Oil prices dropped 3% after US President Donald Trump killings of protesters in Iran had been "halted".

The US President, however, added that he would "watch it and see" about threatened military action.

Trump had repeatedly talked in recent days about coming to the aid of the Iranian people over the crackdown on protests that rights groups say has left at least 3,428 people dead.

But in a surprise announcement at the White House, Trump said he had now received assurances from "very important sources on the other side" that Tehran had now stopped, and that executions would not go ahead.

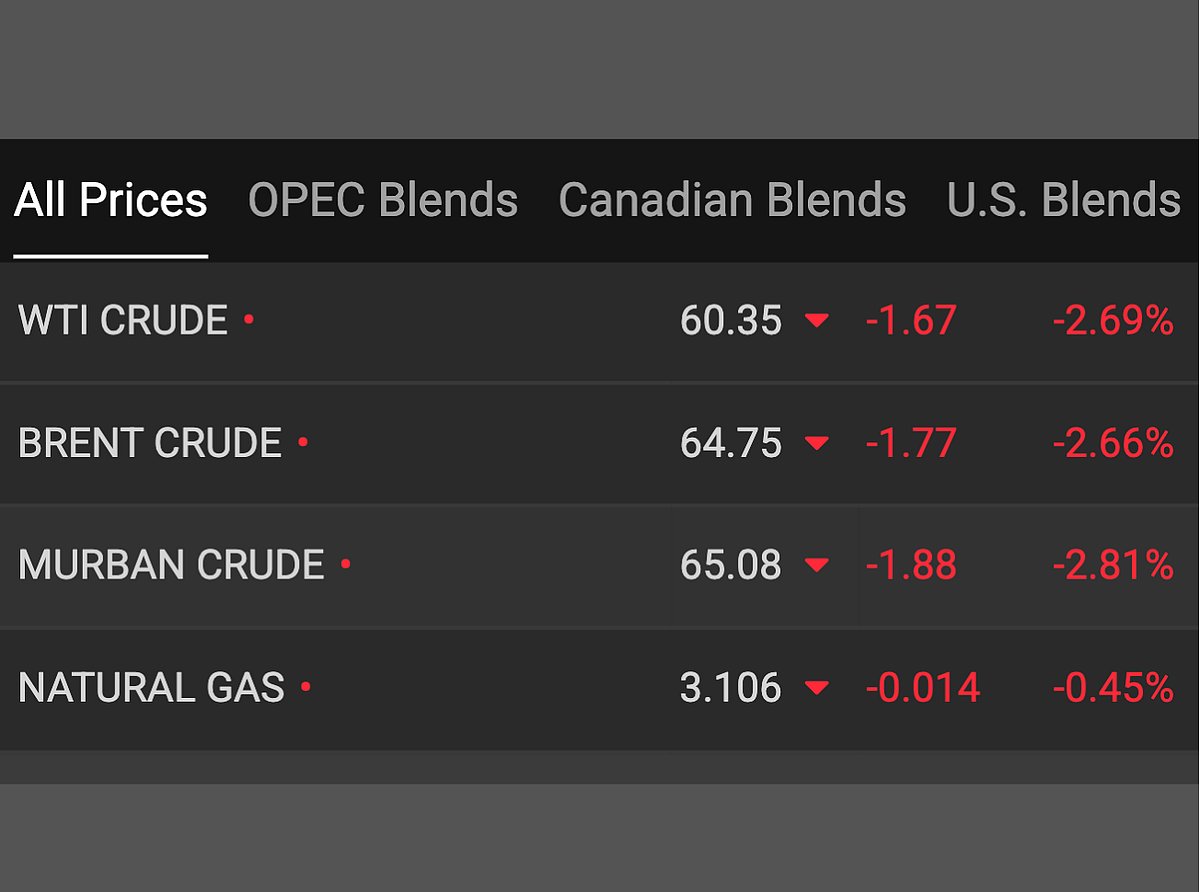

As of January 15, 2026 (around 02:16 GMT), oil prices have pulled back sharply in the latest trading session after a multi-day rally driven by geopolitical tensions.

Brent crude is trading around $64.75–$65 per barrel, down approximately 2–2.6%, after briefly settling higher earlier in the week (e.g., around $66.50 on January 14 before reversing).

WTI crude (West Texas Intermediate) is near $60 per barrel, also down 2.69% (e.g., from settlements around $62 earlier), erasing gains from a six-day streak.

Market reaction

Traders interpreted Trumps January 14 remarks as reducing the immediate risk of US military action against Iran, which had previously fuelled a risk premium and pushed prices up ~10–11% over the prior week amid fears of supply disruptions from the OPEC producer.

Other contributing factors to the downside include:

Larger-than-expected U.S. crude and gasoline inventory builds (reported by EIA).

Resuming Venezuelan oil shipments/exports, adding potential supply (tied to recent U.S. policy shifts post-regime developments there).

Broader expectations of a 2026 supply surplus, with forecasts like Goldman Sachs projecting lower averages (e.g., Brent ~$56).

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox

Network Links

GN StoreDownload our app

© Al Nisr Publishing LLC 2026. All rights reserved.