank of Baroda has tripled in the last year and a half, according to a senior official with the bank in Dubai.

Ananda Kumar, CEO of Bank of Baroda, told Gulf News about the growth on the sidelines of the bank completing 112 years of operations in India on Sunday (July 21). The bank also completed 45 years of operations in the UAE on June 25.

“One of the key reasons for our massive growth has been the rise in home loans. Our mortgage and home loan portfolio stood at around Dh450 million 18 months ago, it currently stands at Dh1.35 million,” said Kumar.

According to the senior bank official, the bank has 136,000 customers across its UAE branches.

Gulf News visited its office in Bur Dubai and the atmosphere was festive. The office was decorated with orange balloons in sync with the bank's logo.

Kumar said the majority of the bank's clients are high net worth Indians. “We have focused on high net-worth individuals in the UAE and this portfolio has been driving our presence in the UAE,” he said.

Bank of Baroda started its overseas journey by opening its first branch way back in 1953 in Mombasa, Kenya. The bank has since come a long way in expanding its international network to serve NRIs / PIOs, Indian corporates around the world and to meet the banking requirements of the local population in the country of operation. The bank has an international presence with a network of 104 branches and offices in 24 countries. “The bank is pursuing an ambitious overseas expansion plan and is in the process of identifying / opening more overseas centres for increasing its global presence to serve its 60 million global customers,” said Kumar.

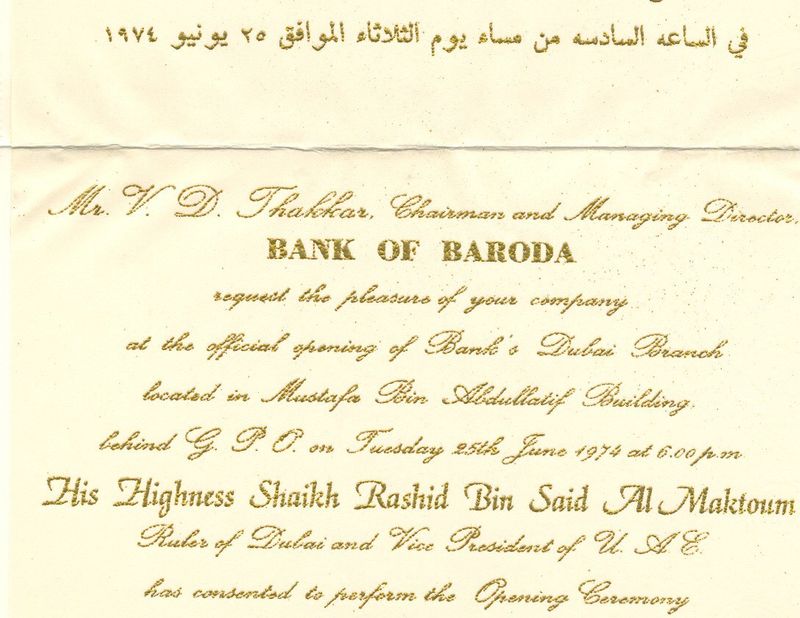

In the UAE, Kumar said it was the migrant Gujarati population who were coming to live and work in the country that prompted Bank of Baroda to begin its operations in the UAE in 1974. “The bank is said to have been inaugurated with much fanfare in the presence of the late Shaikh Rashid bin Saeed Al Maktoum and began operations in the UAE in 1974.”

“The bank started as a small set up. In 1975, the bank opened a branch in Abu Dhabi in 1975 and two years later in Sharjah. These three were the prominent places for Bank of Baroda in the UAE for quite some time. Then we started a branch in Deira, then subsequently we opened offices in Ras Al Khaimah, Al Ain and DIFC.”

“Veteran Indian businessman the late Bharat Bhai Shah was instrumental in bringing the bank to the UAE,” said Kumar.

He said through four decades of the bank’s presence in UAE, the entity has built a personal relationship with its clients. “We may lag behind in technology, but we are very accommodating and have a personal relationship with our clients. [At the] end of the day we are like one big family, [a feeling] which can be lacking in the banking industry,” he added.

Another veteran banker to mention is one Meenakshi Sundaram who also helped set up Bank of Baroda in the UAE. He later went onto to join the Central Bank of UAE.

Dr. BR Shetty, founder and chairman of NMC Healthcare, Finablr, Neopharma and BRS Ventures, said: “Banks play a major role in any economy of the country and a positive one that too. Without banks, most investors and businessmen would not have achieved what we have so far. In 2003, I was launching Abu Dhabi’s first manufacturing unit – Neopharma. At first people laughed at the idea that I wanted to start a pharma venture in the middle of a desert. Nobody was willing to lend me money to set up the company. But I had an old friend, Mr PA Shenoy, who worked in Bank of Baroda. He called a senior official working in the bank and approved my loan request. I needed Dh80 million and the loan was granted in two weeks,” said Dr Shetty.